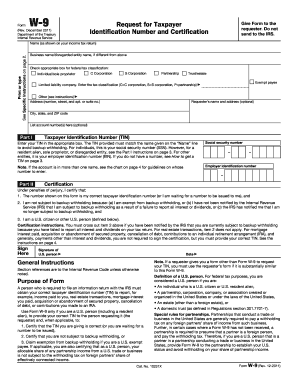

W9 Form

What is the W-9?

The W-9 form, officially known as the Request for Taxpayer Identification Number and Certification, is a document used in the United States by individuals and businesses to provide their taxpayer identification information to other parties. This form is essential for reporting income to the Internal Revenue Service (IRS). The W-9 is commonly used by freelancers, contractors, and vendors who need to report earnings to clients or businesses that pay them. By completing this form, the taxpayer certifies their name, business name (if applicable), address, and Social Security Number (SSN) or Employer Identification Number (EIN).

Steps to Complete the W-9

Completing the W-9 form involves several straightforward steps. First, download the most recent version of the W-9 from the IRS website or obtain it from the requesting party. Next, fill in your name and business name, if applicable, in the appropriate fields. Then, provide your address, ensuring it matches the one on your tax return. The next step is to enter your taxpayer identification number, which can be your SSN or EIN. Finally, sign and date the form to certify that the information provided is accurate. Be sure to keep a copy for your records.

Legal Use of the W-9

The W-9 form is legally binding when completed accurately and submitted to the requesting party. It serves as a certification of your taxpayer identification number and confirms that you are not subject to backup withholding. The IRS requires businesses to collect W-9 forms from contractors and vendors to ensure proper tax reporting. Failure to provide a W-9 when requested can result in penalties, including backup withholding on payments made to you.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the W-9 form. It is important to complete the form accurately to avoid issues with tax reporting. The IRS requires that the information on the W-9 matches the information on your tax return. Additionally, the form should be updated whenever there are changes to your taxpayer identification information, such as a name change or change in business structure. The IRS does not require the W-9 to be submitted with tax returns but rather kept on file by the requesting party for their records.

Form Submission Methods

Once the W-9 form is completed, it can be submitted to the requesting party through various methods. Common submission methods include email, fax, or traditional mail. If submitting electronically, ensure that the method used is secure to protect your sensitive information. Some businesses may also accept W-9 forms through secure online portals. It is important to follow the specific submission instructions provided by the requesting party to ensure compliance.

Examples of Using the W-9

The W-9 form is widely used in various scenarios. For instance, freelancers and independent contractors often provide a W-9 to clients who need to report payments made for services rendered. Similarly, businesses may request a W-9 from vendors to ensure accurate tax reporting. Additionally, financial institutions may require a W-9 when opening accounts for individuals or businesses to comply with IRS regulations. Understanding these examples can help individuals and businesses recognize when to use the W-9 form effectively.

Quick guide on how to complete w9

Complete W9 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without interruptions. Manage W9 on any device using the airSlate SignNow Android or iOS applications and enhance your document-centric operations today.

The easiest way to modify and eSign W9 without hassle

- Obtain W9 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method to submit your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or damaged documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign W9 and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the w9

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a W9 form and why do I need it?

A W9 form is a tax document used in the United States to provide your Taxpayer Identification Number (TIN) to clients or organizations that will be paying you. It's essential for independent contractors and freelancers to fill out a W9 to ensure correct tax reporting. Using airSlate SignNow, you can easily eSign and send your W9 forms securely.

-

How can airSlate SignNow help me with W9 forms?

airSlate SignNow simplifies the process of managing W9 forms by allowing you to create, send, and electronically sign them with ease. The platform offers a user-friendly interface that streamlines document workflow, ensuring you spend less time on paperwork and more time on your business activities. Plus, all documents are securely stored in the cloud.

-

Is airSlate SignNow an affordable option for managing W9 forms?

Yes, airSlate SignNow offers cost-effective pricing plans tailored to the needs of businesses and individuals who frequently manage W9 forms and other documents. By subscribing to our services, you can save on printing and mailing costs associated with traditional document management. Sign up today to discover our competitive pricing.

-

Can I integrate airSlate SignNow with my accounting software for W9 management?

Absolutely! airSlate SignNow offers robust integrations with popular accounting software, allowing you to manage your W9 forms more efficiently. By connecting your existing tools, you can automate data entry and ensure accurate reporting. This integration helps streamline your financial processes.

-

What features does airSlate SignNow provide for handling W9 forms?

airSlate SignNow provides powerful features for handling W9 forms, including customizable templates, real-time tracking, and automated reminders for signatures. Our platform ensures that you never miss an important signature from clients, while also providing a seamless experience for both parties involved in the transaction.

-

Is it safe to sign W9 forms using airSlate SignNow?

Yes, signing W9 forms using airSlate SignNow is secure. We use advanced encryption technologies to protect your sensitive information, ensuring confidentiality throughout the signing process. You can confidently manage your tax forms without worrying about data bsignNowes.

-

How long does it take to get my W9 signed using airSlate SignNow?

Using airSlate SignNow, getting your W9 forms signed can take just minutes. Our platform allows you to send documents for signature instantly and track their status in real-time, reducing the time spent on paperwork signNowly compared to traditional methods.

Get more for W9

- Pui form

- West jersey oral ampamp maxillofacial surgeons p form

- Request reasonable accommodation disability form

- Feet of clay the official errors that exaggerated global form

- Land surveyor certification and certificate program overviews form

- 213 cv 00610 nmk doc government publishing office form

- V 5 aggregate verification group form

- Case 112 cv 00219 rhb doc 73 filed 081913 page 1 of 29 page id form

Find out other W9

- eSign Hawaii Business Credit Application Mobile

- Help Me With eSign California Credit Memo

- eSign Hawaii Credit Memo Online

- Help Me With eSign Hawaii Credit Memo

- How Can I eSign Hawaii Credit Memo

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form