It 214 Instructions Form

What is the It 214 Instructions

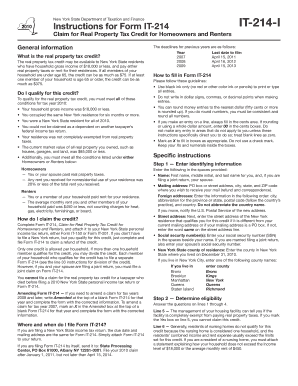

The It 214 instructions provide detailed guidance for completing the New York State IT-214 form, which is used to claim a credit for real property taxes paid by homeowners. This form is essential for individuals who wish to receive a tax benefit related to property ownership. The instructions outline eligibility criteria, necessary documentation, and the process for accurately filling out the form to ensure compliance with state regulations.

Steps to Complete the It 214 Instructions

Completing the IT-214 form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including proof of property ownership and records of property tax payments. Next, carefully read through the IT-214 instructions to understand the requirements and sections of the form. Fill out the form by entering the required information, such as your personal details and tax information. Finally, review the completed form for accuracy before submission.

Legal Use of the It 214 Instructions

The IT-214 instructions are legally binding and must be followed to ensure that the submitted form is valid. Adhering to these instructions guarantees that the claim for the property tax credit is processed correctly. The form must be signed and dated, and it is advisable to retain copies of all submitted documents for personal records. Compliance with state regulations is crucial to avoid penalties or delays in processing.

Required Documents

When completing the IT-214 form, specific documents are required to substantiate your claim. These include:

- Proof of property ownership, such as a deed or mortgage statement.

- Records of property tax payments, which may include tax bills or receipts.

- Identification documents, such as a driver's license or Social Security number.

Having these documents ready will facilitate a smoother filing process and help ensure that all information provided is accurate.

Form Submission Methods

The IT-214 form can be submitted through various methods, depending on individual preferences. Options include:

- Online submission through the New York State Department of Taxation and Finance website.

- Mailing the completed form to the appropriate state address.

- In-person submission at designated tax offices.

Choosing the right submission method can affect the processing time, so it is important to consider personal circumstances when deciding how to file.

Eligibility Criteria

To qualify for the benefits outlined in the IT-214 instructions, taxpayers must meet specific eligibility criteria. Generally, applicants must be homeowners and have paid property taxes on their primary residence. Additionally, income limits may apply, and applicants should check the latest guidelines to ensure they meet all requirements. Understanding these criteria is essential for successfully claiming the property tax credit.

Quick guide on how to complete it 214 instructions

Prepare It 214 Instructions effortlessly on any device

Web-based document management has gained traction among businesses and individuals. It offers a superb environmentally friendly substitute for traditional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage It 214 Instructions on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and eSign It 214 Instructions with ease

- Locate It 214 Instructions and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign It 214 Instructions and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the it 214 instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the nys it214 form and why do I need it?

The nys it214 form is a tax credit application in New York that allows eligible individuals to claim a credit for their property taxes. Utilizing airSlate SignNow to complete and eSign the nys it214 can simplify the process, ensuring accuracy and timely submission. This streamlines your tax filing experience, making it less stressful.

-

How can airSlate SignNow help me with the nys it214?

airSlate SignNow provides a user-friendly platform for filling out and eSigning your nys it214 form. With our service, you can easily upload, edit, and sign documents from anywhere, ensuring you have all your required information organized. Additionally, you can track the status of your nys it214 submission, providing peace of mind.

-

Is there a cost associated with using airSlate SignNow for my nys it214?

Yes, airSlate SignNow offers various pricing plans that provide affordable solutions for eSigning documents like the nys it214. Our plans are designed to cater to different volumes of usage, ensuring you find the perfect fit for your business needs without exceeding your budget. Explore our pricing options to see which one aligns with your requirements.

-

What features does airSlate SignNow offer for eSigning my nys it214?

With airSlate SignNow, you can enjoy features like customizable templates, workflow automation, and document storage for your nys it214. These tools help streamline completion and ensure that your records are organized and easily accessible. Our platform is optimized for both speed and security, giving you confidence in your document management.

-

Can I integrate airSlate SignNow with other tools for my nys it214 process?

Absolutely! airSlate SignNow offers integrations with various applications and platforms that may be useful when working with the nys it214. Connecting your existing tools with our service can enhance your workflow and improve efficiency, so you can focus on filing taxes and applying for your credits.

-

What benefits will I gain from using airSlate SignNow for my nys it214 form?

Using airSlate SignNow for your nys it214 provides numerous benefits, including saving time and reducing errors in the document preparation process. Our cloud-based solution enables easy access and collaboration, ensuring you're never stuck at a desk. Plus, signing electronically is legally binding and secure, ensuring compliance with state regulations.

-

How secure is airSlate SignNow when submitting my nys it214?

Security is a top priority for airSlate SignNow, especially when handling important documents like the nys it214. We implement robust encryption methods and compliance strategies to keep your data safe. You can trust our platform to protect your sensitive information throughout the eSigning process.

Get more for It 214 Instructions

- Dfw airport identificationaccess badge application to be form

- Canada nova scotia community college form

- Healthusnewscomdoctorsmarwan shaykh 205168dr marwan m shaykh mdjacksonville flobstetrician form

- Liability waiver or release form what is itliability waiver or release form what is itrelease of liability formfree waiver

- Immunization form student health centers mercer university

- Consent form for research us legal forms

- Approved student pick up form 21 22

- Wwwcourseherocomfilep78bof3onamestudent id last first phys 121 version a midterm form

Find out other It 214 Instructions

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter