Form 105 Mvat

What is the Form 105 Mvat

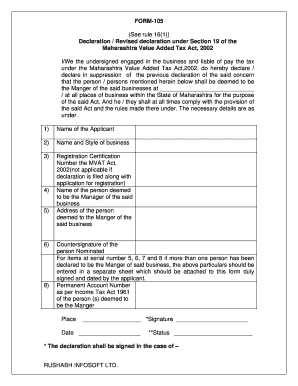

The Form 105 Mvat is a specific document used for reporting and remitting the Minnesota Value Added Tax (MVAT). This form is essential for businesses operating in Minnesota that are subject to the value-added tax. It captures information about taxable sales, purchases, and the total amount of tax due. Understanding the purpose of this form is crucial for compliance with state tax regulations.

Steps to complete the Form 105 Mvat

Completing the Form 105 Mvat involves several key steps to ensure accuracy and compliance. First, gather all necessary financial records, including sales receipts and purchase invoices. Next, fill out the form by entering your business information, including your name, address, and tax identification number. Then, report your total sales and purchases, along with the applicable tax rates. Finally, review the completed form for any errors before submitting it to the appropriate state agency.

Legal use of the Form 105 Mvat

The legal use of the Form 105 Mvat is governed by Minnesota state tax laws. It must be filed accurately and on time to avoid penalties. Businesses are required to keep copies of submitted forms and supporting documentation for audit purposes. Compliance with these regulations ensures that businesses meet their tax obligations and avoid legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the Form 105 Mvat vary depending on the reporting period. Typically, businesses must file this form quarterly or annually, depending on their tax liability. It is important to be aware of these deadlines to ensure timely submission and avoid any late fees. Keeping a calendar of important dates related to tax filings can help businesses stay organized.

Required Documents

When completing the Form 105 Mvat, businesses must provide certain required documents. These include sales records, purchase invoices, and any other documentation that supports the figures reported on the form. Having these documents readily available can streamline the completion process and help ensure accuracy.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the Form 105 Mvat can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. Understanding these penalties emphasizes the importance of timely and accurate filing, helping businesses avoid unnecessary financial burdens.

Who Issues the Form

The Form 105 Mvat is issued by the Minnesota Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance among businesses operating within the state. Businesses can obtain the form directly from the Department of Revenue's website or through authorized channels.

Quick guide on how to complete form 105 mvat

Effortlessly Prepare Form 105 Mvat on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and physically signed documents, enabling you to access the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without any delays. Handle Form 105 Mvat on any device using the airSlate SignNow apps for Android or iOS and simplify your document-related tasks today.

Easily Edit and Electronically Sign Form 105 Mvat

- Locate Form 105 Mvat and click Get Form to begin.

- Utilize the tools available to complete your document.

- Highlight pertinent sections of your documents or redact sensitive information using the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign feature, which takes only seconds and bears the same legal significance as a conventional wet ink signature.

- Verify the details and then click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and electronically sign Form 105 Mvat to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 105 mvat

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the FINCEN 105 consequences for businesses?

The FINCEN 105 consequences can be signNow, including legal penalties and fines for non-compliance with reporting requirements. Businesses must stay informed about regulations to avoid these repercussions, ensuring their operations are within the law.

-

How can airSlate SignNow help with FINCEN 105 compliance?

airSlate SignNow provides a secure platform that helps businesses manage and track essential documents related to FINCEN 105 compliance. Utilizing our e-signature features can streamline your processes while ensuring all necessary documentation is properly executed.

-

What features does airSlate SignNow offer for risk management related to FINCEN 105?

With airSlate SignNow, you can utilize features such as audit trails and document templates that cater to compliance needs, directly addressing FINCEN 105 consequences. These tools help businesses maintain clear records and fulfill their obligations efficiently.

-

Is airSlate SignNow cost-effective for small businesses facing FINCEN 105 consequences?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses. By streamlining document management, we help reduce the overhead costs associated with compliance to mitigate potential FINCEN 105 consequences.

-

Are there specific integrations in airSlate SignNow that assist with FINCEN 105 documentation?

airSlate SignNow integrates seamlessly with various third-party applications to help process and manage documentation related to FINCEN 105. These integrations enhance your ability to track compliance efficiently and reduce legal risks.

-

How does airSlate SignNow improve the e-signature process for FINCEN 105 documents?

airSlate SignNow enhances the e-signature process by providing a user-friendly interface that ensures documents are signed quickly and securely. This efficiency is crucial in addressing the urgency of financial documentation related to FINCEN 105 consequences.

-

Can airSlate SignNow assist me in tracking changes made to FINCEN 105 documentation?

Absolutely! airSlate SignNow includes tools for tracking changes and maintaining version control of your documents, which is essential when dealing with FINCEN 105 consequences. This feature ensures that your organization is transparent and compliant with applicable regulations.

Get more for Form 105 Mvat

- Request for certificate of adoption or form

- Draft alabama uniform power of attorney act with comments

- Legal documents and technical training ultimate estate form

- Am providing a copy of it to my attorney in factagent form

- Control number ak p004 pkg form

- Control number ak p005 pkg form

- Durable power of attorney for college studentcollege confidential form

- Powers of attorney ampamp health care directives alaska court form

Find out other Form 105 Mvat

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form