Image of Dtf 911 Tax Form

What is the image of DTF 911 tax form?

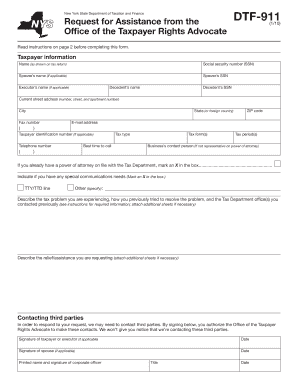

The image of the DTF 911 tax form is a specific document used in New York State for tax purposes. It is primarily designed for individuals and businesses to report certain tax information to the New York State Department of Taxation and Finance. This form plays a crucial role in ensuring compliance with state tax regulations and helps in the accurate assessment of tax liabilities.

How to use the image of DTF 911 tax form

Using the image of the DTF 911 tax form involves several steps. First, ensure you have the correct version of the form, which can typically be downloaded from the New York State Department of Taxation and Finance website. Once you have the form, fill it out with accurate information regarding your tax situation. After completing the form, you can submit it electronically or by mail, depending on your preference and the specific instructions provided with the form.

Steps to complete the image of DTF 911 tax form

Completing the image of the DTF 911 tax form requires careful attention to detail. Follow these steps:

- Download the latest version of the DTF 911 tax form from the official website.

- Gather all necessary information, including your personal details, income, and any applicable deductions.

- Fill out the form accurately, ensuring all sections are completed.

- Review the form for any errors or omissions.

- Submit the completed form either online or by mailing it to the appropriate address.

Legal use of the image of DTF 911 tax form

The image of the DTF 911 tax form is legally binding when filled out and submitted according to New York State tax laws. It must be completed truthfully and accurately to avoid penalties. Compliance with state regulations ensures that the form is accepted by tax authorities, and any discrepancies may lead to audits or fines.

Key elements of the image of DTF 911 tax form

Key elements of the image of the DTF 911 tax form include:

- Identification information, such as name and address.

- Details about income sources and amounts.

- Applicable deductions and credits.

- Signature and date fields to verify the authenticity of the submission.

Filing deadlines / Important dates

Filing deadlines for the image of the DTF 911 tax form are critical to ensure compliance with state tax regulations. Typically, the form must be submitted by the due date specified by the New York State Department of Taxation and Finance. It is essential to stay updated on any changes to deadlines, which may vary from year to year, especially during tax season.

Quick guide on how to complete image of dtf 911 tax form

Complete Image Of Dtf 911 Tax Form with ease on any device

Online document administration has become increasingly favored by businesses and individuals. It offers an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the resources you need to generate, modify, and eSign your documents quickly without interruptions. Manage Image Of Dtf 911 Tax Form on any platform with airSlate SignNow Android or iOS applications and enhance any document-centered process today.

How to edit and eSign Image Of Dtf 911 Tax Form effortlessly

- Locate Image Of Dtf 911 Tax Form and then click Get Form to begin.

- Take advantage of the tools we offer to finish your form.

- Highlight necessary sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Put aside concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and eSign Image Of Dtf 911 Tax Form and ensure effective communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the image of dtf 911 tax form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is dtf 911 and how does it work?

dtf 911 is a specialized service that enhances document workflows by enabling efficient electronic signatures and document management. With airSlate SignNow, it allows users to sign, send, and store important documents securely, making it an essential tool for businesses.

-

How much does using dtf 911 cost?

The pricing for dtf 911 via airSlate SignNow is designed to be cost-effective to meet various business needs. Plans are flexible, allowing users to choose a package that suits them best, ensuring maximum value for document management solutions.

-

What are the key features of dtf 911?

dtf 911 includes features such as customizable templates, automated workflows, and advanced security measures. These capabilities streamline the document signing process, making it quicker and more reliable for users.

-

What benefits can my business expect from dtf 911?

By implementing dtf 911, businesses can expect increased efficiency, reduced turnaround times, and improved compliance with document handling. This leads to greater overall productivity and better customer satisfaction.

-

Can dtf 911 integrate with other business applications?

Yes, dtf 911 is designed to integrate seamlessly with numerous business applications, allowing for enhanced collaboration and document management. This connectivity ensures that users can streamline their processes without switching between multiple platforms.

-

Is dtf 911 secure for sensitive documents?

Absolutely, dtf 911 prioritizes security, providing advanced encryption protocols to protect sensitive documents during transmission and storage. Users can trust that their data is secure and compliant with industry standards.

-

How easy is it to get started with dtf 911?

Getting started with dtf 911 is simple and user-friendly. With airSlate SignNow, new users can quickly set up their accounts, access tutorials, and begin sending documents for electronic signatures in just a few clicks.

Get more for Image Of Dtf 911 Tax Form

- Review of dealing cpaaustralia com form

- Rmit full form

- Bofferb acceptance bformb rmit university

- University of sydney application form

- Company and tax invoice form

- Please fill out front and back of this form signature eleanor

- Business school referencing guide 11th edition the university of sydney edu form

- Claim form accident and health international underwriting

Find out other Image Of Dtf 911 Tax Form

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement