Ct 941 Form

What is the CT 941?

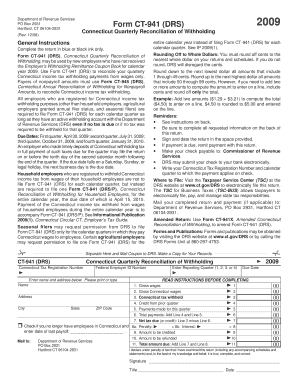

The CT 941 is a tax form used by employers in Connecticut to report their quarterly payroll taxes. This form is essential for businesses to accurately report wages paid, taxes withheld, and contributions to state unemployment insurance. The CT 941 form helps ensure compliance with state tax regulations and provides the necessary information for the state to assess employer contributions to unemployment benefits.

How to Complete the CT 941

Completing the CT 941 involves several steps to ensure accuracy and compliance. First, gather all relevant payroll records for the quarter, including employee wages and tax withholdings. Next, fill out the form by entering the total wages paid, the amount of Connecticut income tax withheld, and any unemployment contributions. It is crucial to double-check all figures for accuracy before submission. Finally, sign and date the form to certify its correctness.

Filing Deadlines for the CT 941

Employers must adhere to specific deadlines when filing the CT 941. The form is due on the last day of the month following the end of each quarter. This means that for the first quarter, the due date is April 30, for the second quarter, it is July 31, for the third quarter, it is October 31, and for the fourth quarter, it is January 31 of the following year. Timely filing helps avoid penalties and ensures compliance with state tax laws.

Legal Use of the CT 941

The CT 941 is legally binding when completed and submitted according to state regulations. Employers must ensure that all information provided is accurate and truthful to avoid legal repercussions. Failure to file or inaccuracies in reporting can lead to penalties, including fines and interest on unpaid taxes. Utilizing a reliable eSignature solution can help ensure that the submission process is secure and compliant with legal standards.

Examples of Using the CT 941

Employers may encounter various scenarios when using the CT 941. For instance, a small business owner may use the form to report wages for part-time employees. A larger corporation may need to report wages for hundreds of employees across multiple locations. Regardless of the size of the business, accurately completing the CT 941 is crucial for maintaining compliance with state tax laws.

Required Documents for the CT 941

To complete the CT 941, employers should have several documents on hand. These include payroll records for the reporting period, employee tax withholding forms, and any documentation related to unemployment contributions. Having these documents readily available ensures a smoother filing process and helps prevent errors that could lead to penalties.

Form Submission Methods for the CT 941

The CT 941 can be submitted through various methods, including online, by mail, or in person. Online submission is often the most efficient and secure method, allowing for faster processing and confirmation of receipt. For those opting to mail the form, it is advisable to use certified mail to ensure it is received by the deadline. In-person submissions can be made at designated state offices, providing immediate confirmation of receipt.

Quick guide on how to complete ct 941

Effortlessly Prepare Ct 941 on Any Device

Managing documents online has become prevalent among businesses and individuals. It offers a superb environmentally friendly alternative to traditional printed and signed documents, as you can access the correct format and securely store it online. airSlate SignNow provides you with all the resources you need to create, modify, and eSign your documents swiftly without any delays. Manage Ct 941 on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to Modify and eSign Ct 941 Effortlessly

- Locate Ct 941 and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight signNow sections of your documents or obscure sensitive information using the tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you prefer to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and eSign Ct 941 and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ct 941

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ct 941 and how does it relate to document eSigning?

CT 941 is a form used by businesses to report their quarterly tax liability. airSlate SignNow simplifies the eSigning process for CT 941 and other documents, allowing users to send, receive, and sign important paperwork quickly and securely.

-

How much does it cost to use airSlate SignNow for processing CT 941 forms?

airSlate SignNow offers competitive pricing plans to fit different business needs. For users looking to manage CT 941 documents, the cost-effective solution ensures that all essential eSigning features are available at an affordable monthly rate.

-

What features does airSlate SignNow provide for CT 941 document management?

airSlate SignNow comes with a robust set of features tailored to manage CT 941 documents effectively. These include customizable templates, tracking and notifications, secure eSigning capabilities, and integration with popular cloud storage services, enhancing workflow efficiency.

-

Is airSlate SignNow compliant with legal requirements for CT 941 eSigning?

Yes, airSlate SignNow ensures compliance with relevant legal standards for eSigning CT 941 forms. The platform adheres to eIDAS and ESIGN Act regulations, providing customers with a legally binding solution for signing essential documents.

-

Can I integrate airSlate SignNow with other tools for managing CT 941 documents?

Absolutely! airSlate SignNow offers seamless integrations with various third-party applications, enhancing your productivity while managing CT 941 documents. Whether you use CRM, accounting software, or cloud storage, SignNow can fit into your workflow effortlessly.

-

What are the benefits of using airSlate SignNow for CT 941 submissions?

Using airSlate SignNow for CT 941 submissions offers numerous benefits, including reduced processing time, improved document accuracy, and enhanced security. The user-friendly interface makes it easy to send and sign forms, helping your business remain compliant and efficient.

-

How does airSlate SignNow ensure the security of my CT 941 documents?

airSlate SignNow prioritizes the security of your CT 941 documents with encryption technologies and secure cloud storage. It provides multiple layers of protection, ensuring that your sensitive information remains confidential and safeguarded against unauthorized access.

Get more for Ct 941

- Expiration date 6302024 form

- Vha 10 0103 veterans application for assistance form

- Va form 10 10cg 571249187

- Veterans can use this form to register in the va foreign medical program

- 21 0538 status of dependents questionnaire form

- Authorization agreement td auto finance is authorized by the below account holder quotiquot quotmequot or quotmyquot to form

- Nycha application form

- Aarto forms

Find out other Ct 941

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online