P45 2008-2026

What is the P45

The P45 is a document issued by an employer in the United States when an employee leaves their job. It serves as an official record of the employee's earnings and tax deductions during their period of employment. The P45 includes essential information such as the employee's name, Social Security number, and the details of their final paycheck. This form is crucial for tax purposes, as it helps the employee accurately report their income to the IRS.

How to Obtain the P45

To obtain a P45, an employee should formally request it from their employer upon leaving the company. This request can be made through a simple email or a written letter. It is essential to include key details such as the employee's full name, job title, and the date of termination in the request. Employers are legally obligated to provide this document, so if it is not received in a timely manner, the employee may need to follow up or seek assistance from human resources.

Steps to Complete the P45

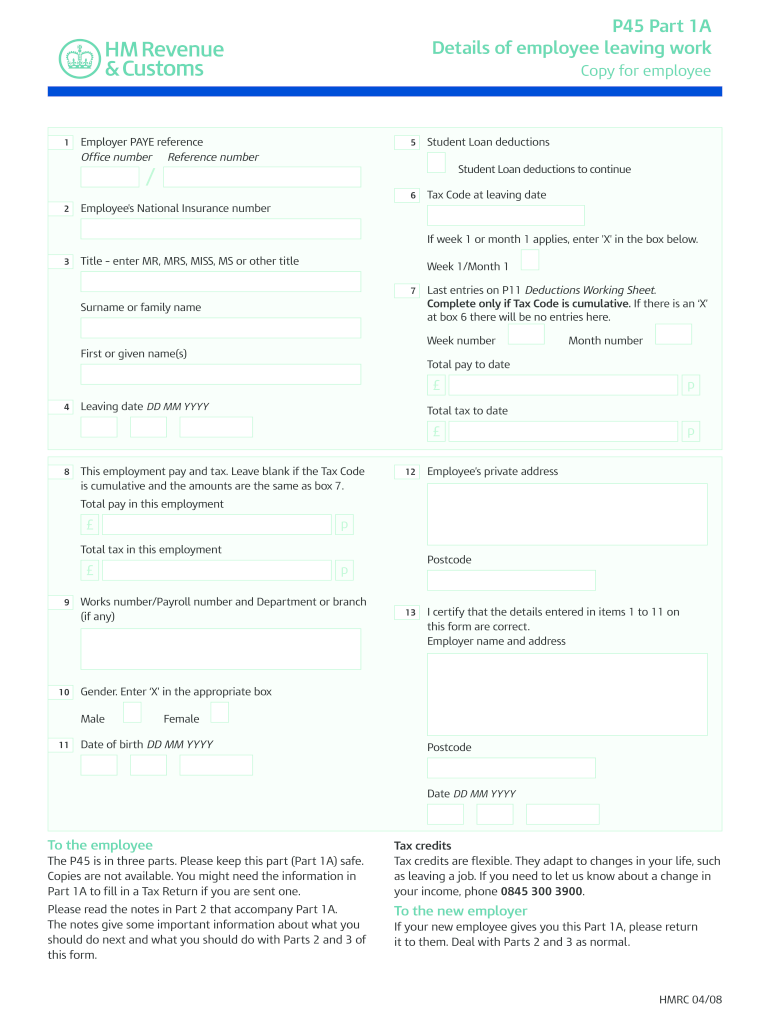

Completing the P45 involves several steps to ensure accuracy and compliance. First, the employer must gather all relevant information about the employee's earnings and tax contributions. Next, the employer should fill out the form accurately, ensuring that all fields are completed, including the employee's details and the final pay information. Finally, the completed P45 should be provided to the employee, who can then use it for their tax filings.

Key Elements of the P45

The P45 contains several critical elements that are necessary for both the employer and employee. These include:

- Employee Information: Name, Social Security number, and contact details.

- Employer Information: Company name and address.

- Employment Details: Dates of employment and job title.

- Tax Information: Total earnings, tax deductions, and any other relevant financial data.

Legal Use of the P45

The P45 is a legally recognized document that plays a significant role in tax reporting. It must be completed accurately to avoid any issues with the IRS. Employers are required to issue this form to departing employees to ensure they can report their income correctly. Failure to provide a P45 can lead to penalties for the employer and complications for the employee during tax filing.

Examples of Using the P45

Employees may use the P45 in various scenarios, such as:

- Filing annual tax returns to report income accurately.

- Applying for new jobs where proof of previous employment is required.

- Claiming tax refunds for overpaid taxes during their employment.

Quick guide on how to complete p45 part 1a details of employee leaving work zpayplus

A concise manual on how to create your P45

Locating the appropriate template can turn into a difficulty when you're required to submit official international documents. Even if you possess the necessary form, it can be tedious to swiftly complete it according to all the specifications if you are using printed versions instead of handling everything digitally. airSlate SignNow is the online eSignature service that assists you in navigating all of this. It allows you to receive your P45 and efficiently fill out and sign it on-site without needing to reprint documents in case you make an error.

Below are the actions you must take to create your P45 with airSlate SignNow:

- Click the Obtain Form button to bring your document into our editor immediately.

- Begin with the first empty field, enter your information, and move forward with the Next function.

- Complete the empty fields using the Cross and Check options from the toolbar above.

- Opt for the Highlight or Line features to emphasize the most important details.

- Click on Image and upload one if your P45 necessitates it.

- Use the right-hand panel to add additional sections for yourself or others to complete if needed.

- Review your responses and validate the document by selecting Date, Initials, and Sign.

- Create, type, upload your eSignature, or capture it using a camera or QR code.

- Conclude editing by clicking the Finished button and selecting your file-sharing preferences.

Once your P45 is prepared, you can distribute it however you wish - send it to your recipients via email, SMS, fax, or even print it directly from the editor. You can also securely save all your finished documents in your account, organized in folders according to your liking. Don’t waste time on manual document completion; give airSlate SignNow a try!

Create this form in 5 minutes or less

FAQs

-

I’m writing a book and I’m trying to work out how I can make my story fill a full length novel. What details should I include and what should I leave out?

Basically, you put your main character in a situation where something bad has happened, and she has to do something she doesn’t want to in order to fix it, with a nice ticking clock and something terrible which will happen if she doesn’t succeed, and you keep throwing shit at her until she learns whatever is necessary to change.If your story won’t fill a novel, it may not have enough content for a full novel and you should think about a novella. Adding in extra bits to make it longer also makes it boring.

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

The company I work for is taking taxes out of my paycheck but has not asked me to complete any paperwork or fill out any forms since day one. How are they paying taxes without my SSN?

WHOA! You may have a BIG problem. When you started, are you certain you did not fill in a W-4 form? Are you certain that your employer doesn’t have your SS#? If that’s the case, I would be alarmed. Do you have paycheck stubs showing how they calculated your withholding? ( BTW you are entitled to those under the law, and if you are not receiving them, I would demand them….)If your employer is just giving you random checks with no calculation of your wages and withholdings, you have a rogue employer. They probably aren’t payin in what they purport to withhold from you.

-

A Data Entry Operator has been asked to fill 1000 forms. He fills 50 forms by the end of half-an hour, when he is joined by another steno who fills forms at the rate of 90 an hour. The entire work will be carried out in how many hours?

Work done by 1st person = 100 forms per hourWork done by 2nd person = 90 forms per hourSo, total work in 1 hour would be = 190 forms per hourWork done in 5hours = 190* 5 = 950Now, remaining work is only 50 formsIn 1 hour or 60minutes, 190 forms are filled and 50 forms will be filled in = 60/190 * 50 = 15.7minutes or 16minutes (approximaty)Total time = 5hours 16minutes

Create this form in 5 minutes!

How to create an eSignature for the p45 part 1a details of employee leaving work zpayplus

How to make an eSignature for your P45 Part 1a Details Of Employee Leaving Work Zpayplus in the online mode

How to create an electronic signature for the P45 Part 1a Details Of Employee Leaving Work Zpayplus in Chrome

How to create an electronic signature for signing the P45 Part 1a Details Of Employee Leaving Work Zpayplus in Gmail

How to make an electronic signature for the P45 Part 1a Details Of Employee Leaving Work Zpayplus right from your smart phone

How to create an electronic signature for the P45 Part 1a Details Of Employee Leaving Work Zpayplus on iOS devices

How to make an eSignature for the P45 Part 1a Details Of Employee Leaving Work Zpayplus on Android OS

People also ask

-

What is a P45 request email?

A P45 request email is a formal way to ask your employer for a P45 document, which outlines your earnings and tax deductions when you leave a job. Using airSlate SignNow, you can create a professional P45 request email template to ensure that your communication is clear and effective.

-

How can airSlate SignNow help me with P45 request emails?

airSlate SignNow streamlines the process of drafting and sending P45 request emails. With our user-friendly platform, you can quickly create, sign, and send these emails electronically, making it easier to track and receive your P45 in a timely manner.

-

Is there a cost associated with using airSlate SignNow for my P45 request email?

Yes, airSlate SignNow offers various pricing plans to fit different business needs. Subscribing to one of our plans allows you to efficiently manage your P45 request emails along with other document signing needs, providing excellent value for your investment.

-

Can I customize my P45 request email using airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize your P45 request email templates to suit your business style. You can add your logo, adjust the message, and personalize recipient details to ensure your request is professional and tailored to your specific needs.

-

What features does airSlate SignNow offer for P45 request emails?

airSlate SignNow provides features such as electronic signatures, document templates, and real-time tracking for P45 request emails. These tools help ensure that your requests are sent, signed, and received efficiently, enhancing your overall document management experience.

-

Does airSlate SignNow integrate with other applications for P45 requests?

Yes, airSlate SignNow offers integrations with several applications that can enhance the process of sending a P45 request email. By integrating with tools like Google Drive and Salesforce, you can streamline your workflow and manage your employment documents seamlessly.

-

How secure is my data when using airSlate SignNow for P45 request emails?

Security is a top priority at airSlate SignNow. When you send a P45 request email, your data is protected with industry-leading encryption and compliance standards, ensuring that your personal and financial information remains confidential.

Get more for P45

Find out other P45

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple