Blank Consumer Loan Application Form

What is the Blank Consumer Loan Application

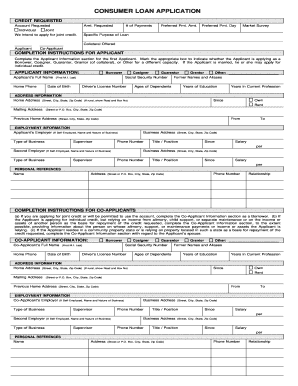

The blank consumer loan application is a standardized document used by individuals seeking to borrow money from financial institutions. This form collects essential information about the applicant's personal and financial background, enabling lenders to assess creditworthiness. Typically, the application includes sections for personal identification, employment details, income verification, and financial obligations. Understanding the purpose of this form is crucial for applicants to ensure they provide accurate and complete information, which can significantly affect loan approval decisions.

How to Use the Blank Consumer Loan Application

Using the blank consumer loan application involves several straightforward steps. First, download the consumer credit application form PDF from a reliable source. Next, fill out the form with accurate information, ensuring that all required fields are completed. It is important to review the application for any errors or omissions before submission. Once completed, the form can be printed for physical submission or saved for electronic submission, depending on the lender's requirements. Utilizing digital tools can streamline this process, making it easier to manage and submit the application securely.

Steps to Complete the Blank Consumer Loan Application

Completing the blank consumer loan application involves a series of organized steps:

- Gather necessary documents, such as identification, proof of income, and financial statements.

- Download and open the consumer credit application form PDF.

- Fill in personal details, including your name, address, and contact information.

- Provide employment information, including your employer's name, address, and your position.

- Detail your income, including salary, bonuses, and any additional sources of income.

- List your financial obligations, such as existing loans, credit card debts, and monthly expenses.

- Review the completed application for accuracy and completeness.

- Submit the application according to the lender's instructions, either online or by mail.

Legal Use of the Blank Consumer Loan Application

The legal use of the blank consumer loan application is governed by various regulations that ensure the protection of both the borrower and the lender. To be considered legally binding, the application must be filled out truthfully and signed by the applicant. Additionally, electronic submissions must comply with eSignature laws, such as the ESIGN Act and UETA, which validate digital signatures. It is essential for applicants to be aware of these legal frameworks to ensure their application is processed without complications.

Key Elements of the Blank Consumer Loan Application

Key elements of the blank consumer loan application include:

- Personal Information: Name, address, date of birth, and Social Security number.

- Employment Details: Employer's name, job title, and length of employment.

- Income Information: Monthly income, bonuses, and other sources of income.

- Financial Obligations: Current debts, monthly expenses, and credit history.

- Signature: Acknowledgment of the information provided and consent for the lender to verify details.

Required Documents

When completing the blank consumer loan application, applicants typically need to provide several supporting documents. These may include:

- Government-issued identification (e.g., driver's license, passport).

- Proof of income (e.g., pay stubs, tax returns).

- Bank statements to verify financial stability.

- Documentation of existing debts and monthly expenses.

Having these documents ready can expedite the application process and improve the chances of approval.

Quick guide on how to complete blank consumer loan application

Complete Blank Consumer Loan Application seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, as you can easily locate the correct form and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Blank Consumer Loan Application on any device with the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Blank Consumer Loan Application effortlessly

- Locate Blank Consumer Loan Application and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your edits.

- Select how you wish to send your form, either by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign Blank Consumer Loan Application and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the blank consumer loan application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a consumer credit application form pdf?

A consumer credit application form pdf is a standardized document used by businesses to collect personal and financial information from potential borrowers. This format allows for easy sharing and completion, enabling applicants to submit their information quickly and securely.

-

How can I access the consumer credit application form pdf?

You can easily download the consumer credit application form pdf directly from our website. Simply navigate to our forms section, and you'll find the PDF available for immediate download, making it simple to start your application process.

-

What are the benefits of using the consumer credit application form pdf?

Using the consumer credit application form pdf streamlines the application process, reduces paperwork, and enhances data accuracy. It allows both businesses and applicants to have a clear, concise format for capturing essential information, which speeds up decision-making.

-

Are there any fees associated with using the consumer credit application form pdf?

Accessing the consumer credit application form pdf is completely free. However, fees may apply based on the specific services provided once the application is processed, so be sure to inquire about any potential costs with your financial institution.

-

Can I edit the consumer credit application form pdf?

Yes, the consumer credit application form pdf can be edited using various PDF editing tools. Make any necessary adjustments to the form before sending it to ensure all your information is accurate and up to date.

-

What integrations are available with the consumer credit application form pdf?

The consumer credit application form pdf can be integrated with various CRM systems and electronic signature solutions, including airSlate SignNow. These integrations facilitate seamless data transfer and electronic signing, improving workflow efficiency.

-

Is the consumer credit application form pdf secure?

Absolutely! The consumer credit application form pdf is designed with data security in mind. When using platforms like airSlate SignNow, your personal information is encrypted and stored securely, ensuring compliance with privacy regulations.

Get more for Blank Consumer Loan Application

- Civ 700 petition for change of name 213 pdf fill in civil forms

- Vs 405 vital stats form 06 5422 application for legal name change 3 15 vital statistics

- In the district superior court for the state of alaska at form

- Alaska adult name change adult name change form

- Anchorage court directory alaska court system form

- Civ 699 instructions for adult change of name state of alaska form

- Minor child form

- Pg 605 state of alaska form

Find out other Blank Consumer Loan Application

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement