Loonbelastingsverklaring Form

Understanding the Loonbelastingsverklaring

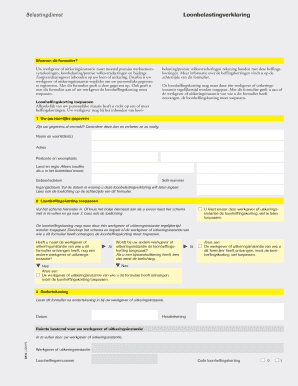

The loonbelastingsverklaring is a crucial document used in the Netherlands for tax purposes. It serves as a declaration of wage tax and is often required by employers to ensure proper tax withholding. Understanding this form is important for both employees and employers, as it impacts tax obligations and compliance. The form provides essential information regarding an employee's tax status and any applicable deductions, making it a key component in the payroll process.

Steps to Complete the Loonbelastingsverklaring

Completing the loonbelastingsverklaring involves several important steps to ensure accuracy and compliance. First, gather all necessary personal information, including your tax identification number and details about your employment. Next, fill out the form carefully, ensuring that all entries are correct and complete. It is essential to review the form for any errors before submission. Finally, submit the completed form to your employer, who will use it to calculate the appropriate tax deductions from your wages.

Legal Use of the Loonbelastingsverklaring

The legal use of the loonbelastingsverklaring is governed by tax laws and regulations. For the form to be considered valid, it must be completed accurately and submitted in a timely manner. Employers are required to keep the form on file as part of their payroll records. Additionally, the form must comply with relevant privacy laws to protect the personal information of employees. Failure to adhere to these legal requirements can result in penalties for both employees and employers.

Who Issues the Loonbelastingsverklaring

The loonbelastingsverklaring is typically issued by the employer. Employers are responsible for providing this form to their employees as part of the onboarding process or when there are changes in employment status. It is important for employees to request this form if it is not provided, as it is necessary for accurate tax reporting and compliance. Additionally, employees should ensure that their personal information is up to date to prevent any issues with tax deductions.

Filing Deadlines and Important Dates

Filing deadlines for the loonbelastingsverklaring are critical for compliance with tax regulations. Employees must submit their completed forms to their employers as soon as they start a new job or when there are changes in their tax situation. Employers, in turn, must ensure that they process these forms promptly to avoid delays in payroll. Staying aware of important dates, such as tax filing deadlines, can help prevent complications and ensure that tax obligations are met on time.

Examples of Using the Loonbelastingsverklaring

There are various scenarios in which the loonbelastingsverklaring is utilized. For instance, a new employee may need to complete the form to establish their tax withholding status. Additionally, if an employee experiences a change in marital status or has a child, they may need to update their loonbelastingsverklaring to reflect these changes. These examples illustrate the importance of keeping the form current to ensure accurate tax deductions and compliance with tax laws.

Quick guide on how to complete loonbelastingsverklaring

Prepare Loonbelastingsverklaring effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and efficiently. Manage Loonbelastingsverklaring across any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven task today.

The easiest way to modify and electronically sign Loonbelastingsverklaring with ease

- Locate Loonbelastingsverklaring and click on Get Form to get going.

- Make use of the tools we provide to complete your document.

- Emphasize important parts of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to store your modifications.

- Choose your preferred method for sending your form, whether by email, SMS, invite link, or download it to your PC.

Forget about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing additional copies. airSlate SignNow meets your document management needs in just a few clicks from the device of your choice. Modify and electronically sign Loonbelastingsverklaring and ensure exceptional communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the loonbelastingsverklaring

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow's pricing structure?

airSlate SignNow offers several pricing tiers designed to meet different business needs, effectively building value for organizations of all sizes. As you scale, you can choose from monthly or annual plans that provide discounts on longer commitments. Each plan includes essential features, ensuring you get maximum savings as you grow.

-

What features does airSlate SignNow provide?

airSlate SignNow comes loaded with features that enhance document management and eSigning, thereby building value for your workflow. Users can create templates, automate workflows, and set reminders for crucial deadlines. These features help streamline processes, making it easier to get documents signed quickly and efficiently.

-

How can airSlate SignNow benefit my business?

By using airSlate SignNow, businesses can signNowly reduce the time and resources spent on document management, effectively building value through increased productivity. The solution allows for seamless collaboration, allowing teams to work together on documents in real-time. This functionality can enhance the speed at which deals are closed and services are delivered.

-

Is airSlate SignNow suitable for small businesses?

Absolutely! airSlate SignNow is particularly designed for businesses of all sizes, helping small businesses build value through its cost-effective solution. With user-friendly features and flexible pricing, small companies can leverage eSigning and document management without extensive upfront costs, which is crucial for budget-conscious operations.

-

What integrations does airSlate SignNow offer?

airSlate SignNow integrates seamlessly with various tools such as Google Drive, Salesforce, and Microsoft Office, building value through enhanced functionality. These integrations facilitate easier data transfer and document management, allowing users to streamline their workflows without switching between different platforms. Such connectivity is essential for businesses looking to maintain efficiency.

-

Can I customize documents in airSlate SignNow?

Yes, airSlate SignNow allows users to customize documents to meet their unique requirements, effectively building value by providing tailored solutions. From adding your company logo to using custom templates, you can create professional documents that represent your brand effectively. Customization is key for businesses looking to maintain a coherent brand image in all communications.

-

How secure is airSlate SignNow for sending documents?

Security is a top priority for airSlate SignNow, which employs advanced encryption methods to protect your documents, thereby building value through peace of mind. With features like two-factor authentication, you can ensure that only authorized users have access to sensitive information. This high level of security helps businesses comply with various regulations and protect their data.

Get more for Loonbelastingsverklaring

Find out other Loonbelastingsverklaring

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed