Ga Form 500 Instructions

What is the GA Form 500 Instructions

The GA Form 500 Instructions provide detailed guidance for completing the Georgia Individual Income Tax Return. This form is essential for residents and part-year residents of Georgia who need to report their income, calculate their tax liability, and claim any applicable credits or deductions. Understanding these instructions is crucial for ensuring compliance with state tax laws and for accurately filing your return.

Steps to Complete the GA Form 500 Instructions

Completing the GA Form 500 involves several key steps:

- Gather Necessary Documents: Collect all relevant financial documents, including W-2s, 1099s, and any other income statements.

- Fill Out Personal Information: Enter your name, address, and Social Security number accurately at the top of the form.

- Report Income: List all sources of income, ensuring you include wages, interest, and any other earnings.

- Calculate Adjusted Gross Income: Follow the instructions to determine your adjusted gross income (AGI) by applying any deductions.

- Determine Tax Liability: Use the provided tax tables to find your tax liability based on your taxable income.

- Claim Credits and Deductions: Identify and apply any eligible tax credits or deductions to reduce your tax owed.

- Sign and Date the Form: Ensure you sign and date your return before submission.

Legal Use of the GA Form 500 Instructions

The GA Form 500 Instructions are legally binding and must be followed to ensure compliance with Georgia tax regulations. Proper adherence to these instructions helps avoid potential penalties and ensures that the submitted tax return is valid. Electronic signatures are accepted, provided they comply with the necessary legal frameworks, making it easier to submit the form digitally.

Filing Deadlines / Important Dates

It is essential to be aware of the deadlines associated with the GA Form 500. Typically, the filing deadline for individual income tax returns is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, if you require more time to file, you can request an extension, but any taxes owed must still be paid by the original due date to avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

The GA Form 500 can be submitted through various methods:

- Online: Use the Georgia Department of Revenue's online portal to file your return electronically.

- Mail: Send your completed form to the appropriate address provided in the instructions. Ensure you use the correct postage and keep a copy for your records.

- In-Person: You may also file your return in person at designated Georgia Department of Revenue offices.

Who Issues the Form

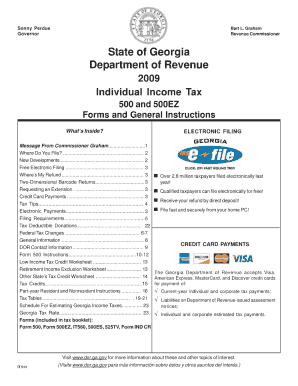

The GA Form 500 is issued by the Georgia Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance among taxpayers. They provide the necessary forms, instructions, and resources to assist individuals in fulfilling their tax obligations.

Quick guide on how to complete ga form 500 instructions 100049837

Effortlessly Prepare Ga Form 500 Instructions on Any Device

The management of online documents has become increasingly popular among both businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed papers since you can easily find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without delays. Manage Ga Form 500 Instructions across any platform using airSlate SignNow applications for Android or iOS and streamline any document-related process today.

How to Edit and eSign Ga Form 500 Instructions with Ease

- Find Ga Form 500 Instructions and click on Get Form to begin.

- Utilize the features we provide to fill out your document.

- Highlight important sections of the documents or obscure sensitive information using tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred delivery method for your form, whether by email, SMS, or invitation link, or download it to your computer.

No more worrying about lost or misplaced files, time-consuming form searches, or mistakes that require reprinting new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your choice. Edit and eSign Ga Form 500 Instructions while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ga form 500 instructions 100049837

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the GA tax form 500 instructions?

The GA tax form 500 instructions provide detailed guidance on completing the Georgia Individual Income Tax Return. This document outlines how to report income, claim deductions, and calculate your tax liability in Georgia. Understanding these instructions is crucial for ensuring compliance and maximizing your potential refund.

-

How can I access the GA tax form 500 instructions?

You can access the GA tax form 500 instructions online through the Georgia Department of Revenue's official website. They typically offer downloadable PDF versions that are easy to print and reference while completing your tax return. Alternatively, you can find these instructions in tax preparation software that integrates with the GA tax forms.

-

What features does airSlate SignNow offer for handling GA tax form 500?

airSlate SignNow offers an easy-to-use platform for eSigning documents, including the GA tax form 500. You can securely send, sign, and store your tax documents, ensuring compliance and confidentiality. This solution simplifies the whole process of submitting your GA tax forms with added efficiency.

-

Is airSlate SignNow cost-effective for individual users preparing GA tax forms?

Yes, airSlate SignNow is a cost-effective solution for individual users preparing GA tax forms like the GA tax form 500. With affordable pricing plans, you can access all necessary features to eSign and manage your tax documentation without breaking the bank. This affordability makes it an ideal choice for tax filers.

-

Can I integrate airSlate SignNow with other tax software for GA tax form 500?

Absolutely! airSlate SignNow easily integrates with popular tax software applications that assist in filling out the GA tax form 500. This integration allows for seamless document handling and improves your overall tax filing experience, making it just a click away to eSign the required forms.

-

What are the benefits of using airSlate SignNow for eSigning GA tax forms?

Using airSlate SignNow for eSigning GA tax forms offers various benefits, including increased efficiency and security. Your documents can be signed anywhere at any time, which eliminates the need for printing and scanning. Moreover, airSlate SignNow provides a secure environment for all your sensitive tax information.

-

Are there any limitations while using airSlate SignNow for GA tax form 500 processing?

While airSlate SignNow is robust, there are some limitations, such as the need for an internet connection to access cloud-based services. Certain advanced features may also require a premium subscription. Understanding these limitations will help you determine how best to utilize airSlate SignNow for your GA tax form 500 needs.

Get more for Ga Form 500 Instructions

- Queens referral form

- Associate of science in nursing program application fall 2020 spring 2021 form

- Capital blue cross fillable claim form

- At edgewood the opportunity for long term recovery and good health is created by form

- Reporting occupational injuries and incidentsstaff pages form

- Pto donation form

- Tricare ohi form

- Intervention incident form

Find out other Ga Form 500 Instructions

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online