Series Nontaxable Transaction Certificate Form

What is the Series Nontaxable Transaction Certificate

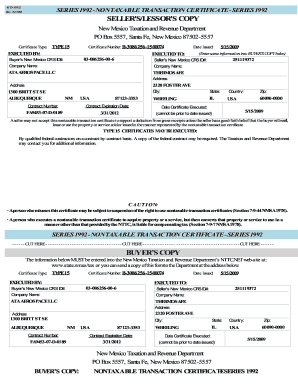

The Series 1992 nontaxable transaction certificate is a specific form used in the United States to document transactions that are exempt from sales tax. This certificate allows businesses to purchase goods or services without incurring sales tax, provided the transaction meets certain criteria. It is particularly relevant for transactions involving resale or specific exempt purposes, such as purchases made by non-profit organizations or governmental entities. Understanding the purpose and function of this certificate is crucial for businesses aiming to comply with tax regulations and avoid unnecessary expenses.

How to use the Series Nontaxable Transaction Certificate

Using the Series 1992 nontaxable transaction certificate involves several steps to ensure compliance with tax laws. First, the buyer must complete the certificate, providing necessary details such as the buyer's name, address, and the nature of the transaction. This information helps establish the legitimacy of the tax-exempt status. The seller must then retain this certificate as part of their records to substantiate the tax-exempt sale. Proper use of the certificate not only facilitates smoother transactions but also protects both parties in the event of an audit.

Steps to complete the Series Nontaxable Transaction Certificate

Completing the Series 1992 nontaxable transaction certificate requires careful attention to detail. Follow these steps:

- Obtain the correct form, ensuring it is the Series 1992 version.

- Fill in the buyer's information, including name, address, and tax identification number.

- Specify the type of transaction and the reason for the nontaxable status.

- Include the seller's information to validate the transaction.

- Sign and date the certificate to confirm its accuracy.

Once completed, provide the certificate to the seller and retain a copy for your records. This process ensures that both parties are protected and compliant with tax regulations.

Legal use of the Series Nontaxable Transaction Certificate

The legal use of the Series 1992 nontaxable transaction certificate is governed by state tax laws. Each state may have specific regulations regarding the acceptance and use of this certificate. It is essential for both buyers and sellers to understand these laws to ensure that the certificate is used appropriately. Misuse or failure to comply with legal requirements can result in penalties, including back taxes and fines. Therefore, consulting with a tax professional or legal advisor is advisable when navigating the complexities of sales tax exemptions.

Key elements of the Series Nontaxable Transaction Certificate

Several key elements are critical to the Series 1992 nontaxable transaction certificate. These include:

- Buyer Information: The name, address, and tax identification number of the buyer.

- Seller Information: The name and address of the seller involved in the transaction.

- Nature of the Transaction: A clear description of the goods or services being purchased.

- Reason for Exemption: The specific reason the transaction is deemed nontaxable, such as resale or exemption status.

- Signature and Date: The buyer's signature and the date of the transaction, confirming the information provided is accurate.

These elements ensure that the certificate serves its purpose effectively and complies with relevant tax regulations.

Eligibility Criteria

Eligibility for using the Series 1992 nontaxable transaction certificate typically depends on the nature of the buyer and the purpose of the purchase. Generally, the following criteria apply:

- The buyer must be a registered business or organization eligible for tax exemptions.

- The transaction must be for goods or services that qualify for nontaxable status, such as items intended for resale.

- The buyer should provide accurate and complete information on the certificate to avoid compliance issues.

Confirming eligibility ensures that the buyer can legitimately utilize the nontaxable transaction certificate, thereby avoiding potential tax liabilities.

Quick guide on how to complete series nontaxable transaction certificate

Complete Series Nontaxable Transaction Certificate smoothly on any device

Digital document management has gained popularity with enterprises and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow supplies you with all the tools you require to create, modify, and eSign your documents quickly without delays. Handle Series Nontaxable Transaction Certificate on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to adjust and eSign Series Nontaxable Transaction Certificate effortlessly

- Find Series Nontaxable Transaction Certificate and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Series Nontaxable Transaction Certificate and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the series nontaxable transaction certificate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a series 1992 nontaxable transaction certificate?

A series 1992 nontaxable transaction certificate is a specific document that allows businesses to signNow certain transactions that are exempt from sales tax. By using this certificate, organizations can streamline their purchase processes, ensuring compliance while saving costs on taxable purchases related to their business operations.

-

How can airSlate SignNow help with series 1992 nontaxable transaction certificates?

AirSlate SignNow provides a seamless platform for eSigning and managing series 1992 nontaxable transaction certificates. Users can easily create, send, and track their certificates, all while ensuring security and compliance, which is crucial for businesses looking to manage tax-exempt transactions efficiently.

-

Is there a cost associated with using airSlate SignNow for series 1992 nontaxable transaction certificates?

Yes, airSlate SignNow offers a cost-effective solution tailored to meet business needs, including handling series 1992 nontaxable transaction certificates. Pricing is flexible, depending on the features you choose, ensuring that you get value for your investment without overspending.

-

What features does airSlate SignNow offer for managing series 1992 nontaxable transaction certificates?

AirSlate SignNow includes features like customizable templates, secure eSignature capabilities, and comprehensive document tracking specifically for series 1992 nontaxable transaction certificates. This enables businesses to manage their certification processes more efficiently while ensuring complete compliance with tax regulations.

-

Can I integrate airSlate SignNow with existing systems for series 1992 nontaxable transaction certificates?

Absolutely! AirSlate SignNow supports integrations with various business applications, allowing you to streamline the process for managing series 1992 nontaxable transaction certificates. This means you can connect with your CRM, ERP, or eCommerce platforms to ensure a cohesive workflow.

-

What are the benefits of using airSlate SignNow for series 1992 nontaxable transaction certificates?

Using airSlate SignNow for series 1992 nontaxable transaction certificates enhances efficiency, reduces compliance risks, and saves time. With its user-friendly interface and automated processes, businesses can focus more on their core tasks while ensuring all necessary documentation is handled promptly and accurately.

-

How can I ensure compliance when using series 1992 nontaxable transaction certificates with airSlate SignNow?

AirSlate SignNow includes compliance tracking features specifically designed for series 1992 nontaxable transaction certificates, ensuring that your documentation meets all legal requirements. The platform keeps records of all signatures and modifications, providing a clear audit trail to aid in compliance and reporting.

Get more for Series Nontaxable Transaction Certificate

- Bac competition form

- English as a second language esl application form

- Freight forward pick up request form castle parcels

- Download the mentor agreement form gonzaga university gonzaga

- Key return form

- Residency fsu admissions florida state university form

- Commissioners endorse sandhills center proposal news form

- 098 baker hall form

Find out other Series Nontaxable Transaction Certificate

- How To Sign Nevada Retainer for Attorney

- How To Sign Georgia Assignment of License

- Sign Arizona Assignment of Lien Simple

- How To Sign Kentucky Assignment of Lien

- How To Sign Arkansas Lease Renewal

- Sign Georgia Forbearance Agreement Now

- Sign Arkansas Lease Termination Letter Mobile

- Sign Oregon Lease Termination Letter Easy

- How To Sign Missouri Lease Renewal

- Sign Colorado Notice of Intent to Vacate Online

- How Can I Sign Florida Notice of Intent to Vacate

- How Do I Sign Michigan Notice of Intent to Vacate

- Sign Arizona Pet Addendum to Lease Agreement Later

- How To Sign Pennsylvania Notice to Quit

- Sign Connecticut Pet Addendum to Lease Agreement Now

- Sign Florida Pet Addendum to Lease Agreement Simple

- Can I Sign Hawaii Pet Addendum to Lease Agreement

- Sign Louisiana Pet Addendum to Lease Agreement Free

- Sign Pennsylvania Pet Addendum to Lease Agreement Computer

- Sign Rhode Island Vacation Rental Short Term Lease Agreement Safe