South Carolina Form D 137

What is the South Carolina Form D 137

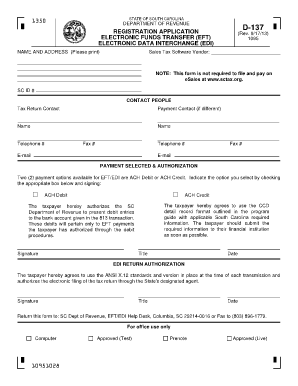

The South Carolina Form D 137 is a specific document used for various legal and administrative purposes within the state. It is essential for individuals and businesses to understand its function, as it may be required for compliance with state regulations. The form serves as a means to provide necessary information for specific transactions or requests, ensuring that all parties involved are aware of their rights and obligations.

How to use the South Carolina Form D 137

Using the South Carolina Form D 137 involves several key steps. First, individuals or businesses must identify the specific purpose for which the form is required. This could range from tax-related issues to other legal matters. Once the purpose is clear, the next step is to accurately fill out the form with the required information, ensuring that all details are correct and complete. After completing the form, it should be submitted through the appropriate channels, whether online, by mail, or in person, depending on the requirements of the issuing authority.

Steps to complete the South Carolina Form D 137

Completing the South Carolina Form D 137 requires careful attention to detail. Here are the essential steps:

- Gather all necessary information, including personal or business details, and any relevant documentation.

- Download the form from a reliable source or obtain a physical copy from the appropriate agency.

- Carefully fill out the form, ensuring that all fields are completed accurately.

- Review the form for any errors or omissions before submission.

- Submit the completed form according to the specific instructions provided, ensuring compliance with any deadlines.

Legal use of the South Carolina Form D 137

The legal use of the South Carolina Form D 137 is crucial for ensuring that all transactions and requests are valid under state law. The form must be completed in accordance with the relevant legal requirements to be considered binding. This includes providing accurate information and obtaining necessary signatures where applicable. Understanding the legal implications of the form can help prevent potential disputes or compliance issues in the future.

Key elements of the South Carolina Form D 137

The South Carolina Form D 137 contains several key elements that are important for its validity and effectiveness. These elements typically include:

- Identification of the parties involved in the transaction.

- Detailed descriptions of the purpose of the form.

- Signature lines for all relevant parties, indicating their agreement.

- Dates for when the form is completed and submitted.

Who Issues the Form

The South Carolina Form D 137 is typically issued by state government agencies or departments that oversee the specific area related to the form's purpose. This could include tax authorities, regulatory bodies, or other governmental entities. It is essential to obtain the form from the correct source to ensure its legitimacy and compliance with state regulations.

Quick guide on how to complete south carolina form d 137

Complete South Carolina Form D 137 effortlessly on any device

Online document administration has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, amend, and eSign your documents swiftly and without delays. Manage South Carolina Form D 137 on any device using the airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

The simplest way to modify and eSign South Carolina Form D 137 with ease

- Locate South Carolina Form D 137 and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Mark important sections of your documents or black out confidential information using tools provided by airSlate SignNow specifically for this purpose.

- Create your signature with the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you want to send your form: via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign South Carolina Form D 137 and ensure excellent communication throughout the preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the south carolina form d 137

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 137 form?

The 137 form is a specific document used to facilitate transactions and agreements between parties. With airSlate SignNow, you can easily create, send, and eSign 137 forms, streamlining your workflow and ensuring timely execution.

-

How does airSlate SignNow enhance the process of completing a 137 form?

airSlate SignNow simplifies the completion of a 137 form by providing intuitive tools for document management and electronic signatures. Users can fill out the form, add fields as needed, and send it for signature within minutes, reducing turnaround times signNowly.

-

Is airSlate SignNow cost-effective for businesses using the 137 form?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, making it a cost-effective solution for managing the 137 form. Companies can utilize its features without incurring high costs, ensuring value for their investment.

-

What features does airSlate SignNow offer for 137 forms?

airSlate SignNow provides a range of features for 137 forms, including real-time collaboration, customizable templates, and automated reminders for signers. These capabilities enhance the entire signing experience and ensure compliance with deadlines.

-

Can I integrate airSlate SignNow with other software while using the 137 form?

Absolutely! airSlate SignNow seamlessly integrates with popular applications like Google Drive, Salesforce, and more. This allows users to import data directly into their 137 form, enhancing efficiency and reducing the need for manual entry.

-

How does airSlate SignNow ensure the security of my 137 form?

Security is a top priority at airSlate SignNow. All transactions, including those involving the 137 form, are protected with encryption and comply with industry standards, ensuring your documents remain confidential and secure throughout the signing process.

-

Can I track the status of my 137 form once sent?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your 137 form in real time. Users can see when the document is opened, signed, or completed, giving greater control over the signing process.

Get more for South Carolina Form D 137

- Control number ak p004 pkg form

- Control number ak p005 pkg form

- Durable power of attorney for college studentcollege confidential form

- Powers of attorney ampamp health care directives alaska court form

- Alaska small claims forms for court us legal forms

- Control number ak p008 pkg form

- Revocation power of attorney form

- For newly divorced form

Find out other South Carolina Form D 137

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document

- How Do I Electronic signature Minnesota Car Dealer Form

- Can I Electronic signature Missouri Car Dealer Document

- How Do I Electronic signature Nevada Car Dealer PDF

- How To Electronic signature South Carolina Banking Document

- Can I Electronic signature New York Car Dealer Document

- How To Electronic signature North Carolina Car Dealer Word

- How Do I Electronic signature North Carolina Car Dealer Document

- Can I Electronic signature Ohio Car Dealer PPT

- How Can I Electronic signature Texas Banking Form

- How Do I Electronic signature Pennsylvania Car Dealer Document

- How To Electronic signature South Carolina Car Dealer Document

- Can I Electronic signature South Carolina Car Dealer Document

- How Can I Electronic signature Texas Car Dealer Document

- How Do I Electronic signature West Virginia Banking Document

- How To Electronic signature Washington Car Dealer Document

- Can I Electronic signature West Virginia Car Dealer Document