Hsbc Crs Self Certification Form

What is the HSBC CRS Self Certification Form

The HSBC CRS Self Certification Form is a document required by financial institutions to comply with the Common Reporting Standard (CRS) established by the Organisation for Economic Co-operation and Development (OECD). This form is necessary for individuals and entities to declare their tax residency status. By completing the form, you provide HSBC with the necessary information to report your financial accounts to the relevant tax authorities, ensuring compliance with international tax regulations.

Steps to Complete the HSBC CRS Self Certification Form

Completing the HSBC CRS Self Certification Form involves several key steps to ensure accuracy and compliance. Here’s a straightforward guide:

- Gather Required Information: Collect personal details such as your name, address, date of birth, and tax identification number.

- Determine Tax Residency: Identify your tax residency status based on your country of residence and applicable tax laws.

- Fill Out the Form: Carefully complete all sections of the form, ensuring that information is accurate and up to date.

- Review and Sign: Check the completed form for any errors before signing to confirm that the information provided is correct.

- Submit the Form: Follow the submission guidelines provided by HSBC, which may include online submission or mailing the form.

How to Obtain the HSBC CRS Self Certification Form

The HSBC CRS Self Certification Form can be obtained through several methods:

- Online Download: Visit the HSBC website where the form is typically available for download in PDF format.

- Branch Request: You can request a physical copy of the form at your local HSBC branch.

- Customer Service: Contact HSBC customer service for assistance in obtaining the form, either through phone or email.

Legal Use of the HSBC CRS Self Certification Form

The legal use of the HSBC CRS Self Certification Form is crucial for compliance with international tax laws. By accurately completing and submitting this form, individuals and entities fulfill their obligations under the CRS, which aims to combat tax evasion. Failure to provide accurate information may result in penalties or legal consequences, making it essential to ensure that all details are correct and complete.

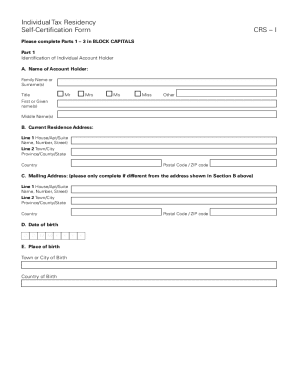

Key Elements of the HSBC CRS Self Certification Form

Understanding the key elements of the HSBC CRS Self Certification Form is vital for proper completion. The form typically includes:

- Personal Identification: Name, address, and date of birth.

- Tax Residency Information: Countries where you are considered a tax resident.

- Tax Identification Number: Required for each country of tax residency.

- Signature and Declaration: A section where you affirm the accuracy of the provided information.

Form Submission Methods

Submitting the HSBC CRS Self Certification Form can be done through various methods, depending on your preference and the options provided by HSBC:

- Online Submission: Many users prefer to submit the form electronically through the HSBC online banking platform.

- Mail: You can print the completed form and send it via postal mail to the designated HSBC address.

- In-Person: Alternatively, you may visit a local HSBC branch to submit the form directly to a representative.

Quick guide on how to complete hsbc crs self certification form

Effortlessly prepare Hsbc Crs Self Certification Form on any device

Managing documents online has gained popularity among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed materials, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents quickly without any delays. Handle Hsbc Crs Self Certification Form on any device using the airSlate SignNow apps for Android or iOS and enhance any document-oriented process today.

The easiest way to edit and electronically sign Hsbc Crs Self Certification Form seamlessly

- Locate Hsbc Crs Self Certification Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools designed specifically for that purpose provided by airSlate SignNow.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet signature.

- Review the information and then click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Edit and electronically sign Hsbc Crs Self Certification Form and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the hsbc crs self certification form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a SIFE form sample PDF?

A SIFE form sample PDF is a template used to capture information for various purposes. It is particularly useful for organizations needing a standardized format to collect responses. Utilizing airSlate SignNow, you can easily create and customize a SIFE form sample PDF to meet your specific requirements.

-

How can I create a SIFE form sample PDF using airSlate SignNow?

To create a SIFE form sample PDF, simply log into your airSlate SignNow account and select 'Create Document.' From there, you can upload your existing document or start from a template. The easy-to-use interface allows you to add fields and customize it to suit your needs, turning it into a professional SIFE form sample PDF.

-

Is airSlate SignNow suitable for businesses of all sizes to manage SIFE form sample PDFs?

Yes, airSlate SignNow is designed to cater to businesses of all sizes, from startups to large enterprises. Our platform provides a cost-effective solution to send and eSign documents efficiently. Regardless of your company's size, you can easily manage SIFE form sample PDFs tailored to your needs.

-

What are the benefits of using airSlate SignNow for SIFE form sample PDFs?

Using airSlate SignNow for SIFE form sample PDFs offers numerous benefits, including increased efficiency, reduced paper usage, and faster turnaround times for document signing. Its secure and compliant platform ensures that your documents are safely stored and easily accessible. Plus, you can track the status of each SIFE form sample PDF in real time.

-

Are there integrations available for handling SIFE form sample PDFs with airSlate SignNow?

Absolutely! airSlate SignNow integrates seamlessly with various platforms such as Google Drive, Salesforce, and Microsoft Office. This means you can easily manage your SIFE form sample PDFs alongside your other business tools, streamlining your workflow and improving productivity.

-

What is the pricing model for using airSlate SignNow for SIFE form sample PDFs?

airSlate SignNow offers flexible pricing plans to accommodate different business needs. Depending on the features you require, you can choose from individual plans or enterprise-level subscriptions. Each plan provides access to tools necessary for creating and managing SIFE form sample PDFs at an affordable price.

-

Can I track the status of my SIFE form sample PDFs in airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your SIFE form sample PDFs with ease. You can see who has viewed, signed, or declined a document, providing you with transparency throughout the process. This feature helps you stay organized and ensures timely follow-ups when necessary.

Get more for Hsbc Crs Self Certification Form

- Face sheet and health insurance claim information

- Submit casebohbot ampamp riles pc attorneys at lawoakland form

- Sports medicine department form

- Eeoc inquiry form

- Financial questionnaire policy if known goforformscom

- Fillable online pharmacy ca nonresident sterile form

- Hospital pharmacy self assessment california state board of form

- Idnr land access permision form

Find out other Hsbc Crs Self Certification Form

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document