Ct 1041 Form

What is the CT 1041

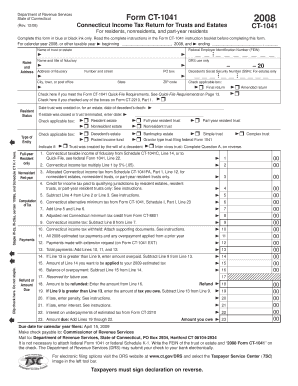

The CT 1041 is a tax form used for reporting income and calculating tax liability for estates and trusts in Connecticut. This form is essential for fiduciaries responsible for managing the financial affairs of these entities. By filing the CT 1041, trustees and executors ensure compliance with state tax laws and provide necessary financial information to the Connecticut Department of Revenue Services. Understanding the purpose of this form is crucial for anyone involved in estate or trust management.

How to use the CT 1041

Using the CT 1041 involves several steps to ensure accurate reporting of income and expenses related to the estate or trust. Initially, gather all necessary financial documents, including income statements, receipts for expenses, and prior year tax returns. Next, complete the form by providing detailed information about the estate or trust, including its name, identification number, and the period covered by the tax return. It is important to accurately report income, deductions, and any applicable tax credits. Finally, review the completed form for accuracy before submission.

Steps to complete the CT 1041

Completing the CT 1041 requires careful attention to detail. Follow these steps:

- Gather all relevant financial documents, including income sources and expenses.

- Fill in the estate or trust's name and federal identification number on the form.

- Report all income received during the tax year, including interest, dividends, and capital gains.

- List all allowable deductions, such as administrative expenses and distributions to beneficiaries.

- Calculate the total tax liability based on the reported income and deductions.

- Sign and date the form, ensuring that it is filed by the due date to avoid penalties.

Filing Deadlines / Important Dates

Filing deadlines for the CT 1041 are critical to avoid penalties. The form is typically due on the fifteenth day of the fourth month following the close of the tax year. For estates and trusts operating on a calendar year basis, this means the form is due by April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. It is advisable to stay informed about any changes to filing deadlines to ensure timely submission.

Legal use of the CT 1041

The legal use of the CT 1041 is governed by Connecticut tax laws, which require fiduciaries to report income and pay taxes on behalf of estates and trusts. Filing this form accurately is essential for compliance with state regulations and helps prevent legal issues related to tax liabilities. Additionally, proper use of the CT 1041 can protect fiduciaries from potential penalties or audits by the Connecticut Department of Revenue Services.

Required Documents

To complete the CT 1041, certain documents are necessary. These include:

- Financial statements detailing income and expenses for the estate or trust.

- Prior year tax returns, if applicable.

- Documentation of distributions made to beneficiaries.

- Receipts for any deductions claimed, such as administrative costs.

Having these documents ready will facilitate a smoother filing process and ensure compliance with tax requirements.

Quick guide on how to complete ct 1041

Complete Ct 1041 effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an ideal eco-friendly substitute for traditionally printed and signed paperwork, allowing you to access the necessary form and securely save it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents quickly without any hiccups. Manage Ct 1041 on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related procedure today.

The optimal approach to modify and electronically sign Ct 1041 with ease

- Locate Ct 1041 and click Get Form to begin.

- Take advantage of the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive details with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes only a few seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the information and click the Done button to save your modifications.

- Choose your preferred method of sending your form, whether through email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Ct 1041 and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ct 1041

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ct 1041 form and how does airSlate SignNow assist with it?

The ct 1041 form is essential for Connecticut fiduciaries to report income on behalf of trusts and estates. airSlate SignNow simplifies the process by enabling users to easily eSign and send the ct 1041 digitally, ensuring compliance and efficiency in managing tax filings.

-

What are the pricing options for using airSlate SignNow for ct 1041 eSigning?

airSlate SignNow offers various pricing plans tailored to meet the needs of businesses, starting with a free trial. For users dealing with the ct 1041, our competitive pricing ensures that you get the best value while streamlining your document signing process.

-

How can airSlate SignNow enhance the efficiency of managing the ct 1041?

With airSlate SignNow, businesses can easily automate the signing process for the ct 1041, minimizing delays and errors. Our platform provides templates and document tracking features, allowing users to manage their forms efficiently and securely.

-

Are there any integrations available for handling the ct 1041 with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with popular applications such as Google Drive and Dropbox, which can be incredibly helpful for managing the ct 1041. These integrations simplify access to necessary documents, making the eSigning process even more efficient.

-

Can airSlate SignNow support multiple users signing the ct 1041 form?

Absolutely! airSlate SignNow allows multiple users to collaboratively sign the ct 1041 form, ensuring that all necessary parties can provide their signatures quickly and efficiently. This feature is particularly useful for trusts and estates involving multiple stakeholders.

-

What security measures does airSlate SignNow have in place for ct 1041 document handling?

airSlate SignNow prioritizes security with advanced encryption and secure storage for all documentation, including the ct 1041 form. You can trust that your sensitive financial information is well protected throughout the eSigning process.

-

How does airSlate SignNow ensure compliance for the ct 1041?

Compliance is paramount when dealing with tax forms like the ct 1041. airSlate SignNow is designed to meet legal standards, providing users with an audit trail and ensuring that all signatures comply with state and federal regulations.

Get more for Ct 1041

Find out other Ct 1041

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure