4334, Motor Fuel Untaxed Products Return State of Michigan Michigan Form

What is the Michigan Form 4334?

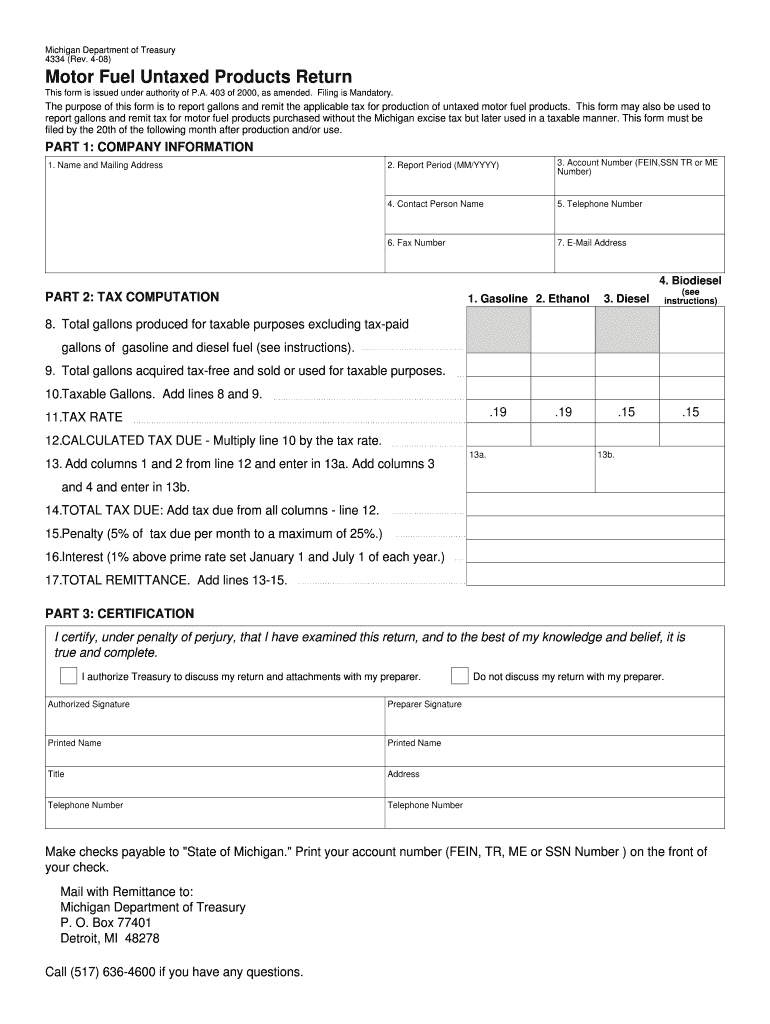

The Michigan Form 4334, also known as the Motor Fuel Untaxed Products Return, is a state-specific document used by businesses and individuals to report and pay taxes on motor fuel products that have not been taxed. This form is essential for those who manufacture, sell, or distribute untaxed motor fuels within Michigan. It ensures compliance with state tax regulations and helps maintain accurate records for tax purposes.

How to Use the Michigan Form 4334

Using the Michigan Form 4334 involves several steps to ensure accurate reporting. First, gather all necessary information regarding the untaxed motor fuels you have handled. This includes details about the type and quantity of fuel, as well as the intended use. Once you have the information, you can fill out the form either digitally or on paper. Ensure all sections are completed accurately to avoid delays in processing.

Steps to Complete the Michigan Form 4334

Completing the Michigan Form 4334 requires careful attention to detail. Follow these steps:

- Obtain the latest version of the form from the Michigan Department of Treasury website.

- Enter your business information, including name, address, and tax identification number.

- Detail the types and quantities of untaxed motor fuels you are reporting.

- Calculate the tax owed based on the quantities reported.

- Review the completed form for accuracy before submission.

Legal Use of the Michigan Form 4334

The Michigan Form 4334 must be used in compliance with state laws governing motor fuel taxation. It is legally binding when completed accurately and submitted on time. Failure to comply with the reporting requirements can result in penalties, including fines and additional taxes owed. Therefore, it is crucial to understand the legal implications of submitting this form.

Filing Deadlines for the Michigan Form 4334

Timely filing of the Michigan Form 4334 is essential to avoid penalties. The filing deadlines may vary based on the reporting period. Generally, the form is due quarterly, with specific deadlines set by the Michigan Department of Treasury. It is advisable to check the latest guidelines to ensure compliance with all filing dates.

Who Issues the Michigan Form 4334?

The Michigan Form 4334 is issued by the Michigan Department of Treasury. This department is responsible for overseeing tax compliance and ensuring that all motor fuel taxes are collected and reported accurately. For any questions regarding the form or its requirements, individuals can contact the department directly for assistance.

Quick guide on how to complete 4334 motor fuel untaxed products return state of michigan michigan

Effortlessly Prepare 4334, Motor Fuel Untaxed Products Return State Of Michigan Michigan on Any Device

The management of online documents has gained signNow traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly, eliminating delays. Manage 4334, Motor Fuel Untaxed Products Return State Of Michigan Michigan on any platform using the airSlate SignNow applications available for Android or iOS, and enhance any document-driven process today.

How to Modify and eSign 4334, Motor Fuel Untaxed Products Return State Of Michigan Michigan with Ease

- Locate 4334, Motor Fuel Untaxed Products Return State Of Michigan Michigan and click on Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize important parts of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method for sending your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, the hassle of searching for forms, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your preference. Edit and eSign 4334, Motor Fuel Untaxed Products Return State Of Michigan Michigan while ensuring excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 4334 motor fuel untaxed products return state of michigan michigan

How to make an eSignature for your 4334 Motor Fuel Untaxed Products Return State Of Michigan Michigan online

How to generate an eSignature for your 4334 Motor Fuel Untaxed Products Return State Of Michigan Michigan in Chrome

How to create an electronic signature for putting it on the 4334 Motor Fuel Untaxed Products Return State Of Michigan Michigan in Gmail

How to create an electronic signature for the 4334 Motor Fuel Untaxed Products Return State Of Michigan Michigan from your smartphone

How to make an electronic signature for the 4334 Motor Fuel Untaxed Products Return State Of Michigan Michigan on iOS

How to generate an eSignature for the 4334 Motor Fuel Untaxed Products Return State Of Michigan Michigan on Android OS

People also ask

-

What is the 4334, Motor Fuel Untaxed Products Return State Of Michigan Michigan?

The 4334, Motor Fuel Untaxed Products Return State Of Michigan Michigan is a form used to report and remit taxes on untaxed motor fuel products in Michigan. This return is essential for businesses that handle motor fuel and need to comply with state regulations to avoid penalties.

-

How can airSlate SignNow help with filing the 4334, Motor Fuel Untaxed Products Return State Of Michigan Michigan?

airSlate SignNow provides a streamlined solution for electronically signing and sending the 4334, Motor Fuel Untaxed Products Return State Of Michigan Michigan. Our platform simplifies the process, ensuring your documents are securely signed and submitted on time, making compliance easier for businesses.

-

What are the costs associated with using airSlate SignNow for the 4334, Motor Fuel Untaxed Products Return State Of Michigan Michigan?

airSlate SignNow offers a range of pricing plans to suit different business needs. By using our service for the 4334, Motor Fuel Untaxed Products Return State Of Michigan Michigan, you can save on costs related to paper, printing, and mailing, making it a cost-effective solution for compliance.

-

What features does airSlate SignNow offer for managing the 4334, Motor Fuel Untaxed Products Return State Of Michigan Michigan?

airSlate SignNow includes features such as document templates, real-time collaboration, and secure eSigning, specifically designed to assist with forms like the 4334, Motor Fuel Untaxed Products Return State Of Michigan Michigan. These features ensure your document management is efficient and compliant.

-

Is airSlate SignNow compliant with Michigan's regulations for the 4334, Motor Fuel Untaxed Products Return?

Yes, airSlate SignNow is compliant with Michigan's regulations for the 4334, Motor Fuel Untaxed Products Return State Of Michigan Michigan. Our platform adheres to electronic signature laws and ensures that your submissions meet state requirements.

-

Can I integrate airSlate SignNow with other software for my 4334, Motor Fuel Untaxed Products Return State Of Michigan Michigan?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enhancing your workflow for managing the 4334, Motor Fuel Untaxed Products Return State Of Michigan Michigan. This integration allows for greater efficiency and reduces manual entry errors.

-

How secure is airSlate SignNow for submitting the 4334, Motor Fuel Untaxed Products Return State Of Michigan Michigan?

Security is a top priority at airSlate SignNow. Our platform uses advanced encryption and secure storage to protect your documents, including the 4334, Motor Fuel Untaxed Products Return State Of Michigan Michigan, ensuring that sensitive information remains confidential.

Get more for 4334, Motor Fuel Untaxed Products Return State Of Michigan Michigan

Find out other 4334, Motor Fuel Untaxed Products Return State Of Michigan Michigan

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free

- How To eSignature Wyoming LLC Operating Agreement

- eSignature California Commercial Lease Agreement Template Myself

- eSignature California Commercial Lease Agreement Template Easy

- eSignature Florida Commercial Lease Agreement Template Easy

- eSignature Texas Roommate Contract Easy

- eSignature Arizona Sublease Agreement Template Free

- eSignature Georgia Sublease Agreement Template Online

- eSignature Arkansas Roommate Rental Agreement Template Mobile