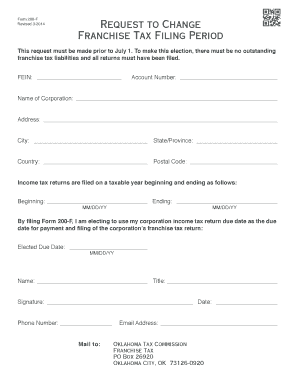

Oklahoma Form 200 F

What is the Oklahoma Form 200 F

The Oklahoma Form 200 F, also known as the Oklahoma Franchise Election Form 200 F, is a crucial document used by businesses operating in Oklahoma. This form allows entities to elect to be treated as a franchise for state tax purposes. It is essential for ensuring compliance with Oklahoma tax laws and can impact how a business is taxed at the state level. Understanding the purpose and implications of this form is vital for business owners to make informed decisions regarding their tax obligations.

Steps to complete the Oklahoma Form 200 F

Completing the Oklahoma Form 200 F involves several important steps to ensure accuracy and compliance. First, gather all necessary information about your business, including its legal name, address, and federal Employer Identification Number (EIN). Next, carefully read the instructions provided with the form to understand the specific requirements. Fill out the form completely, ensuring that all sections are accurately completed. After filling out the form, review it for any errors or omissions before submission. Finally, submit the form according to the guidelines provided, either electronically or via mail, depending on your preference.

Legal use of the Oklahoma Form 200 F

The Oklahoma Form 200 F is legally binding when completed and submitted in accordance with state regulations. For the form to be valid, it must be filled out accurately and submitted within the designated deadlines. Compliance with the relevant tax laws, including the provisions outlined in the Oklahoma Tax Code, is essential. Businesses that fail to comply with these regulations may face penalties or additional tax liabilities. Therefore, understanding the legal implications of the form is crucial for maintaining compliance and avoiding potential issues with state authorities.

How to obtain the Oklahoma Form 200 F

Obtaining the Oklahoma Form 200 F is a straightforward process. The form can be accessed online through the Oklahoma Tax Commission's official website. Alternatively, businesses can request a physical copy by contacting the Tax Commission directly. It is important to ensure that you are using the most current version of the form, as outdated forms may not be accepted for filing. Always check for any updates or changes to the form or its requirements before proceeding.

Filing Deadlines / Important Dates

Filing deadlines for the Oklahoma Form 200 F are critical for businesses to adhere to in order to avoid penalties. Typically, the form must be submitted by a specific date, often aligned with the business's tax year. It is advisable to check the Oklahoma Tax Commission's website for the most current deadlines and any changes that may occur annually. Keeping track of these important dates ensures that businesses remain compliant and can effectively manage their tax responsibilities.

Required Documents

When completing the Oklahoma Form 200 F, certain documents may be required to support the information provided. These documents typically include the business's federal tax return, proof of the business's legal structure, and any additional documentation that verifies the entity's eligibility for franchise tax treatment. Having these documents ready can facilitate a smoother completion process and ensure that all necessary information is accurately reported.

Examples of using the Oklahoma Form 200 F

Understanding how the Oklahoma Form 200 F is utilized can provide valuable insights for business owners. For instance, a corporation electing to be treated as a franchise may use this form to ensure it is taxed appropriately under Oklahoma law. Similarly, a limited liability company (LLC) may complete the form to clarify its tax obligations. These examples highlight the importance of the form in determining tax treatment and compliance for various business structures operating within the state.

Quick guide on how to complete oklahoma form 200 f

Complete Oklahoma Form 200 F effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and eSign your documents swiftly without delays. Manage Oklahoma Form 200 F on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and eSign Oklahoma Form 200 F with ease

- Find Oklahoma Form 200 F and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or mask sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Craft your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method for sending your form - via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign Oklahoma Form 200 F and ensure seamless communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the oklahoma form 200 f

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 200 f?

Form 200 f is a specific type of document commonly used in various business transactions. It typically includes essential information for compliance and operational purposes, making it vital for businesses to manage effectively. With airSlate SignNow, you can easily create and eSign form 200 f, streamlining your workflow.

-

How can airSlate SignNow help with form 200 f?

airSlate SignNow simplifies the process of managing form 200 f by providing an easy-to-use platform for sending and signing documents electronically. You can customize your form 200 f templates, track their status, and ensure secure signing, enhancing efficiency in your operations. This reduces the chances of errors and saves time.

-

Is airSlate SignNow affordable for businesses needing form 200 f?

Yes, airSlate SignNow offers a cost-effective solution for businesses of all sizes needing to handle form 200 f. With flexible pricing plans, you can choose one that suits your company's budget while benefiting from a comprehensive document management system. The investment pays off through improved productivity and reduced paper costs.

-

What features does airSlate SignNow provide for form 200 f?

airSlate SignNow includes a variety of features designed to enhance the management of form 200 f, such as customizable templates, bulk sending, and automated reminders. The platform also offers real-time collaboration and secure cloud storage, ensuring that all your documents are safe and easily accessible. These features empower you to manage form 200 f efficiently.

-

Can I integrate form 200 f into existing software using airSlate SignNow?

Absolutely! airSlate SignNow supports integrations with popular applications, allowing you to incorporate form 200 f seamlessly into your current workflows. Whether you're using CRM systems, project management tools, or other software, airSlate SignNow enhances your versatility. This simplifies your document management process signNowly.

-

What are the benefits of using airSlate SignNow for form 200 f?

Using airSlate SignNow for form 200 f provides numerous benefits, including faster processing times, reduced paperwork, and improved accuracy. Additionally, you'll experience enhanced compliance with electronic signatures that meet legal standards. Overall, it enhances the efficiency of your business operations.

-

Is it easy to get started with airSlate SignNow for form 200 f?

Yes, getting started with airSlate SignNow for form 200 f is straightforward and user-friendly. After signing up, you can quickly create and upload your form 200 f documents. The intuitive interface guides you through the setup, making it easy even for those without technical expertise.

Get more for Oklahoma Form 200 F

- Dl 300 form california

- Preschool questionnaire form

- Sfst scoring sheet form

- Mah factfinder 1 metlife auto ampamp home fact finder form

- Tooth gem consent form 477185943

- Account verificationauthorization form red stag casino

- Affidavit professional corporation law form

- Individual course drop request asubedu form

Find out other Oklahoma Form 200 F

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure

- Help Me With eSign Texas Plumbing Business Plan Template

- Can I eSign Texas Plumbing Cease And Desist Letter

- eSign Utah Plumbing Notice To Quit Secure

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free