Ex103 Form

What is the Ex103?

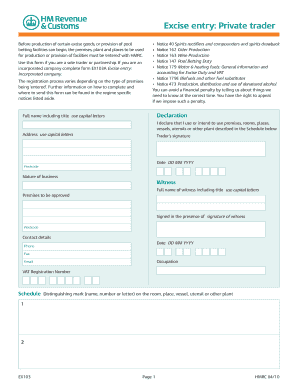

The Ex103 is a form used in the context of the United Kingdom's majesty revenue customs excise. It serves as a declaration for goods that are subject to excise duties. This form is essential for individuals and businesses that need to report the movement of excise goods, ensuring compliance with customs regulations. Understanding the purpose and requirements of the Ex103 is crucial for anyone involved in the import or export of excise goods.

How to use the Ex103

Using the Ex103 involves several steps to ensure accurate reporting and compliance with customs regulations. First, gather all necessary information regarding the goods being declared, including their description, quantity, and value. Next, fill out the form with precise details, ensuring that all sections are completed correctly. Once the form is filled, it must be submitted to the appropriate customs authority as per the guidelines provided. Utilizing electronic tools for this process can streamline the submission and tracking of the form.

Steps to complete the Ex103

Completing the Ex103 requires careful attention to detail. Here are the steps to follow:

- Gather all relevant information about the goods, including their classification and value.

- Access the Ex103 form through the appropriate customs platform.

- Fill in the form, ensuring all required fields are completed accurately.

- Review the form for any errors or missing information.

- Submit the form electronically or via mail, depending on the submission guidelines.

Legal use of the Ex103

The legal use of the Ex103 is governed by the customs regulations set forth by the United Kingdom's majesty revenue customs excise. Properly completing and submitting this form is vital for ensuring compliance with excise duty laws. Failure to use the Ex103 correctly can result in penalties, including fines or delays in the processing of goods. It is important to stay informed about any updates to the legal requirements surrounding this form.

Key elements of the Ex103

When filling out the Ex103, several key elements must be included to ensure the form is valid:

- Goods Description: A clear and accurate description of the excise goods.

- Quantity: The total amount of goods being declared.

- Value: The monetary value of the goods.

- Origin: Information about where the goods were produced or sourced.

- Destination: The intended location for the goods after customs clearance.

Form Submission Methods

The Ex103 can be submitted through various methods, depending on the preferences of the user and the requirements of the customs authority. Common submission methods include:

- Online Submission: Utilizing electronic platforms to submit the form directly to customs.

- Mail: Sending a printed version of the form to the designated customs office.

- In-Person: Delivering the form directly to customs officials at specified locations.

Quick guide on how to complete ex103

Effortlessly Create Ex103 on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely archive it online. airSlate SignNow provides all the necessary tools to create, edit, and electronically sign your documents swiftly without interruptions. Manage Ex103 on any device using airSlate SignNow's Android or iOS applications and enhance your document-related workflows today.

Steps to Edit and Electronically Sign Ex103 with Ease

- Locate Ex103 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form: via email, SMS, invitation link, or download it to your computer.

Eliminate concerns over lost or misfiled documents, laborious form searches, or mistakes that necessitate additional printed copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Edit and electronically sign Ex103 and ensure excellent communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ex103

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is majesty revenue customs excise?

Majesty revenue customs excise refers to the regulations and fees imposed by the government on certain goods and services. Understanding these laws is crucial for businesses to ensure compliance and avoid penalties. By utilizing airSlate SignNow, companies can streamline the documentation process related to customs and excise duties.

-

How can airSlate SignNow help with majesty revenue customs excise documentation?

airSlate SignNow simplifies the preparation and signing of documents required for majesty revenue customs excise transactions. The platform offers templates and automation features that enhance efficiency and reduce human error in documentation. This allows businesses to stay compliant while saving time and resources.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers a variety of pricing plans to suit different business needs, including options tailored for teams handling majesty revenue customs excise tasks. These plans are designed to be cost-effective, ensuring that businesses can access the features they need without overspending. A free trial is also available to help prospective customers evaluate the service.

-

Are there any integrations available for handling majesty revenue customs excise?

Yes, airSlate SignNow provides numerous integrations with popular business applications that facilitate the management of majesty revenue customs excise. This ensures that users can efficiently connect their existing systems to streamline document workflows. Integrations help maintain a cohesive process for document management and compliance.

-

What benefits does airSlate SignNow offer for customs and excise documentation?

Using airSlate SignNow for majesty revenue customs excise documentation offers several benefits, including enhanced accuracy, faster turnaround times, and improved collaboration. The eSigning feature allows multiple stakeholders to review and sign documents seamlessly. This ultimately helps businesses maintain compliance and avoid costly delays.

-

Can I use airSlate SignNow for international majesty revenue customs excise documents?

Absolutely, airSlate SignNow supports international transactions related to majesty revenue customs excise. The platform is designed to accommodate various standards and compliance requirements for different countries. This flexibility allows businesses to manage their customs and excise documentation effectively, whether domestically or internationally.

-

Is airSlate SignNow secure for handling majesty revenue customs excise documents?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that all documents related to majesty revenue customs excise are handled securely. The platform utilizes advanced encryption protocols and is compliant with industry standards. This provides peace of mind for businesses concerned about data integrity and confidentiality.

Get more for Ex103

Find out other Ex103

- Sign Connecticut Quitclaim Deed Free

- Help Me With Sign Delaware Quitclaim Deed

- How To Sign Arkansas Warranty Deed

- How Can I Sign Delaware Warranty Deed

- Sign California Supply Agreement Checklist Online

- How Can I Sign Georgia Warranty Deed

- Sign Maine Supply Agreement Checklist Computer

- Sign North Dakota Quitclaim Deed Free

- Sign Oregon Quitclaim Deed Simple

- Sign West Virginia Quitclaim Deed Free

- How Can I Sign North Dakota Warranty Deed

- How Do I Sign Oklahoma Warranty Deed

- Sign Florida Postnuptial Agreement Template Online

- Sign Colorado Prenuptial Agreement Template Online

- Help Me With Sign Colorado Prenuptial Agreement Template

- Sign Missouri Prenuptial Agreement Template Easy

- Sign New Jersey Postnuptial Agreement Template Online

- Sign North Dakota Postnuptial Agreement Template Simple

- Sign Texas Prenuptial Agreement Template Online

- Sign Utah Prenuptial Agreement Template Mobile