Section 6378 Exemption Certificate Form

What is the Section 6378 Exemption Certificate

The Section 6378 exemption certificate is a specific document used in California that allows certain businesses to claim exemptions from sales tax on qualifying purchases related to film and television production. This certificate is essential for companies involved in post-production activities, enabling them to reduce their tax burden while complying with state regulations. It is particularly relevant for productions that meet specific criteria set forth by the California Department of Tax and Fee Administration.

How to use the Section 6378 Exemption Certificate

To utilize the Section 6378 exemption certificate effectively, businesses must first ensure that they qualify under the guidelines established by the California government. Once eligibility is confirmed, the certificate can be presented to vendors at the time of purchase. This allows the business to avoid paying sales tax on items directly related to production activities. It is crucial to keep accurate records of all transactions where the exemption certificate is applied, as these may be subject to review by tax authorities.

Steps to complete the Section 6378 Exemption Certificate

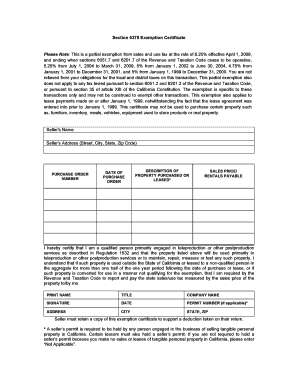

Completing the Section 6378 exemption certificate involves several key steps:

- Gather necessary information, including the business name, address, and tax identification number.

- Clearly identify the specific items or services being purchased that qualify for the exemption.

- Fill out the certificate accurately, ensuring all required fields are completed.

- Sign and date the certificate before submitting it to the vendor.

- Maintain a copy of the completed certificate for your records.

Legal use of the Section 6378 Exemption Certificate

The legal use of the Section 6378 exemption certificate requires adherence to California tax laws. Businesses must ensure that the certificate is only used for eligible purchases related to film and television production. Misuse of the certificate can result in penalties, including back taxes owed and potential fines. It is advisable to consult with a tax professional to ensure compliance with all legal requirements when using this exemption certificate.

Eligibility Criteria

To be eligible for the Section 6378 exemption certificate, businesses must meet specific criteria established by the California government. These criteria typically include being engaged in film or television production activities and making purchases that directly relate to these activities. Additionally, the business must be registered with the appropriate state agencies and possess a valid seller's permit. It is important to review the latest state guidelines to confirm eligibility before applying.

Required Documents

When applying for the Section 6378 exemption certificate, certain documents may be required to verify eligibility. These typically include:

- A valid seller's permit issued by the California Department of Tax and Fee Administration.

- Proof of business registration in California.

- Documentation showing the nature of the production activities, such as contracts or production schedules.

Form Submission Methods

The Section 6378 exemption certificate can be submitted through various methods, depending on the vendor's policies. Common submission methods include:

- Presenting a physical copy of the completed certificate at the time of purchase.

- Submitting the certificate via email if the vendor accepts electronic submissions.

- Utilizing an online platform for document management and eSignature to streamline the process.

Quick guide on how to complete section 6378 exemption certificate 5601780

Accomplish Section 6378 Exemption Certificate effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers a superb eco-friendly alternative to traditional printed and signed documents, enabling you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to generate, modify, and eSign your documents swiftly without delays. Manage Section 6378 Exemption Certificate on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to alter and eSign Section 6378 Exemption Certificate with ease

- Acquire Section 6378 Exemption Certificate and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark pertinent sections of the documents or obscure private information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and carries the same legal weight as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you prefer to deliver your form, via email, SMS, invite link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form searches, or errors that necessitate printing out new copies of documents. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your preference. Edit and eSign Section 6378 Exemption Certificate while ensuring outstanding communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the section 6378 exemption certificate 5601780

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the section 6378 exemption certificate 2019?

The section 6378 exemption certificate 2019 allows businesses to claim certain sales tax exemptions for qualified purchases. This certificate can be crucial for firms looking to maximize their savings. airSlate SignNow helps streamline the process by providing easy access to essential documents, including exemption certificates.

-

How can I apply for the section 6378 exemption certificate 2019?

To apply for the section 6378 exemption certificate 2019, businesses typically need to submit an application to their state's tax authority. It is recommended to include all necessary documentation to avoid delays. Using airSlate SignNow can facilitate this process by enabling you to eSign and send documents quickly and securely.

-

What features does airSlate SignNow offer for managing exemption certificates?

airSlate SignNow offers features that include document customization, secure eSigning, and easy storage for exemption certificates like the section 6378 exemption certificate 2019. These tools help businesses manage their documentation efficiently. Additionally, you can track the status of documents in real-time, ensuring you don't miss important deadlines.

-

Is there a cost associated with obtaining the section 6378 exemption certificate 2019?

While there may be no direct fees for obtaining the section 6378 exemption certificate 2019 itself, businesses should be aware of any associated costs, such as filing fees or legal assistance. airSlate SignNow offers a cost-effective solution for managing this documentation, reducing overhead costs related to paperwork.

-

How can airSlate SignNow help with compliance regarding exemption certificates?

airSlate SignNow assists businesses in maintaining compliance by providing a structured method to manage and store exemption certificates like the section 6378 exemption certificate 2019. This ensures that all necessary documentation is readily available for audits or inspections. Our platform also allows for easy updates to keep information current.

-

What integrations does airSlate SignNow offer for managing tax exemption documentation?

airSlate SignNow seamlessly integrates with various business tools and platforms, enhancing the management of tax exemption documentation, including the section 6378 exemption certificate 2019. These integrations allow for efficient workflows and easy importation and exportation of data. This connectivity can save businesses time and improve productivity.

-

Can I store multiple exemption certificates with airSlate SignNow?

Yes, airSlate SignNow allows businesses to store multiple exemption certificates, including the section 6378 exemption certificate 2019, in a secure, organized manner. This feature ensures that all important documents are easily accessible. Additionally, advanced search functions can help you find specific certificates quickly.

Get more for Section 6378 Exemption Certificate

- 20 by county state of ohio form

- Name of person acknowledged 490205026 form

- Heshethey executed the form

- And who executed the within and foregoing instrument and acknowledged to me that form

- That grantor for and in form

- Individual affidavits from the lds historical department form

- Index no gpc015 state of ohio general services division form

- Grant deed of conservation easement form

Find out other Section 6378 Exemption Certificate

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy