Hingham Excise Tax Form

What is the Hingham Excise Tax

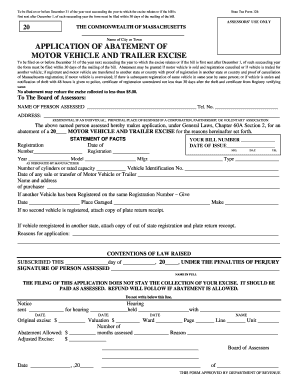

The Hingham excise tax is a local tax imposed on vehicles registered in the town of Hingham, Massachusetts. This tax is assessed annually and is based on the value of the vehicle. The purpose of the excise tax is to generate revenue for local services and infrastructure. The tax is calculated using a formula that considers the vehicle's value, age, and type. Understanding this tax is essential for residents to ensure compliance and proper financial planning.

Steps to Complete the Hingham Excise Tax

Completing the Hingham excise tax involves several important steps:

- Gather necessary information about your vehicle, including its make, model, year, and Vehicle Identification Number (VIN).

- Determine the assessed value of your vehicle, which can usually be found in the town's assessors database.

- Calculate the excise tax amount using the town's tax rate and the assessed value.

- Complete the required forms, ensuring all information is accurate and up to date.

- Submit your completed forms and payment to the town of Hingham tax collector by the specified deadline.

Legal Use of the Hingham Excise Tax

The Hingham excise tax is legally binding and must be paid by all vehicle owners residing in the town. Failure to comply with the tax regulations can result in penalties, including fines or additional fees. It is important for residents to understand their obligations under local law to avoid any legal issues. The town provides resources to help residents navigate the requirements and ensure compliance.

Required Documents

To complete the Hingham excise tax, certain documents are necessary:

- Proof of vehicle ownership, such as the vehicle title or registration.

- Documentation of the vehicle's assessed value, which can be accessed through the Hingham assessors online database.

- Any previous tax bills or correspondence from the town regarding the excise tax.

Form Submission Methods

Residents can submit their Hingham excise tax forms through various methods:

- Online submission via the town's official website, where forms can be filled out and submitted electronically.

- Mailing the completed forms and payment to the Hingham tax collector's office.

- In-person submission at the tax collector's office during business hours.

Penalties for Non-Compliance

Non-compliance with the Hingham excise tax can lead to significant penalties. Residents who fail to pay their excise tax by the deadline may incur late fees, which can accumulate over time. Additionally, the town may take further action, such as placing a lien on the vehicle or pursuing collection efforts. It is crucial for residents to stay informed about their tax obligations to avoid these consequences.

Quick guide on how to complete hingham excise tax

Effortlessly Prepare Hingham Excise Tax on Any Device

The management of online documents has become increasingly popular among both companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the needed form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly without any delays. Control Hingham Excise Tax on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

Edit and Electronically Sign Hingham Excise Tax with Ease

- Find Hingham Excise Tax and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes only seconds and has the same legal validity as a conventional ink signature.

- Review the information and then press the Done button to save your modifications.

- Choose your preferred method to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns over lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Hingham Excise Tax to ensure outstanding communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the hingham excise tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Hingham excise tax and how does it affect businesses?

Hingham excise tax refers to the local tax applied to certain goods and services in Hingham. Businesses operating in this area need to be aware of these taxes to maintain compliance. By understanding the Hingham excise tax, businesses can plan their financial strategies effectively.

-

How can airSlate SignNow help with managing Hingham excise tax documents?

AirSlate SignNow simplifies the process of managing Hingham excise tax documents by providing a secure platform for eSigning and document management. This efficiency helps ensure that all tax-related documents are promptly signed and stored. With SignNow, businesses can streamline their tax processes seamlessly.

-

What are the pricing options for airSlate SignNow?

AirSlate SignNow offers several pricing tiers tailored to different business needs. These plans are designed to suit varying budgets while providing robust features for managing documents, including those related to Hingham excise tax. Users can select a plan that best fits their operational requirements.

-

Is airSlate SignNow compliant with Hingham excise tax regulations?

Yes, airSlate SignNow is designed to help businesses comply with various regulations, including Hingham excise tax requirements. By enabling secure document transactions and eSignatures, SignNow ensures that all compliance documents are managed according to local laws. This allows businesses to focus on growth without worrying about legal issues.

-

What features does airSlate SignNow offer to assist with tax documentation?

AirSlate SignNow offers features such as customizable templates, secure storage, and easy sharing options for tax documentation, including those dealing with Hingham excise tax. These tools help businesses efficiently manage all necessary paperwork while reducing processing time. With SignNow, users can enhance their document workflow signNowly.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely, airSlate SignNow integrates seamlessly with numerous accounting software platforms, making it easier to manage Hingham excise tax documents. This integration allows for improved workflow and data accuracy, ensuring that tax information is efficiently processed. Users can connect their favorite tools for a cohesive experience.

-

How secure is airSlate SignNow for handling sensitive tax information?

AirSlate SignNow prioritizes security, providing encryption and compliance with industry standards to protect sensitive tax information, including Hingham excise tax documents. This commitment to security ensures that user data remains confidential and secure throughout the signing process. Businesses can confidently manage their documents without fear of bsignNowes.

Get more for Hingham Excise Tax

- Type name of partner if this option chosen form

- West virginia legal last will and us legal forms

- In cases where you and your partner are making wills you would form

- Type the name of the successor trustee you wish to form

- Maryland mutual wills package with last us legal forms

- Field 67 form

- Only include this paragraph in one will or state in both which will is to control form

- This article sets forth powers of your personal representative and form

Find out other Hingham Excise Tax

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation