Example of Completed Form 8958

What is the example of completed Form 8958

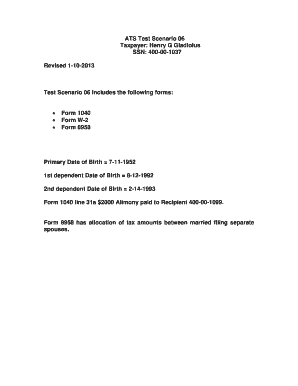

The example of completed Form 8958 serves as a reference for taxpayers who need to report the allocation of income, deductions, and credits among partners in a partnership. This form is specifically designed for use by partnerships that have elected to be treated as corporations for tax purposes. The completed form illustrates how to accurately fill in the necessary sections, ensuring compliance with IRS requirements.

Steps to complete the example of Form 8958

Completing the example of Form 8958 involves several key steps:

- Gather all necessary financial documents related to the partnership's income and expenses.

- Fill out the identifying information, including the name and taxpayer identification number of the partnership.

- Report the total income, deductions, and credits for the partnership in the designated sections.

- Allocate the amounts to each partner according to the partnership agreement.

- Review the completed form for accuracy before submission.

Legal use of the example of completed Form 8958

The legal use of the example of completed Form 8958 is crucial for ensuring that all partners are accurately reporting their share of the partnership's income and expenses. This form must be filed with the IRS to maintain compliance with tax laws. Failure to accurately complete and submit the form can lead to penalties and increased scrutiny from tax authorities.

IRS guidelines for Form 8958

The IRS provides specific guidelines for completing Form 8958, which include instructions on how to report income, deductions, and credits. Taxpayers should refer to the IRS instructions for Form 8958 to understand the requirements for reporting and the consequences of non-compliance. These guidelines ensure that the form is filled out correctly and submitted on time.

Filing deadlines for Form 8958

Understanding the filing deadlines for Form 8958 is essential for compliance. Typically, the form must be filed by the due date of the partnership's tax return. If the partnership is on a calendar year basis, the deadline is usually March fifteenth of the following year. Extensions may be available, but it is important to file the form by the original deadline to avoid penalties.

Required documents for Form 8958

To complete Form 8958, certain documents are required. These include:

- Partnership agreement outlining the allocation of income and expenses.

- Financial statements detailing the partnership's income and expenses.

- Tax identification numbers for all partners involved.

Form submission methods for Form 8958

Form 8958 can be submitted through various methods. Taxpayers have the option to file electronically using IRS-approved software, which often simplifies the process and reduces errors. Alternatively, the form can be printed and mailed to the appropriate IRS address. It's important to ensure that the submission method chosen complies with IRS regulations to guarantee proper processing.

Quick guide on how to complete example of completed form 8958

Prepare Example Of Completed Form 8958 effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can obtain the required form and safely store it online. airSlate SignNow provides you with all the resources necessary to create, edit, and eSign your documents quickly and without delays. Manage Example Of Completed Form 8958 on any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to edit and eSign Example Of Completed Form 8958 hassle-free

- Locate Example Of Completed Form 8958 and click Get Form to begin.

- Utilize the tools at your disposal to fill out your form.

- Emphasize important sections of your documents or redact sensitive data using tools provided by airSlate SignNow specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all information and click the Done button to save your modifications.

- Select your preferred method for submitting your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the concerns of lost or misplaced files, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and eSign Example Of Completed Form 8958 and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the example of completed form 8958

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of the airSlate SignNow platform for completing form 8958 instructions 2017?

The airSlate SignNow platform offers intuitive tools for completing form 8958 instructions 2017, including customizable templates, electronic signatures, and document tracking. Users can easily fill out and sign documents securely, ensuring compliance with the latest requirements. The platform also supports seamless collaboration among team members.

-

How much does it cost to use airSlate SignNow for processing form 8958 instructions 2017?

AirSlate SignNow provides various pricing plans designed to accommodate different business needs. Users can choose from flexible subscription options that ensure they get the best value for processing form 8958 instructions 2017. Additionally, a free trial is available, allowing businesses to explore features before committing.

-

Are there integrations available for using form 8958 instructions 2017 in airSlate SignNow?

Yes, airSlate SignNow offers multiple integrations with popular applications that can enhance your workflow when handling form 8958 instructions 2017. You can easily connect with platforms like Google Drive, Dropbox, and Microsoft Office for a seamless experience. This integration capability streamlines document management and increases efficiency.

-

Can I save time when completing form 8958 instructions 2017 with airSlate SignNow?

Absolutely! AirSlate SignNow enables users to save time with features designed for efficiency, such as auto-fill options, bulk sending, and pre-made templates for form 8958 instructions 2017. These tools help minimize repetitive tasks, allowing you to focus on more critical aspects of your business.

-

What security measures does airSlate SignNow implement for form 8958 instructions 2017?

AirSlate SignNow prioritizes the security of your documents, including form 8958 instructions 2017, by employing industry-standard encryption and secure cloud storage. All signed documents are stored safely, ensuring compliance with legal regulations. Additionally, the platform includes robust authentication methods to safeguard user access.

-

Is airSlate SignNow user-friendly for completing form 8958 instructions 2017?

Yes, airSlate SignNow is designed with user experience in mind, making it incredibly user-friendly for completing form 8958 instructions 2017. The intuitive interface allows users of all technical skill levels to navigate and utilize its features effortlessly. Comprehensive support and resources are also available to assist users at any stage.

-

What are the benefits of using airSlate SignNow for form 8958 instructions 2017?

Using airSlate SignNow for form 8958 instructions 2017 streamlines the document signing process, increases operational efficiency, and enhances collaboration. The platform enables quick access to signed documents, reduces paper usage, and ensures all parties can sign from any location. These benefits lead to signNow time and cost savings for businesses.

Get more for Example Of Completed Form 8958

- Rhode island self proving affidavit form

- Consent to minors change of name new york form

- Revised aom certificate of graduation form9518docx

- Judgment of foreclosure and sale form new york state

- Fillable online arkansas notary discount association co form

- Arkansas self proving affidavit form

- Arkansas notary discount association form

- Information regarding the father of minor child

Find out other Example Of Completed Form 8958

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document