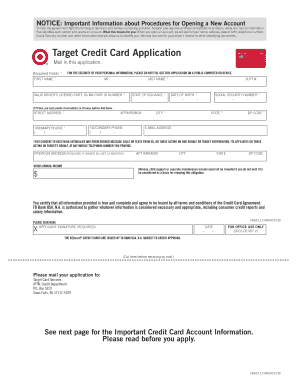

Target Credit Card Apply Form

What is the Target Credit Card Apply

The Target credit card application allows individuals to apply for a credit card that provides various benefits for shopping at Target stores and online. This card is designed for customers who frequently shop at Target, offering rewards such as discounts, cashback, and special financing options. The application process can be completed online, making it convenient for users to submit their information securely and quickly.

Steps to complete the Target Credit Card Apply

Completing the Target credit card application involves a straightforward process. Here are the essential steps:

- Visit the Target website or mobile app.

- Navigate to the credit card application section.

- Provide personal information, including your name, address, and Social Security number.

- Enter financial details, such as income and employment status.

- Review the application for accuracy and submit it electronically.

After submission, applicants typically receive a decision quickly, often within minutes.

Eligibility Criteria

To apply for the Target credit card, applicants must meet specific eligibility requirements. These generally include:

- Being at least eighteen years old.

- Having a valid Social Security number.

- Residing in the United States.

- Demonstrating a stable income or employment.

Meeting these criteria helps ensure a smoother application process and increases the likelihood of approval.

Legal use of the Target Credit Card Apply

The legal use of the Target credit card application is governed by various regulations that protect consumers. Applicants must provide accurate information, as submitting false information can lead to legal consequences. Additionally, the application process must comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act, ensuring that electronic signatures and documents are legally binding.

How to obtain the Target Credit Card Apply

To obtain the Target credit card application, individuals can access it directly through the Target website or mobile app. The application is available year-round, allowing users to apply at their convenience. Once on the site, users can find the application by searching for “Target credit card” or navigating through the financial services section.

Application Process & Approval Time

The application process for the Target credit card is designed to be efficient. After submitting the application, most applicants receive a decision within a few minutes. If additional information is needed, the applicant may be contacted for clarification. Once approved, users can begin using their card for purchases at Target and earn rewards immediately.

Quick guide on how to complete target credit card apply

Effortlessly prepare Target Credit Card Apply on any device

Digital document management has become widely embraced by businesses and individuals alike. It offers an ideal environmentally-friendly alternative to physical printed and signed documents, enabling you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the essential tools to create, modify, and electronically sign your documents swiftly without delays. Manage Target Credit Card Apply on any platform with the airSlate SignNow applications for Android or iOS, elevating any document-centric process today.

How to edit and electronically sign Target Credit Card Apply with ease

- Find Target Credit Card Apply and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant sections of your documents or redact sensitive information using the tools specifically provided by airSlate SignNow for this purpose.

- Generate your electronic signature using the Sign tool, which only takes seconds and holds the same legal significance as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form-finding, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Target Credit Card Apply to ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the target credit card apply

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the benefits of applying for a Target credit card?

When you choose to target credit card apply, you unlock numerous benefits, such as earning rewards for every purchase. Cardholders often receive exclusive discounts and promotions at Target stores, enhancing your shopping experience. Additionally, special financing options can make big purchases more manageable.

-

How does the Target credit card application process work?

To target credit card apply, you can complete the application online or in-store. The process is straightforward, requiring basic personal information and financial details. Once submitted, you will typically receive a decision instantly, allowing you to start enjoying your benefits right away.

-

What credit score do I need to apply for a Target credit card?

While there's no specific credit score required to target credit card apply, a good to excellent credit score will increase your chances of approval. Generally, a score above 600 is favorable for a Target credit card application. However, each application is evaluated on various factors beyond just the credit score.

-

Are there any fees associated with the Target credit card?

When you target credit card apply, it's important to be aware of potential fees. The Target credit card has no annual fee, making it a great cost-effective option. Nevertheless, late payment fees may apply if the account is not managed responsibly.

-

Can I use my Target credit card outside of Target stores?

Yes, you can use your Target credit card anywhere Mastercard is accepted when you target credit card apply for the Target Mastercard. This gives you flexibility while still earning rewards on every purchase. Note that some benefits may be exclusive to Target purchases.

-

What rewards can I earn with a Target credit card?

When you target credit card apply, you can earn 5% back on every purchase made at Target and Target.com. Additionally, cardholders may receive special offers, early access to sales, and other unique perks that maximize savings at Target. Keeping an eye on promotional events can further enhance your rewards.

-

How do I manage my Target credit card account?

After you successfully target credit card apply, managing your account is easy through the Target app or online portal. You can view your balance, make payments, and monitor your rewards all in one place. Setting up alerts can help you stay on top of payment deadlines and new offers.

Get more for Target Credit Card Apply

- Test tray audit form

- Cao gcs 4 7 motion for genetic tests hampampw form

- Idaho motion for genetic testing form

- New student registration form

- Ladwp bill pdf form

- Non receipt of goods disclaimer form

- Rigom general office personal data form

- 2017 fr 800q sales and use tax quarterly return fill in version otr cfo dc form

Find out other Target Credit Card Apply

- Can I Electronic signature Michigan Trademark License Agreement

- Electronic signature Indiana Letter Bankruptcy Inquiry Now

- eSignature Oklahoma Payroll Deduction Authorization Easy

- How To eSignature Texas Payroll Deduction Authorization

- Can I Electronic signature Connecticut Retainer for Attorney

- How Do I Electronic signature Idaho Assignment of License

- Electronic signature New Jersey Lease Renewal Free

- Electronic signature Texas Lease Renewal Fast

- How Can I Electronic signature Colorado Notice of Intent to Vacate

- eSignature Delaware Employee Compliance Survey Later

- eSignature Kansas Employee Compliance Survey Myself

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage