Tax Residency Certificate Saudi Arabia Form

What is the Tax Residency Certificate Saudi Arabia

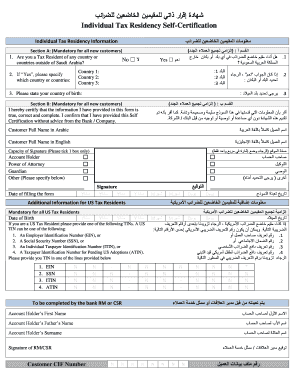

The Tax Residency Certificate in Saudi Arabia is an official document that certifies an individual or entity's residency status for tax purposes. This certificate is crucial for those who need to prove their tax residency to foreign tax authorities or for certain financial transactions. It confirms that the individual or entity is subject to Saudi Arabian tax laws and may be necessary for claiming tax benefits or exemptions in other jurisdictions.

How to obtain the Tax Residency Certificate Saudi Arabia

To obtain the Tax Residency Certificate in Saudi Arabia, applicants typically need to follow a specific process. This usually involves submitting a request to the relevant tax authority along with necessary documentation. Required documents may include proof of residency, identification, and any other supporting materials that demonstrate the applicant's tax status. It is important to ensure that all information is accurate and complete to avoid delays in processing.

Steps to complete the Tax Residency Certificate Saudi Arabia

Completing the Tax Residency Certificate involves several key steps:

- Gather required documents, including proof of residency and identification.

- Fill out the application form accurately, ensuring all details are correct.

- Submit the application along with the necessary documents to the appropriate tax authority.

- Await confirmation and processing of the application.

- Receive the Tax Residency Certificate once approved.

Legal use of the Tax Residency Certificate Saudi Arabia

The Tax Residency Certificate serves as a legal document that can be used in various situations, such as applying for tax treaties or exemptions in other countries. It is essential for individuals and businesses to understand the legal implications of this certificate, as it can affect their tax obligations both domestically and internationally. Proper use of the certificate can help avoid double taxation and ensure compliance with tax regulations.

Key elements of the Tax Residency Certificate Saudi Arabia

Key elements of the Tax Residency Certificate include the name and identification details of the taxpayer, the period of residency, and the confirmation of tax status. Additionally, the certificate may include the issuing authority's details and any applicable tax identification numbers. These elements are vital for ensuring the certificate's validity and acceptance by foreign tax authorities.

Required Documents

When applying for the Tax Residency Certificate in Saudi Arabia, several documents are typically required:

- Proof of residency, such as a utility bill or rental agreement.

- Identification documents, like a passport or national ID.

- Tax identification number, if applicable.

- Any additional documentation requested by the tax authority.

Quick guide on how to complete tax residency certificate saudi arabia

Effortlessly prepare Tax Residency Certificate Saudi Arabia on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without any obstacles. Manage Tax Residency Certificate Saudi Arabia on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign Tax Residency Certificate Saudi Arabia with ease

- Obtain Tax Residency Certificate Saudi Arabia and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Tax Residency Certificate Saudi Arabia to ensure seamless communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax residency certificate saudi arabia

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is residency certification and why do I need it?

Residency certification is a document that verifies an individual's residency status, often required for legal, educational, or financial purposes. It is crucial for maintaining compliance with various regulations and to access certain benefits or services. Using airSlate SignNow, you can easily create and manage your residency certification electronically.

-

How does airSlate SignNow help with residency certification?

airSlate SignNow streamlines the process of obtaining residency certification by allowing users to quickly send, sign, and manage documents online. Our easy-to-use platform eliminates the hassle of physical paperwork, ensuring that your residency certification can be completed in a fraction of the time. With secure eSigning features, you can also ensure the authenticity of your documents.

-

What features does airSlate SignNow offer for residency certification?

airSlate SignNow provides a range of features tailored to assist with residency certification, including customizable templates, automatic reminders, and secure cloud storage. These features not only save you time but also enhance the accuracy and efficiency of the certification process. You can easily track the status of your documents, ensuring that everything is processed in a timely manner.

-

Is there a cost associated with using airSlate SignNow for residency certification?

Yes, there is a cost associated with using airSlate SignNow, which offers several pricing plans based on your needs. Our plans are designed to be cost-effective, especially when considering the time savings and increased efficiency in handling residency certification. You can choose the plan that best fits your business to ensure a return on investment.

-

Can I integrate airSlate SignNow with other software for residency certification?

Absolutely! airSlate SignNow offers seamless integrations with popular software solutions, enabling you to enhance your workflow for residency certification. This includes integrations with CRM systems, document management tools, and cloud storage providers, making it easier to keep all your documentation organized in one place.

-

How secure is airSlate SignNow for handling residency certification documents?

Security is a top priority at airSlate SignNow. We employ advanced security measures, including encryption and secure servers, to protect your residency certification documents. Our platform complies with industry standards to ensure that sensitive information remains confidential and secure.

-

What are the benefits of using airSlate SignNow for residency certification?

Using airSlate SignNow for residency certification streamlines the entire process, saving time and resources while ensuring compliance. You benefit from a user-friendly interface, quick turnaround times, and enhanced security for your documents. Plus, our support team is available to assist you whenever you have questions during the process.

Get more for Tax Residency Certificate Saudi Arabia

- Supreme court of the state of new york 1 form

- I am not a party to the action am over 18 years of age and reside at form

- Notary public license law new york state department form

- Middle atlantic ud4 4 space utility rack drawer black bampamph form

- The summons with notice or summons and verified complaint and the notice form

- 111 a 1123 112 b form

- Free drl 111 111 a 112 115 scpa17251 form 1

- Form 1 ca

Find out other Tax Residency Certificate Saudi Arabia

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form