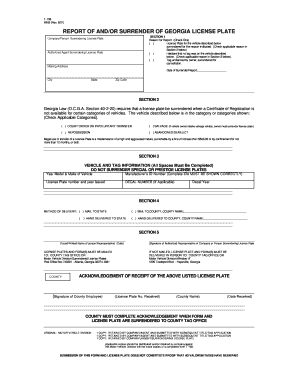

T 158 Form

What is the T 158

The T 158 form is a specific document used in various legal and administrative contexts. It is essential for individuals and businesses to understand its purpose and implications. This form typically pertains to tax-related matters and is often required by the Internal Revenue Service (IRS) or state tax authorities. The T 158 serves as a formal declaration or request, ensuring compliance with applicable regulations.

How to use the T 158

Using the T 158 form involves several straightforward steps. First, gather all necessary information, including personal details and relevant financial data. Next, fill out the form accurately, ensuring that all fields are completed as required. Once the form is filled, it can be submitted either electronically or via traditional mail, depending on the specific instructions provided by the issuing authority. Always double-check for any errors before submission to avoid delays or complications.

Steps to complete the T 158

Completing the T 158 form requires careful attention to detail. Follow these steps for a smooth process:

- Obtain the latest version of the T 158 form from the appropriate source.

- Read the instructions thoroughly to understand the requirements.

- Fill in your personal information, including name, address, and identification numbers.

- Provide any additional information requested, such as financial details or supporting documentation.

- Review the completed form for accuracy and completeness.

- Submit the form as directed, either online or by mail.

Legal use of the T 158

The T 158 form must be used in accordance with legal guidelines to ensure its validity. It is crucial to comply with all relevant laws and regulations when completing and submitting this form. Failure to adhere to these legal requirements can result in penalties or rejection of the form. Understanding the legal context surrounding the T 158 helps users navigate its complexities and ensures proper usage.

IRS Guidelines

The IRS provides specific guidelines for the completion and submission of the T 158 form. These guidelines outline the necessary steps, required information, and deadlines for submission. It is vital for individuals and businesses to familiarize themselves with these guidelines to avoid errors and ensure compliance. Regularly checking for updates on IRS protocols related to the T 158 can also help maintain adherence to current regulations.

Filing Deadlines / Important Dates

Filing deadlines for the T 158 form are critical to ensure timely compliance with tax obligations. These deadlines may vary based on individual circumstances or changes in tax law. It is important to keep track of these dates to avoid penalties. Users should consult the IRS or relevant state authorities for the most current filing deadlines associated with the T 158 form.

Required Documents

When completing the T 158 form, certain documents may be required to support the information provided. These documents can include identification, proof of income, and any other relevant financial records. Ensuring that all necessary documents are gathered before starting the form can streamline the process and reduce the likelihood of errors or omissions. Always refer to the instructions accompanying the T 158 for a comprehensive list of required documents.

Quick guide on how to complete t 158

Handle T 158 smoothly on any device

Online document management has become commonplace among businesses and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, as you can access the right form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents swiftly without delays. Manage T 158 on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign T 158 effortlessly

- Locate T 158 and click on Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign T 158 and guarantee clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the t 158

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is t 158 and how does it relate to airSlate SignNow?

t 158 is a key feature of airSlate SignNow that optimizes the eSigning process for businesses. It provides users with a streamlined way to send documents for signatures, ensuring that transactions are fast, efficient, and secure. Understanding t 158 can enhance your experience with our platform.

-

How can I benefit from using t 158 with airSlate SignNow?

By utilizing t 158 within airSlate SignNow, businesses can signNowly reduce turnaround times for signed documents. This feature allows for easy tracking and management of eSignatures, providing a clear overview of document statuses. Ultimately, t 158 enhances productivity and ensures that important contracts are executed efficiently.

-

What pricing plans are available for t 158 in airSlate SignNow?

airSlate SignNow offers various pricing plans that include access to the t 158 feature. Our competitive pricing is tailored to fit businesses of all sizes, ensuring that everyone can leverage the advantages of t 158 without breaking the bank. For detailed pricing information, please check our website.

-

Are there any integrations available for t 158 with other tools?

Yes, t 158 supports multiple third-party integrations that enhance its functionality within airSlate SignNow. This means you can easily connect it with your favorite CRM, document management, or project management tools. The seamless integration capabilities of t 158 allow for a more unified workflow.

-

How secure is the t 158 feature in airSlate SignNow?

The t 158 feature in airSlate SignNow adheres to the highest security standards to protect your sensitive documents. We utilize encryption and secure authentication measures to ensure that all eSignatures are legally binding and safe from tampering. With t 158, your documents are in trusted hands.

-

Can I customize documents using t 158 in airSlate SignNow?

Absolutely! The t 158 feature allows users to customize documents according to their unique requirements. Whether you need to add logos, fields, or specific instructions, airSlate SignNow provides the tools necessary for complete customization, ensuring your documents reflect your brand.

-

What types of documents can be signed using t 158 in airSlate SignNow?

With t 158, you can easily sign various types of documents including contracts, agreements, and forms. The flexibility of airSlate SignNow allows users to handle everything from simple signatures on PDFs to complex multi-party agreements. This makes t 158 an essential tool for diverse business needs.

Get more for T 158

- Article nine this article sets forth powers of your personal representative and is form

- Designed to give broad powers without the requirement that court approval be sought for form

- Civil union partner with no children form

- Civil union with minor children form

- County new hampshire declare this as a codicil to my will dated form

- Receive your property form

- Where the persons are in a civil union and there is form

- The parent may form

Find out other T 158

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online