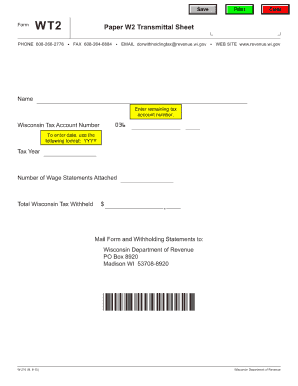

W2 Form 210

What makes the w2 form 210 legally valid?

As the society ditches in-office work, the execution of documents more and more happens online. The w2 form 210 isn’t an exception. Dealing with it using digital means is different from doing so in the physical world.

An eDocument can be viewed as legally binding on condition that specific needs are met. They are especially crucial when it comes to signatures and stipulations related to them. Entering your initials or full name alone will not ensure that the organization requesting the form or a court would consider it performed. You need a trustworthy solution, like airSlate SignNow that provides a signer with a digital certificate. In addition to that, airSlate SignNow maintains compliance with ESIGN, UETA, and eIDAS - main legal frameworks for eSignatures.

How to protect your w2 form 210 when filling out it online?

Compliance with eSignature regulations is only a portion of what airSlate SignNow can offer to make form execution legal and secure. Furthermore, it offers a lot of possibilities for smooth completion security smart. Let's quickly run through them so that you can stay assured that your w2 form 210 remains protected as you fill it out.

- SOC 2 Type II and PCI DSS certification: legal frameworks that are set to protect online user data and payment information.

- FERPA, CCPA, HIPAA, and GDPR: leading privacy standards in the USA and Europe.

- Dual-factor authentication: provides an extra layer of protection and validates other parties identities through additional means, such as a Text message or phone call.

- Audit Trail: serves to catch and record identity authentication, time and date stamp, and IP.

- 256-bit encryption: transmits the data securely to the servers.

Filling out the w2 form 210 with airSlate SignNow will give better confidence that the output document will be legally binding and safeguarded.

Quick guide on how to complete w2 form 210

Complete W2 Form 210 effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, as you can easily locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without holdups. Manage W2 Form 210 on any device with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The simplest way to modify and eSign W2 Form 210 with ease

- Locate W2 Form 210 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools designed specifically for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign W2 Form 210 to ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the w2 form 210

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a W2 Form 210 and why is it important?

The W2 Form 210 is a tax document that employers use to report an employee's annual wages and the taxes withheld from them. It's important because it provides essential information for both employers and employees when filing taxes. Accurate and timely submission of the W2 Form 210 ensures compliance with IRS regulations and avoids potential penalties.

-

How can airSlate SignNow help with W2 Form 210 processing?

airSlate SignNow simplifies the eSigning and distribution process for W2 Form 210 by offering a user-friendly platform that allows businesses to send, track, and receive signed documents quickly. This streamlines the workflow and saves valuable time, ensuring that your W2 Form 210 is delivered securely and promptly to employees and the IRS.

-

What are the pricing options for using airSlate SignNow for W2 Form 210?

airSlate SignNow offers several pricing plans that cater to different business needs, including a cost-effective solution specifically for handling W2 Form 210 processing. You can choose a plan that fits your budget and business scale, allowing you to manage document signing without incurring excessive costs. Most plans include features beneficial for automating the W2 Form 210 workflow.

-

Are there any integration options for W2 Form 210 with other software?

Yes, airSlate SignNow supports integrations with a variety of popular software and tools, allowing for seamless data transfer and management related to the W2 Form 210. Whether you're using HR management systems or accounting software, these integrations enhance your overall efficiency and make handling W2 Form 210 easier.

-

What features does airSlate SignNow offer for managing W2 Form 210 effectively?

airSlate SignNow is equipped with robust features designed for efficient management of W2 Form 210, such as document templates, automated reminders, and secure cloud storage. These features ensure that the signing process is quick and compliant with tax regulations, providing peace of mind during tax season.

-

Can I track the status of my W2 Form 210 with airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking features that allow you to monitor the status of your W2 Form 210 throughout the signing process. This means you can quickly see when documents are sent, viewed, and signed, keeping you informed and organized.

-

Is there customer support available for questions related to W2 Form 210?

Yes, airSlate SignNow offers dedicated customer support to assist with any inquiries regarding the W2 Form 210. Whether you need help navigating the platform, understanding pricing, or addressing technical issues, our support team is ready to provide prompt assistance.

Get more for W2 Form 210

- Student food allergy assessment form lake stevens school lkstevens wednet

- Barsch learning style preference form pasadena city college pasadena

- Property condition report form 52907614

- Mold disclosure form

- Form 130 u texas

- Ministries checklist form

- Ecsi wilderness first aid report form pdf

- Affidavit of undertaking form

Find out other W2 Form 210

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form