St 105 Fillable Form

What is the St 105 Fillable Form

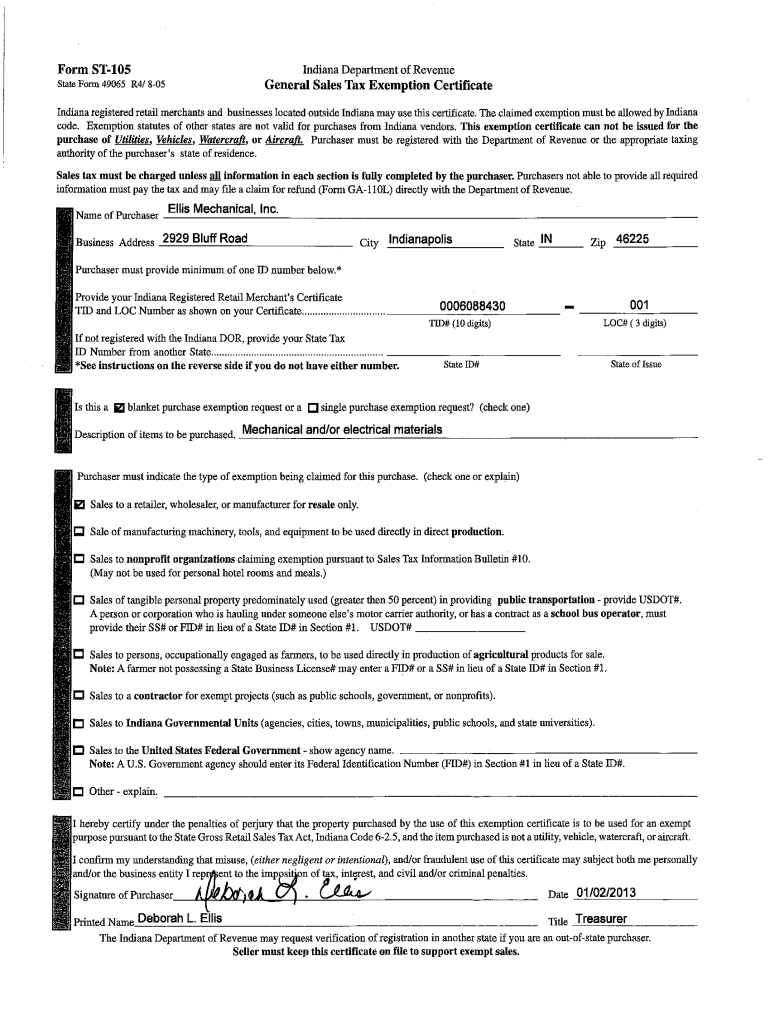

The St 105 fillable form is a tax exemption certificate used in Indiana. It allows eligible purchasers to claim exemption from sales tax on certain purchases. This form is particularly relevant for businesses and organizations that qualify for tax-exempt status under specific criteria outlined by the state. By providing this form to vendors, buyers can avoid paying sales tax on qualifying transactions, which can lead to significant savings over time.

How to use the St 105 Fillable Form

To effectively use the St 105 fillable form, start by ensuring that you meet the eligibility criteria for tax exemption. Fill in the required fields, including your name, address, and the nature of your business or organization. Be specific about the type of purchases that will be exempt. After completing the form, present it to the seller at the time of purchase. It is essential to keep a copy for your records, as it may be required for future reference or audits.

Steps to complete the St 105 Fillable Form

Completing the St 105 fillable form involves several straightforward steps:

- Download the form from a reliable source or access it through a digital platform.

- Fill in your business name and address accurately.

- Indicate the type of exemption you are claiming.

- Provide a detailed description of the items you are purchasing that qualify for the exemption.

- Sign and date the form to validate it.

Once completed, ensure that the form is presented to the vendor during the transaction to avoid sales tax charges.

Legal use of the St 105 Fillable Form

The St 105 fillable form is legally binding when filled out correctly and used in accordance with Indiana state laws. To ensure its legal standing, it is crucial to provide accurate information and use the form solely for qualifying purchases. Misuse of the form, such as claiming exemptions for ineligible items, can lead to penalties or legal repercussions. Always consult the latest state guidelines to confirm compliance with current regulations.

Key elements of the St 105 Fillable Form

Key elements of the St 105 fillable form include:

- Purchaser Information: Name and address of the entity claiming the exemption.

- Exemption Type: Specific category under which the exemption is claimed.

- Item Description: Detailed information about the items being purchased.

- Signature: The form must be signed by an authorized representative of the organization.

Each of these elements must be completed accurately to ensure the form's validity and acceptance by vendors.

Form Submission Methods

The St 105 fillable form can be submitted in various ways, depending on the vendor's preferences:

- In-Person: Present the completed form directly to the seller at the time of purchase.

- Online: Some vendors may allow electronic submission of the form through their websites.

- Mail: If required, send a printed copy of the form to the vendor before the transaction.

Always confirm with the vendor regarding their preferred submission method to ensure compliance and acceptance.

Examples of using the St 105 Fillable Form

Examples of using the St 105 fillable form include:

- A nonprofit organization purchasing office supplies for its operations.

- A school district acquiring educational materials and equipment.

- A government agency procuring services or products necessary for public functions.

In each case, the form serves to exempt qualifying purchases from sales tax, thereby supporting the financial efficiency of the organization.

Quick guide on how to complete st 105 fillable form

Prepare St 105 Fillable Form effortlessly on any device

Web-based document management has become increasingly popular among companies and individuals. It offers an ideal environmentally friendly option to conventional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Manage St 105 Fillable Form on any platform with airSlate SignNow applications for Android or iOS and streamline any document-related process today.

How to edit and electronically sign St 105 Fillable Form with ease

- Obtain St 105 Fillable Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or mislaid files, tedious form retrieval, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and electronically sign St 105 Fillable Form and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the st 105 fillable form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the st 105 fillable form?

The st 105 fillable form is a specific tax exemption certificate used in various states to document sales tax exemptions for eligible purchasers. By utilizing airSlate SignNow, users can easily fill out and eSign the st 105 fillable form, ensuring compliance and smooth transactions.

-

How do I access the st 105 fillable form on airSlate SignNow?

To access the st 105 fillable form on airSlate SignNow, simply log into your account and search for the form within our document library. Our platform allows you to edit, fill out, and eSign the st 105 fillable form seamlessly.

-

Is there a cost associated with using the st 105 fillable form on airSlate SignNow?

AirSlate SignNow offers flexible pricing plans, including options that allow you to fill out and eSign the st 105 fillable form without breaking your budget. You can choose a plan that best suits your needs to access this feature.

-

Can I integrate the st 105 fillable form with other software?

Yes, airSlate SignNow supports integrations with various software applications, allowing users to streamline their workflow while filling out the st 105 fillable form. This capability enhances productivity and ensures smoother document management.

-

What are the benefits of using airSlate SignNow for the st 105 fillable form?

Using airSlate SignNow for the st 105 fillable form eliminates paperwork, speeds up the signing process, and enhances document security. Our platform provides an intuitive interface that makes it easy for anyone to fill out and eSign the form quickly and efficiently.

-

Can multiple users eSign the st 105 fillable form?

Absolutely! AirSlate SignNow allows multiple users to eSign the st 105 fillable form collaboratively. This feature ensures that all necessary parties can review and sign the document in a streamlined manner, enhancing teamwork.

-

Is it easy to modify the st 105 fillable form once it's created?

Yes, with airSlate SignNow, modifying the st 105 fillable form is simple and efficient. Users can easily make edits, add information, or update sections of the form as needed to align with their specific requirements.

Get more for St 105 Fillable Form

- Organization record form board for professional engineers and

- Vita tax exam free pdf file sharing form

- Form 4695

- Special education process forms west virginia

- Internal revenue service payment form

- Schedule 6 form 8849 rev august 2013 other claims

- Form 8849 fillable

- A guide to paying federal taxes electronically for tax form

Find out other St 105 Fillable Form

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document