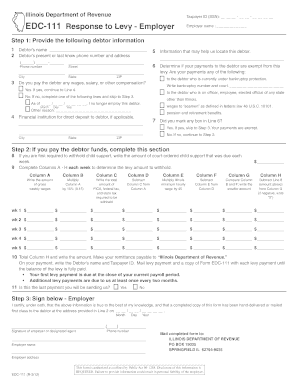

Illinois Form Edc 111w

What is the Illinois Form Edc 111w

The Illinois Form Edc 111w is a specific document used for educational purposes, particularly in relation to property tax levies. This form is essential for local governments and school districts in Illinois to request approval for property tax increases. It provides a structured way to communicate the need for additional funding to support educational initiatives and maintain school operations.

How to use the Illinois Form Edc 111w

Using the Illinois Form Edc 111w involves several steps to ensure compliance with state regulations. First, gather the necessary information regarding the proposed tax levy, including the amount requested and the justification for the increase. Next, complete the form accurately, ensuring that all required fields are filled out. Once completed, submit the form to the appropriate local authority for review. It is important to keep copies of the submitted form for your records.

Steps to complete the Illinois Form Edc 111w

Completing the Illinois Form Edc 111w requires careful attention to detail. Follow these steps:

- Obtain the latest version of the form from the appropriate state or local government website.

- Fill in the entity's name, address, and contact information.

- Specify the proposed levy amount and provide a detailed explanation of its necessity.

- Include any supporting documentation that may strengthen the request.

- Review the completed form for accuracy before submission.

Legal use of the Illinois Form Edc 111w

The legal use of the Illinois Form Edc 111w is governed by state laws concerning property tax levies. To ensure that the form is legally binding, it must be completed in accordance with the Illinois Property Tax Code. This includes adhering to deadlines for submission and ensuring that all required information is provided. Failure to comply with these regulations may result in the rejection of the form or legal challenges.

Key elements of the Illinois Form Edc 111w

The Illinois Form Edc 111w includes several key elements that are crucial for its validity. These elements typically consist of:

- Identification of the taxing district or school board.

- Details of the proposed tax levy, including the amount and purpose.

- Signatures of authorized representatives.

- Supporting documentation that justifies the request.

Filing Deadlines / Important Dates

Filing deadlines for the Illinois Form Edc 111w are critical to ensure timely processing. Generally, forms must be submitted by a specific date each year, often aligned with the budget approval cycle for local governments. It is essential to check the current year's deadlines to avoid any penalties or complications in the approval process.

Quick guide on how to complete illinois form edc 111w

Effortlessly Prepare Illinois Form Edc 111w on Any Device

The management of online documents has surged in popularity among businesses and individuals alike. It serves as an excellent environmentally friendly alternative to traditional printed and signed paperwork, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to swiftly create, modify, and electronically sign your documents without delays. Handle Illinois Form Edc 111w on any device using the airSlate SignNow Android or iOS applications and streamline your document-related tasks today.

How to Modify and eSign Illinois Form Edc 111w with Ease

- Obtain Illinois Form Edc 111w and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Mark pertinent sections of the document or obscure sensitive details using tools provided specifically for that function by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that require creating new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Illinois Form Edc 111w and ensure seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the illinois form edc 111w

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the EDC 111 and how does it work?

The EDC 111 is an advanced electronic document creation and management tool offered by airSlate SignNow. It allows businesses to streamline their document workflows by efficiently sending and eSigning documents. With its user-friendly interface, the EDC 111 ensures a smooth experience for all users, enhancing productivity and reducing turnaround time.

-

What features does the EDC 111 provide?

The EDC 111 includes a variety of powerful features such as customizable templates, in-person signing, and secure cloud storage. Users can easily create, manage, and track documents, ensuring that every signature is captured accurately. These features make the EDC 111 a versatile tool for businesses of all sizes.

-

How much does the EDC 111 cost?

Pricing for the EDC 111 varies depending on the plan you choose, but airSlate SignNow provides affordable and flexible pricing options to suit different business needs. Companies can opt for monthly or annual subscriptions, allowing them to select a plan that fits their budget while enjoying all the functionalities of the EDC 111.

-

What are the benefits of using the EDC 111?

Using the EDC 111 empowers businesses to digitize and automate their document workflows, leading to increased efficiency and reduced operational costs. With its intuitive design, the EDC 111 helps users save time by eliminating the need for paper documents and manual processing. Overall, this tool enhances collaboration and allows for faster decision-making.

-

Can the EDC 111 integrate with other software?

Yes, the EDC 111 can seamlessly integrate with various third-party applications such as CRM systems, cloud storage services, and project management tools. This interoperability allows businesses to create a cohesive workflow that leverages existing software solutions while optimizing document management processes. Integrating the EDC 111 ensures that you can work efficiently in your preferred environment.

-

Is the EDC 111 secure for handling sensitive documents?

Absolutely, the EDC 111 is designed with security as a top priority. It employs industry-standard encryption and adheres to compliance regulations to protect sensitive information during transmission and storage. Businesses can confidently manage sensitive documents knowing that the EDC 111 maintains high-security standards.

-

How user-friendly is the EDC 111 for new customers?

The EDC 111 is built with user experience in mind, making it incredibly easy for new customers to get started. With an intuitive interface, comprehensive tutorials, and customer support available, you can quickly learn how to navigate and utilize all features. This ensures a smooth onboarding process for users of all technical skill levels.

Get more for Illinois Form Edc 111w

- Summer soccer camp waiver form rider high school

- Citizens bank subordination form

- Pcds nova scotia form

- Motorcycle club registration form

- Fha identity of interest form

- Service credit union direct deposit form

- Fillable online ampamp trustee declaration fax email print pdffiller form

- Banner health new patient forms

Find out other Illinois Form Edc 111w

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template