Vat 201 Form in Excel Format

What is the VAT 201 Form in Excel Format

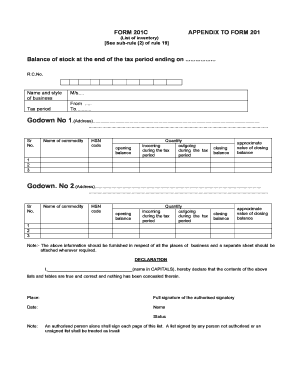

The VAT 201 form is a crucial document used for reporting value-added tax (VAT) in various jurisdictions. In the United States, this form is often utilized by businesses to declare VAT liabilities and ensure compliance with tax regulations. The Excel format of the VAT 201 form allows for easier data entry and calculations, making it a preferred choice for many users. This format facilitates the organization of financial data, ensuring accuracy and efficiency in the reporting process.

How to Use the VAT 201 Form in Excel Format

Using the VAT 201 form in Excel format involves a few straightforward steps. First, download the Excel template designed for the VAT 201 form. Once downloaded, open the file in Microsoft Excel or compatible software. Input your business details, including the VAT registration number, and fill in the required fields with accurate financial information. Excel's built-in formulas can assist in calculating totals and ensuring that all figures are correct before submission.

Steps to Complete the VAT 201 Form in Excel Format

Completing the VAT 201 form in Excel format requires careful attention to detail. Follow these steps for successful completion:

- Open the downloaded VAT 201 Excel template.

- Enter your business information, including name and address.

- Fill in the sales and purchase details accurately.

- Use Excel formulas to calculate the total VAT payable or refundable.

- Review the completed form for accuracy.

- Save the document securely, ensuring it is backed up.

Legal Use of the VAT 201 Form in Excel Format

The VAT 201 form in Excel format is legally valid when filled out correctly and submitted in accordance with local tax laws. It is essential to ensure that all entries comply with the relevant regulations governing VAT reporting. Electronic submission of the completed form is acceptable in many jurisdictions, provided that the necessary electronic signature and verification processes are followed. This ensures that the form is recognized as a legitimate document by tax authorities.

Key Elements of the VAT 201 Form in Excel Format

Several key elements must be included when completing the VAT 201 form in Excel format. These elements typically include:

- VAT registration number

- Business name and address

- Sales and purchase amounts

- Total VAT collected and paid

- Signature or electronic verification

Each of these components plays a vital role in ensuring that the form is complete and compliant with tax regulations.

Filing Deadlines / Important Dates

Filing deadlines for the VAT 201 form can vary based on the specific regulations in your state or locality. It is crucial to be aware of these deadlines to avoid penalties. Typically, businesses are required to submit their VAT returns quarterly or annually, depending on their revenue levels. Keeping a calendar of important dates can help ensure timely submissions and compliance with tax obligations.

Form Submission Methods

The VAT 201 form can be submitted through various methods, including online, by mail, or in person. Many jurisdictions encourage electronic submission for efficiency and speed. When submitting online, ensure that you follow the specific guidelines provided by the tax authority. If submitting by mail, double-check that the form is sent to the correct address and is postmarked by the filing deadline.

Quick guide on how to complete vat 201 form in excel format

Finish Vat 201 Form In Excel Format effortlessly on any device

Digital document management has gained traction among companies and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, as you can locate the appropriate form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Vat 201 Form In Excel Format on any device using airSlate SignNow’s Android or iOS applications and enhance any document-based workflow today.

The easiest method to modify and eSign Vat 201 Form In Excel Format without hassle

- Locate Vat 201 Form In Excel Format and click Get Form to begin.

- Employ the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that task.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Verify all details and click on the Done button to save your amendments.

- Choose how you wish to deliver your form, either via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or mislaid files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Modify and eSign Vat 201 Form In Excel Format and guarantee effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vat 201 form in excel format

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the VAT 201 form in Excel format?

The VAT 201 form in Excel format is a digital template that businesses can use to report their value-added tax calculations to the relevant tax authorities. This format simplifies data entry and allows for easier calculations, making it a valuable tool for effective tax management.

-

How can airSlate SignNow help me manage the VAT 201 form in Excel format?

With airSlate SignNow, you can easily create, sign, and manage your VAT 201 form in Excel format. Our platform streamlines the process of filling out and submitting the form, reducing errors and saving time, so you can focus on running your business.

-

Is there a cost associated with using the VAT 201 form in Excel format on your platform?

airSlate SignNow offers various pricing plans that include features for managing documents, including the VAT 201 form in Excel format. Our plans are designed to be cost-effective, making it accessible for businesses of all sizes.

-

Can I integrate airSlate SignNow with other tools to manage the VAT 201 form in Excel format?

Yes, airSlate SignNow integrates seamlessly with various business applications, ensuring that your workflow remains efficient. You can connect to your accounting or file management tools to streamline the process of handling the VAT 201 form in Excel format.

-

What are the benefits of using the VAT 201 form in Excel format instead of a paper form?

Using the VAT 201 form in Excel format offers numerous benefits, including reduced printing costs and the ability to quickly make adjustments. Digital formats allow for easier data manipulation and quicker submission to tax authorities, enhancing overall efficiency.

-

Is the VAT 201 form in Excel format customizable?

Absolutely! The VAT 201 form in Excel format available through airSlate SignNow is customizable to fit your business needs. You can modify fields and formulas within the template to better suit your reporting requirements.

-

How does airSlate SignNow ensure the security of my VAT 201 form in Excel format?

At airSlate SignNow, we prioritize the security of your documents, including the VAT 201 form in Excel format. Our platform employs advanced encryption and compliance measures to protect your sensitive information from unauthorized access.

Get more for Vat 201 Form In Excel Format

- Church position acceptance letter form

- Cartwheel a thon form

- Form no ejn june 2016

- Affidavit declaration of rebecca ms busch mba filed by form

- Certified healthcare internal audit professional form

- Positive personal profile form

- How to obtain dol gold card form

- Family emergency communication plan fillable card form

Find out other Vat 201 Form In Excel Format

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe