How to Fill Out Mw507 Form

What is the mw507 form?

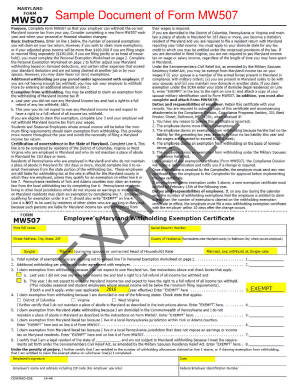

The mw507 form, officially known as the Maryland Personal Exemptions Worksheet, is a tax document used by residents of Maryland to claim personal exemptions on their state income tax returns. This form is essential for determining the amount of tax owed or the refund due based on individual circumstances, including marital status and dependents. Understanding the mw507 form is crucial for accurate tax filing and ensuring compliance with state tax regulations.

Steps to complete the mw507 form

Completing the mw507 form involves several straightforward steps. Begin by gathering necessary information, such as your Social Security number, filing status, and details about dependents. Follow these steps:

- Enter your name and address at the top of the form.

- Indicate your filing status by checking the appropriate box (single, married, etc.).

- List any dependents you are claiming, providing their names and Social Security numbers.

- Calculate your personal exemptions based on the information provided.

- Review the form for accuracy before submission.

Once completed, the mw507 form should be submitted along with your Maryland state income tax return.

Key elements of the mw507 form

The mw507 form contains several key elements that taxpayers must understand to ensure proper completion. These include:

- Filing Status: This section determines your tax rate and eligibility for certain deductions.

- Personal Exemptions: Taxpayers can claim exemptions for themselves and their dependents, which can reduce taxable income.

- Dependent Information: Accurate details about dependents are necessary for claiming exemptions.

Each of these components plays a vital role in calculating the overall tax liability for Maryland residents.

Legal use of the mw507 form

The mw507 form is legally recognized by the state of Maryland as part of the income tax filing process. It must be filled out accurately to comply with Maryland tax laws. Misrepresentation or errors on this form can lead to penalties, including fines or audits. Therefore, understanding the legal implications of the mw507 form is essential for all taxpayers in Maryland.

Examples of using the mw507 form

Practical examples can help clarify how to use the mw507 form effectively. For instance, a married couple with two children would fill out the form by indicating their filing status as married and listing each child as a dependent. This would allow them to claim multiple exemptions, reducing their taxable income. Another example could involve a single taxpayer with no dependents, who would simply indicate their status and claim one exemption for themselves.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the mw507 form. Typically, the form must be submitted by April 15 of each year, coinciding with the federal tax filing deadline. However, if April 15 falls on a weekend or holiday, the due date may be extended. Taxpayers should also be mindful of any changes in deadlines that may occur due to state regulations or unforeseen circumstances.

Quick guide on how to complete how to fill out mw507

Prepare How To Fill Out Mw507 effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can easily locate the right form and securely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and eSign your documents quickly and efficiently. Handle How To Fill Out Mw507 on any device using the airSlate SignNow applications for Android or iOS and simplify any document-related tasks today.

The simplest method to modify and eSign How To Fill Out Mw507 with ease

- Locate How To Fill Out Mw507 and then click Get Form to begin.

- Use the tools provided to complete your document.

- Mark important sections of your documents or conceal sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes just moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Select how you want to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, exhausting searches for forms, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in a few clicks from any device you prefer. Edit and eSign How To Fill Out Mw507 and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the how to fill out mw507

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the mw507 form and why is it important?

The mw507 form is an essential document used in Maryland for tax withholding purposes. It helps employers determine the appropriate amount to withhold from employees' paychecks, ensuring compliance with state tax laws. Filling out the mw507 form accurately is crucial for both employers and employees to avoid tax-related issues.

-

How can airSlate SignNow help with the mw507 form?

airSlate SignNow offers a streamlined solution for signing and managing the mw507 form electronically. With our easy-to-use platform, users can send, receive, and eSign the mw507 form securely, saving time and reducing the risk of errors. This ensures that tax forms are processed efficiently and compliant with regulations.

-

Is there a cost associated with using airSlate SignNow for the mw507 form?

Yes, airSlate SignNow offers flexible pricing plans designed to suit various business needs. Users can choose from different tiers based on their requirements, allowing for an economical solution when handling documents like the mw507 form. Additionally, we often provide a free trial to help new users experience our features without initial investment.

-

Can I integrate airSlate SignNow with other software for handling the mw507 form?

Absolutely! airSlate SignNow supports integration with various software applications such as CRMs and cloud storage platforms. This means you can seamlessly incorporate the mw507 form into your existing workflows, enhancing productivity and ensuring that all necessary documents are easily accessible and properly managed.

-

What are the benefits of using airSlate SignNow for the mw507 form?

Using airSlate SignNow for the mw507 form comes with numerous benefits, including improved efficiency and reduced paperwork. Our platform allows for quick electronic signatures, reducing the time spent on document management. Additionally, our secure storage ensures that your mw507 form and other sensitive documents are safe and compliant with industry standards.

-

Is the mw507 form available for mobile signing through airSlate SignNow?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing users to sign the mw507 form on the go. This feature is particularly useful for busy professionals who need to manage documents quickly from anywhere. With our mobile app, you can easily access, eSign, and share the mw507 form without being tied to your desk.

-

How does airSlate SignNow ensure the security of my mw507 form?

Security is a top priority at airSlate SignNow. We employ industry-leading encryption and security protocols to protect your mw507 form and related documents. Our platform also includes features such as user authentication and audit trails, ensuring that your document management process is secure and transparent.

Get more for How To Fill Out Mw507

- Fillable online state of wisconsin circuit court form

- On guardianship of a minor form

- 2420 served by publication form

- Commonwealth of kentuckypetitioner form

- Pge medical baseline form

- Customer authorization of disclosure of financial records dboqr 500265 rev 10 17 form

- Fillable online equipment lease agreement catalog form

- All information on this form must be

Find out other How To Fill Out Mw507

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP