Sd 141 Long Form

What is the Sd 141 Long Form

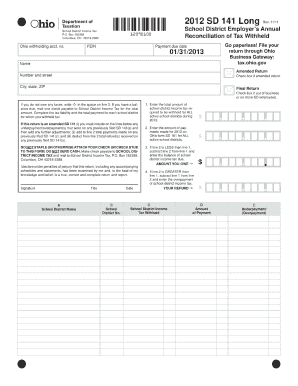

The Sd 141 Long Form is a specific document used primarily for reporting and compliance purposes within various sectors. It is often utilized in the context of tax reporting or legal documentation. This form is essential for individuals and businesses to accurately convey necessary information to the relevant authorities. Understanding its purpose and structure is crucial for ensuring compliance with applicable regulations.

How to use the Sd 141 Long Form

Using the Sd 141 Long Form involves several steps to ensure that all required information is accurately captured. Begin by carefully reading the instructions provided with the form. Gather all necessary documentation and information, including personal identification details and any relevant financial data. Complete each section of the form methodically, ensuring that all entries are clear and legible. Once completed, review the form for accuracy before submission.

Steps to complete the Sd 141 Long Form

Completing the Sd 141 Long Form can be broken down into a series of straightforward steps:

- Obtain the latest version of the form from a reliable source.

- Read the instructions thoroughly to understand the requirements.

- Collect all necessary documents and information needed for completion.

- Fill out the form section by section, ensuring accuracy in all entries.

- Review the completed form for any errors or omissions.

- Submit the form through the appropriate method, whether online, by mail, or in person.

Legal use of the Sd 141 Long Form

The legal use of the Sd 141 Long Form is governed by specific regulations that dictate how and when it should be completed. This form must be filled out accurately to maintain its validity in legal contexts. Compliance with relevant laws, such as those pertaining to tax reporting and documentation, is essential. Failure to adhere to these regulations can result in penalties or legal complications.

Key elements of the Sd 141 Long Form

Understanding the key elements of the Sd 141 Long Form is vital for effective completion. The form typically includes sections for personal identification, financial information, and any necessary declarations. Each section is designed to capture specific data that is crucial for compliance. Familiarizing oneself with these elements can streamline the completion process and reduce the likelihood of errors.

Form Submission Methods (Online / Mail / In-Person)

The Sd 141 Long Form can be submitted through various methods, depending on the requirements set by the issuing authority. Options typically include:

- Online Submission: Many agencies allow for electronic submission through secure portals.

- Mail: The form can be printed and mailed to the designated address.

- In-Person: Some situations may require the form to be submitted in person at a designated office.

Quick guide on how to complete sd 141 long form

Prepare Sd 141 Long Form effortlessly on any device

Digital document management has gained traction with businesses and individuals alike. It serves as a superb eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the required format and securely save it online. airSlate SignNow equips you with all the resources needed to create, edit, and eSign your documents quickly without delays. Handle Sd 141 Long Form on any device using airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to edit and eSign Sd 141 Long Form with ease

- Find Sd 141 Long Form and click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Verify all the details and click on the Done button to finalize your changes.

- Select your preferred method of sending your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, exhaustive form searches, or errors necessitating new document copies. airSlate SignNow takes care of your document management needs in just a few clicks from your selected device. Alter and eSign Sd 141 Long Form while ensuring excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sd 141 long form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Sd 141 Long Form and how is it used?

The Sd 141 Long Form is a specialized document used for specific legal and administrative purposes. With airSlate SignNow, you can easily complete and eSign the Sd 141 Long Form digitally, saving time and ensuring compliance with necessary regulations.

-

How does airSlate SignNow simplify the Sd 141 Long Form process?

airSlate SignNow streamlines the process for the Sd 141 Long Form by providing an intuitive platform for editing, signing, and storing documents securely. Users can collaborate in real-time, eliminating the complexities of paper-based workflows.

-

What are the pricing options for using the Sd 141 Long Form with airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet various business needs, including unlimited access to features necessary for managing the Sd 141 Long Form. You can choose a plan based on your document volume and user requirements.

-

Are there any integrations available for managing the Sd 141 Long Form?

Yes, airSlate SignNow integrates seamlessly with various popular applications, allowing users to manage the Sd 141 Long Form alongside other workflows. This integration facilitates easier document sharing and enhances overall productivity.

-

What benefits can businesses expect from using the Sd 141 Long Form in airSlate SignNow?

Using the Sd 141 Long Form with airSlate SignNow provides businesses with advantages such as reduced processing time, improved accuracy, and enhanced security. This results in a more efficient document management process that supports business growth.

-

Is it easy to track changes made to the Sd 141 Long Form?

Absolutely! airSlate SignNow includes robust tracking features that allow users to monitor any changes made to the Sd 141 Long Form. This transparency helps maintain document integrity and accountability throughout the signing process.

-

Can I use airSlate SignNow for mobile signing of the Sd 141 Long Form?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing you to sign the Sd 141 Long Form on the go. This flexibility ensures that you can complete important documents anytime and anywhere, enhancing productivity.

Get more for Sd 141 Long Form

- Wisconsin mechanics lien form for subconstractorsfree template

- West virginia mechanics lien formfree template levelset

- Control number wy p091 pkg form

- Instructions for downloading the files from the floppy for use in your form

- District of columbia will form

- Emailrm25jun10evlanrao public wiki nrao safe server form

- How to install software from the iwu application catalog indiana form

- Below is designed to assign you complete the fields contained in the form

Find out other Sd 141 Long Form

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe