Schedule 2 Form 8849

What is the Schedule 2 Form 8849

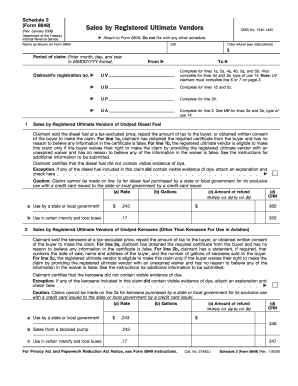

The Schedule 2 Form 8849 is a specific tax form used by businesses and individuals to claim refunds for certain excise taxes paid on fuel. This form is particularly relevant for those who have incurred excise taxes on gasoline or diesel fuel used for non-taxable purposes, such as farming or certain off-road activities. Understanding the purpose of this form is crucial for taxpayers seeking to recover funds from the IRS.

How to use the Schedule 2 Form 8849

Using the Schedule 2 Form 8849 involves several key steps. First, gather all necessary documentation related to the excise taxes you wish to claim. This may include receipts and records of fuel purchases. Next, accurately fill out the form, ensuring that all required fields are completed and that the information matches your supporting documents. Finally, submit the form to the IRS, either electronically or via mail, depending on your preference and the requirements set forth by the IRS.

Steps to complete the Schedule 2 Form 8849

Completing the Schedule 2 Form 8849 requires careful attention to detail. Follow these steps:

- Obtain the latest version of the Schedule 2 Form 8849 from the IRS website.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Detail the specific excise taxes you are claiming refunds for, including the type of fuel and the amount paid.

- Attach any necessary documentation that supports your claim.

- Review the completed form for accuracy before submission.

Legal use of the Schedule 2 Form 8849

The Schedule 2 Form 8849 is legally recognized for claiming refunds on excise taxes, provided it is filled out correctly and submitted in accordance with IRS guidelines. To ensure compliance, taxpayers should familiarize themselves with relevant tax laws and regulations that govern the use of this form. Proper execution is essential to avoid potential penalties or issues with the IRS regarding your tax claims.

Filing Deadlines / Important Dates

Timely submission of the Schedule 2 Form 8849 is essential to ensure that you receive any refunds owed to you. The IRS typically sets specific deadlines for filing this form, which may vary based on the type of excise tax being claimed. It is important to keep track of these dates and file your form accordingly to avoid missing out on potential refunds.

Form Submission Methods (Online / Mail / In-Person)

The Schedule 2 Form 8849 can be submitted through various methods. Taxpayers have the option to file the form electronically using approved e-filing software or to print and mail the completed form to the appropriate IRS address. In-person submissions are generally not available for this form. Choosing the right submission method can help expedite the processing of your refund claim.

Quick guide on how to complete schedule 2 form 8849

Effortlessly Prepare Schedule 2 Form 8849 on Any Device

Managing documents online has gained immense traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Schedule 2 Form 8849 on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to Edit and Electronically Sign Schedule 2 Form 8849 with Ease

- Obtain Schedule 2 Form 8849 and select Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize important parts of the documents or conceal sensitive details using tools designed specifically for that purpose by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Schedule 2 Form 8849 and ensure excellent communication at every phase of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule 2 form 8849

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the schedule 2 form 8849?

The schedule 2 form 8849 is a supplemental form used by businesses to claim a refund of federal excise taxes on specific situations, such as certain fuel uses. It is essential for ensuring that your organization properly documents its claims and avoids errors in tax refunds.

-

How can airSlate SignNow assist with completing the schedule 2 form 8849?

airSlate SignNow offers an intuitive platform that allows users to fill out and eSign the schedule 2 form 8849 quickly and efficiently. With features like templates and collaboration tools, you can ensure your form is completed accurately and submitted on time.

-

Is there a cost associated with using airSlate SignNow for schedule 2 form 8849?

Yes, airSlate SignNow offers various pricing plans suited for different business needs, including a plan that caters to users specifically needing to manage forms like the schedule 2 form 8849. The pricing is competitive and reflects the value of its document management features.

-

What are the benefits of using airSlate SignNow for managing the schedule 2 form 8849?

Using airSlate SignNow to manage the schedule 2 form 8849 provides benefits such as faster processing times, reduced paperwork, and enhanced accuracy. The platform helps streamline the submission process, making it easier to track submissions and updates.

-

Are there any integrations available with airSlate SignNow for the schedule 2 form 8849?

Yes, airSlate SignNow integrates with various applications and services that can aid in the management of your schedule 2 form 8849. These integrations can enhance functionality, allowing for seamless workflow automation and better document tracking.

-

Can multiple users collaborate on the schedule 2 form 8849 with airSlate SignNow?

Absolutely! airSlate SignNow allows for real-time collaboration on the schedule 2 form 8849, enabling multiple users to work together, review, and edit the document simultaneously, ensuring all necessary signatures and approvals are obtained efficiently.

-

How secure is the data when using airSlate SignNow for the schedule 2 form 8849?

Security is a top priority at airSlate SignNow. When handling sensitive documents like the schedule 2 form 8849, the platform employs advanced encryption and compliance measures to protect your data and maintain confidentiality throughout the signing process.

Get more for Schedule 2 Form 8849

Find out other Schedule 2 Form 8849

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free