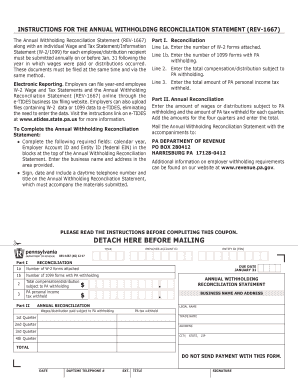

Instructions for the Annual Withholding Reconciliation Statement Form

What is the Instructions For The Annual Withholding Reconciliation Statement

The Instructions For The Annual Withholding Reconciliation Statement is a crucial document used by employers in the United States to reconcile the amounts withheld from employee wages for federal income tax purposes. This form serves as a summary of the total withholding amounts reported throughout the tax year and ensures that the correct amounts have been submitted to the Internal Revenue Service (IRS). It is essential for employers to accurately complete this statement to avoid discrepancies that could lead to penalties or audits.

Steps to complete the Instructions For The Annual Withholding Reconciliation Statement

Completing the Instructions For The Annual Withholding Reconciliation Statement involves several key steps:

- Gather all relevant payroll records for the tax year, including W-2 forms and 1099 forms.

- Calculate the total federal income tax withheld from all employees.

- Ensure that the amounts reported match the figures submitted to the IRS throughout the year.

- Fill out the form accurately, paying close attention to detail to avoid errors.

- Review the completed form for accuracy before submission.

Legal use of the Instructions For The Annual Withholding Reconciliation Statement

The legal use of the Instructions For The Annual Withholding Reconciliation Statement is governed by IRS regulations. It must be completed and submitted by employers to ensure compliance with federal tax laws. Failure to submit this form accurately and on time can result in penalties, including fines and interest on unpaid taxes. Employers should maintain copies of the completed statement and related documents for their records, as they may be required for future audits or inquiries.

Filing Deadlines / Important Dates

Employers must adhere to specific filing deadlines for the Instructions For The Annual Withholding Reconciliation Statement. Generally, the form is due by January thirty-first of the year following the tax year being reported. It is essential for employers to be aware of these deadlines to avoid late filing penalties. Additionally, employers should also consider state-specific deadlines, which may vary.

Form Submission Methods (Online / Mail / In-Person)

The Instructions For The Annual Withholding Reconciliation Statement can be submitted through various methods, providing flexibility for employers. The primary submission methods include:

- Online submission through the IRS e-file system, which allows for quicker processing.

- Mailing the completed form to the appropriate IRS address, ensuring it is postmarked by the deadline.

- In-person submission at local IRS offices, although this method is less common.

IRS Guidelines

IRS guidelines for the Instructions For The Annual Withholding Reconciliation Statement provide detailed instructions on how to complete the form correctly. Employers should refer to the IRS website or the official IRS publication related to withholding reconciliation for the most up-to-date information. These guidelines outline the necessary information to include, as well as common mistakes to avoid, ensuring compliance with federal tax laws.

Quick guide on how to complete instructions for the annual withholding reconciliation statement

Complete Instructions For The Annual Withholding Reconciliation Statement effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources you require to create, modify, and electronically sign your documents quickly and without delays. Manage Instructions For The Annual Withholding Reconciliation Statement on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The simplest way to alter and eSign Instructions For The Annual Withholding Reconciliation Statement with ease

- Locate Instructions For The Annual Withholding Reconciliation Statement and then click Get Form to begin.

- Make use of the features we provide to fill out your form.

- Emphasize relevant sections of your documents or conceal sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, by email, text message (SMS), or invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Instructions For The Annual Withholding Reconciliation Statement and guarantee exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the instructions for the annual withholding reconciliation statement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Instructions For The Annual Withholding Reconciliation Statement?

The Instructions For The Annual Withholding Reconciliation Statement provide detailed guidelines on how to complete the form accurately. This ensures that your company complies with federal and state regulations regarding employee withholdings. It's essential to follow these instructions closely to avoid any penalties.

-

How does airSlate SignNow assist with the Instructions For The Annual Withholding Reconciliation Statement?

AirSlate SignNow offers a streamlined process for preparing and eSigning the Instructions For The Annual Withholding Reconciliation Statement. Our user-friendly platform simplifies document management, allowing you to easily prepare your reconciliation statement online. This saves you time and reduces paperwork errors.

-

What features does airSlate SignNow offer for managing withholding reconciliation documents?

AirSlate SignNow includes features such as document templates, electronic signatures, and automated workflows. These tools are designed to enhance your efficiency when creating and executing the Instructions For The Annual Withholding Reconciliation Statement. You can also track document status to ensure timely completion.

-

What are the pricing options for airSlate SignNow when dealing with tax documents?

AirSlate SignNow provides flexible pricing plans suitable for businesses of all sizes. Whether you need basic eSigning features or advanced functionality for the Instructions For The Annual Withholding Reconciliation Statement, there’s an option that fits your budget. Contact our sales team for specific pricing tailored to your needs.

-

Can airSlate SignNow integrate with accounting software for withholding reconciliation?

Yes, airSlate SignNow seamlessly integrates with popular accounting software, simplifying the process of preparing the Instructions For The Annual Withholding Reconciliation Statement. By connecting with your existing systems, you can ensure data accuracy and streamline workflows for tax compliance. Check our integrations page for more details.

-

What advantages does using airSlate SignNow provide for managing withholding documentation?

Using airSlate SignNow for managing your withholding documents offers the advantage of greater efficiency and compliance. Our intuitive platform ensures that you can complete the Instructions For The Annual Withholding Reconciliation Statement quickly and securely. Additionally, our electronic signature feature reduces turnaround time.

-

Is there customer support available for questions about withholding reconciliation?

Absolutely! AirSlate SignNow offers dedicated customer support to assist you with any inquiries regarding the Instructions For The Annual Withholding Reconciliation Statement. Our knowledgeable team is ready to help via chat, email, or phone to ensure you have all the resources you need for a smooth process.

Get more for Instructions For The Annual Withholding Reconciliation Statement

Find out other Instructions For The Annual Withholding Reconciliation Statement

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile