Vdd1 Form

What is the Vdd1 Form

The Vdd1 form is a specific document used primarily for tax-related purposes in the United States. It serves as a declaration or application for various financial transactions, particularly in relation to direct debit arrangements. This form is essential for individuals and businesses alike, as it ensures compliance with tax regulations and facilitates the smooth processing of payments. Understanding the purpose and requirements of the Vdd1 form is crucial for accurate and timely submissions.

How to Obtain the Vdd1 Form

Obtaining the Vdd1 form is a straightforward process. It can typically be accessed through official government websites or financial institutions that require its use. Users can download the Vdd1 form in PDF format for easy printing and completion. It is advisable to ensure that the most current version of the form is used, as updates may occur periodically. For those who prefer a digital approach, many platforms offer the option to fill out the form online, streamlining the submission process.

Steps to Complete the Vdd1 Form

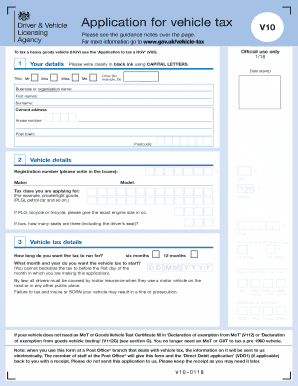

Completing the Vdd1 form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information, including personal identification details and financial information relevant to the direct debit arrangement. Next, carefully fill out each section of the form, ensuring that all fields are completed accurately. After completing the form, review it for any errors or omissions before submitting it. This careful attention to detail helps prevent delays in processing and ensures that the form is legally binding.

Legal Use of the Vdd1 Form

The Vdd1 form holds legal significance when properly completed and submitted. It is essential for establishing a direct debit agreement, which allows for automatic withdrawals from a bank account. To ensure its legal standing, the form must meet specific requirements, including obtaining necessary signatures and adhering to relevant regulations. Utilizing a trusted eSignature solution can further enhance the legal validity of the Vdd1 form, providing added security and compliance with electronic signature laws.

Key Elements of the Vdd1 Form

Several key elements must be included in the Vdd1 form to ensure its effectiveness. These elements typically include the name and contact information of the account holder, bank details for the direct debit, and the specific amount to be withdrawn. Additionally, there may be sections for authorizing the direct debit and providing consent for the transaction. Ensuring that all required information is accurately filled out is crucial for the successful processing of the form.

Form Submission Methods

The Vdd1 form can be submitted through various methods, depending on the requirements of the institution or organization requesting it. Common submission methods include online submission via secure portals, mailing a physical copy to the appropriate address, or delivering it in person. Each method has its advantages, and users should choose the one that best fits their needs while ensuring that it complies with any specified deadlines.

IRS Guidelines

When dealing with the Vdd1 form, it is important to be aware of the IRS guidelines that govern its use. These guidelines outline the necessary information to be included, the legal implications of the form, and any associated deadlines for submission. Adhering to IRS guidelines helps ensure that the form is processed correctly and that the individual or business remains compliant with tax regulations. Regularly reviewing these guidelines can provide valuable insights into any changes that may affect the use of the Vdd1 form.

Quick guide on how to complete vdd1 form

Effortlessly Prepare Vdd1 Form on Any Device

Digital document management has gained popularity among organizations and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage Vdd1 Form on any device using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

How to Edit and eSign Vdd1 Form with Ease

- Find Vdd1 Form and click on Get Form to initiate the process.

- Utilize the tools we offer to fill out your form.

- Select important sections of the documents or redact sensitive information with the tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes moments and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Decide how you want to deliver your form—via email, SMS, invitation link, or download it to your computer.

No more concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from your preferred device. Modify and eSign Vdd1 Form to ensure effective communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vdd1 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the vdd1 form and how is it used?

The vdd1 form is a specific document format that facilitates easy eSigning for various business transactions. Utilizing the airSlate SignNow platform, users can quickly send and sign the vdd1 form, ensuring that all signers are legally bound and the process is efficient.

-

How does airSlate SignNow support the vdd1 form?

airSlate SignNow offers robust tools for managing the vdd1 form, allowing users to customize templates and automate workflows. This enhances efficiency and reduces the time spent on document management, making it an ideal solution for businesses needing reliable electronic signatures.

-

What are the benefits of using the vdd1 form with airSlate SignNow?

Using the vdd1 form with airSlate SignNow streamlines the signing process, offers enhanced security, and reduces paper waste. The user-friendly interface ensures that anyone, regardless of technical skill, can navigate the signing process with ease.

-

Is there a cost associated with using the vdd1 form on airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, including options that support the use of the vdd1 form. You can choose a plan that best suits your requirements, ensuring affordability and value for your investment.

-

Can I integrate the vdd1 form with other software using airSlate SignNow?

Absolutely! airSlate SignNow supports numerous integrations that allow you to connect the vdd1 form with popular applications like CRM systems and cloud storage solutions. This ensures a seamless workflow that enhances productivity and document accessibility.

-

What features does airSlate SignNow offer for managing the vdd1 form?

AirSlate SignNow provides a range of features for the vdd1 form, including customizable templates, secure storage, and advanced tracking options. These features empower users to manage their documents efficiently and ensure compliance with legal standards.

-

Is it easy to send a vdd1 form for signing?

Yes, sending a vdd1 form for signing with airSlate SignNow is incredibly straightforward. Users can upload their document, specify signers, and send it off in just a few clicks, making it one of the simplest eSigning solutions available.

Get more for Vdd1 Form

- Chronic wasting disease cwd kansas department of agriculture form

- Deep chronic wasting disease ctgov form

- Authorization for uw medicine to use or disclose protected form

- Application for 1915c hcbs waiver ky0333r0400 jan 01 2017 form

- Application for 1915c hcbs waiver ky40146r0600 oct 01 2015 form

- Civil money penalty funds cabinet for health and family form

- Microdermabrasion application permit louisiana board lsbc louisiana form

- Office for citizens with developmental disabilities services and form

Find out other Vdd1 Form

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe