Hood County Homestead Exemption Form

What is the Hood County Homestead Exemption Form

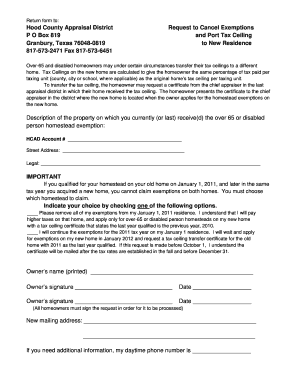

The Hood County Homestead Exemption Form is a document that allows homeowners in Hood County, Texas, to apply for a homestead exemption. This exemption reduces the amount of property taxes owed on a primary residence by excluding a portion of the property's value from taxation. The form is essential for homeowners seeking to benefit from tax savings and is typically filed with the Hood County Appraisal District (CAD).

How to obtain the Hood County Homestead Exemption Form

Homeowners can obtain the Hood County Homestead Exemption Form directly from the Hood County Appraisal District's website or by visiting their office in person. The form is usually available as a downloadable PDF, making it easy to print and complete. Additionally, local government offices may provide physical copies of the form for those who prefer to fill it out by hand.

Steps to complete the Hood County Homestead Exemption Form

Completing the Hood County Homestead Exemption Form involves several key steps:

- Provide personal information, including your name, address, and contact details.

- Indicate the property for which you are applying for the exemption, including its legal description.

- Confirm that the property is your primary residence and provide any required documentation to support this claim.

- Sign and date the form to certify the information provided is accurate.

Eligibility Criteria

To qualify for the Hood County Homestead Exemption, applicants must meet specific criteria. Generally, the property must be the applicant's primary residence, and the homeowner must have owned the property as of January first of the tax year for which the exemption is sought. Additionally, applicants must not have claimed a homestead exemption on another property in Texas during the same tax year.

Form Submission Methods

The Hood County Homestead Exemption Form can be submitted in several ways. Homeowners may choose to file the form online through the Hood County Appraisal District's website, mail it to their office, or deliver it in person. Each method ensures that the application is received and processed in a timely manner, allowing homeowners to benefit from the exemption as soon as possible.

Legal use of the Hood County Homestead Exemption Form

The Hood County Homestead Exemption Form is legally binding once submitted and accepted by the Hood County Appraisal District. Homeowners must ensure that the information provided is accurate and truthful, as any discrepancies may lead to penalties or denial of the exemption. Compliance with local regulations regarding the use of this form is essential to maintain eligibility for the tax benefits it provides.

Quick guide on how to complete hood county homestead exemption form

Complete Hood County Homestead Exemption Form seamlessly on any device

Digital document management has gained immense popularity among businesses and individuals alike. It offers a superb eco-friendly alternative to conventional printed and signed papers, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without any delays. Manage Hood County Homestead Exemption Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and eSign Hood County Homestead Exemption Form effortlessly

- Find Hood County Homestead Exemption Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

No more worries about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Hood County Homestead Exemption Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the hood county homestead exemption form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Hood County homestead exemption form?

The Hood County homestead exemption form is a legal document that allows homeowners in Hood County to apply for property tax exemptions on their primary residence. This form helps reduce the property tax burden and provides financial relief. It’s crucial to complete and submit this form accurately to benefit from potential savings.

-

How do I obtain the Hood County homestead exemption form?

You can obtain the Hood County homestead exemption form from the Hood County Appraisal District website or visit their office directly. The form is available for download or can be filled out in person. Ensure you have the required information on hand to complete the form efficiently.

-

Are there any fees associated with submitting the Hood County homestead exemption form?

There are no fees associated with submitting the Hood County homestead exemption form. It is a free service offered to eligible homeowners in Hood County. However, failing to submit the form by the deadline could result in increased property taxes.

-

What information do I need to complete the Hood County homestead exemption form?

To complete the Hood County homestead exemption form, you will need your property’s address, a description of your property, and identification verification. It’s important to provide accurate and up-to-date information to avoid processing delays.

-

How long does it take to process the Hood County homestead exemption form?

Processing the Hood County homestead exemption form usually takes several weeks. The timeline can vary based on the volume of applications received by the appraisal district. You will receive notification once your application is processed, so you can plan accordingly.

-

Can I eSign my Hood County homestead exemption form using airSlate SignNow?

Yes, you can easily eSign your Hood County homestead exemption form using airSlate SignNow. Our platform allows you to electronically sign documents quickly and securely. This can streamline your submission process and ensure timely delivery of your application.

-

What are the benefits of filing the Hood County homestead exemption form?

Filing the Hood County homestead exemption form can signNowly reduce your property tax bill and provide financial relief. Additionally, it can enhance your home’s marketability and may offer other local property tax benefits. This form is essential for homeowners looking to optimize their tax advantages.

Get more for Hood County Homestead Exemption Form

- Oklahoma applicant questionnaire background investigation form pdf

- Amended articles of organization oklahoma form

- Form 14cr001e ocr 1 instructions okdhs

- Direct deposit accounts payable form_6 05 13pdf hdesd

- Counseling supervision contract form

- U chicago for a wall street career college confidential form

- Filing a complaint with the board it is the boards oregon gov oregon form

- Inheritance form 2007

Find out other Hood County Homestead Exemption Form

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form