Ub 106 a Form

What is the Ub 106 A

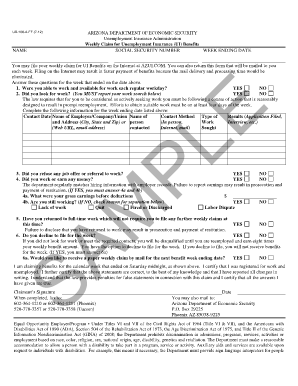

The Ub 106 A form is a crucial document used for unemployment benefits in Arizona. This form is specifically designed for individuals seeking unemployment insurance benefits. It serves as a formal request for assistance during periods of joblessness, ensuring that applicants can receive the financial support they need while searching for new employment opportunities. Understanding the purpose of the Ub 106 A is essential for anyone navigating the unemployment benefits process in Arizona.

How to use the Ub 106 A

Using the Ub 106 A form involves several steps to ensure accurate completion and submission. First, gather all necessary personal information, including your Social Security number, employment history, and details about your previous employers. Next, fill out the form accurately, providing all requested information. After completing the form, review it carefully to ensure there are no errors. Finally, submit the Ub 106 A form through the designated method, whether online, by mail, or in person, to initiate your unemployment benefits claim.

Steps to complete the Ub 106 A

Completing the Ub 106 A form requires attention to detail. Follow these steps for successful submission:

- Gather necessary documents, including identification and employment records.

- Access the Ub 106 A form from the appropriate state website or office.

- Fill out the form with accurate personal and employment information.

- Double-check all entries for accuracy and completeness.

- Submit the form as instructed, ensuring you keep a copy for your records.

Legal use of the Ub 106 A

The Ub 106 A form is legally recognized as a valid request for unemployment benefits in Arizona. To ensure its legal standing, applicants must adhere to state regulations and provide truthful information. Misrepresentation or failure to comply with the requirements can lead to penalties, including denial of benefits or legal repercussions. Understanding the legal implications of using the Ub 106 A is vital for applicants to protect their rights and ensure compliance with state laws.

Who Issues the Form

The Ub 106 A form is issued by the Arizona Department of Economic Security (DES). This state agency is responsible for administering unemployment benefits and ensuring that applicants meet the necessary criteria for assistance. By obtaining the form directly from the DES, applicants can ensure they are using the most current version and following the correct procedures for submission.

Form Submission Methods (Online / Mail / In-Person)

Applicants can submit the Ub 106 A form through various methods, providing flexibility based on individual preferences. The primary submission methods include:

- Online: Applicants can complete and submit the form electronically via the Arizona DES website.

- Mail: The completed form can be printed and sent to the designated address provided by the DES.

- In-Person: Individuals may also visit a local DES office to submit the form directly and receive assistance if needed.

Quick guide on how to complete ub 106 a

Effortlessly Prepare Ub 106 A on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without any delays. Handle Ub 106 A on any device with the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The simplest way to modify and eSign Ub 106 A effortlessly

- Find Ub 106 A and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate reprinting document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you choose. Edit and eSign Ub 106 A and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ub 106 a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to james holmes ub?

airSlate SignNow is a powerful eSigning platform that allows users to send, sign, and manage documents electronically. When searching for 'james holmes ub,' you'll find that airSlate SignNow provides a seamless experience for handling legal documents, making it essential for various applications, including legal cases associated with james holmes ub.

-

How much does airSlate SignNow cost for businesses looking to implement james holmes ub solutions?

Pricing for airSlate SignNow varies based on the plan you choose, allowing you to find a solution that fits your budget. For businesses interested in using airSlate SignNow for james holmes ub or similar documentation needs, we recommend exploring the subscription options to determine which plan offers the best value.

-

What features does airSlate SignNow offer for managing documents related to james holmes ub?

airSlate SignNow offers a range of features such as customizable templates, in-app document editing, and secure cloud storage. These features are particularly beneficial for those dealing with cases related to james holmes ub, as they streamline the signing and document management process.

-

Can airSlate SignNow integrate with other tools for handling matters connected to james holmes ub?

Yes, airSlate SignNow can integrate with various productivity and management tools such as Google Drive, Salesforce, and Microsoft Office. This integration capability is important for professionals working on cases related to james holmes ub, enabling users to streamline workflows and improve efficiency.

-

What benefits can businesses gain from using airSlate SignNow in relation to james holmes ub?

Using airSlate SignNow brings numerous benefits, including time savings, reduced paperwork, and improved security. Businesses dealing with matters related to james holmes ub will particularly appreciate these advantages as they simplify the process of document handling.

-

Is airSlate SignNow easy to use for someone unfamiliar with james holmes ub documentation?

Absolutely! airSlate SignNow is designed to be user-friendly, making it accessible even for those unfamiliar with processes involving james holmes ub documentation. Users can quickly learn to navigate the platform, ensuring that they can efficiently send and sign documents.

-

What security features does airSlate SignNow provide for documents associated with james holmes ub?

airSlate SignNow prioritizes security with features such as encryption, secure data storage, and compliance with industry standards. These security measures are crucial for handling sensitive documents linked to cases like james holmes ub, giving users peace of mind.

Get more for Ub 106 A

- Washington county transfer tax exemption form

- Waza to kokorohands and heart the use of stone in the form

- New client registration garden oaks veterinary clinic form

- 6 weeks 18 months form

- Pdf fee waiver applicationgrades 7 12 granite school district form

- Fee waiver application grades 7 12 granite school district form

- Virginia innovation health employer application 51 100 employees aetna virginia innovation health employer application 51 100 form

- 5138 macarthur blvd nw washington dc 20016 202 363 form

Find out other Ub 106 A

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast