82 052a Current Form

What is the 82 052a Current Form

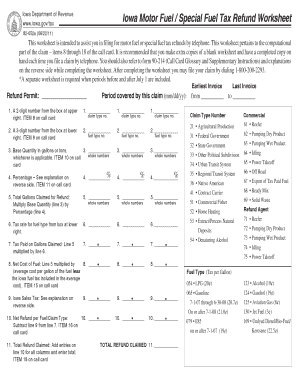

The 82 052a current form is a fuel tax form used in Iowa, specifically designed for businesses and individuals who need to report fuel usage and pay applicable taxes. This form is essential for compliance with state regulations surrounding fuel tax obligations. It provides a structured way to disclose fuel purchases and usage, ensuring that all necessary information is captured for tax purposes. Understanding the purpose of this form is crucial for anyone involved in the transportation or fuel distribution sectors in Iowa.

How to use the 82 052a Current Form

Using the 82 052a current form involves several straightforward steps. First, gather all necessary documentation regarding fuel purchases and usage. This includes invoices, receipts, and any other relevant records. Next, accurately fill out the form, ensuring that all required fields are completed. Pay special attention to detail, as errors can lead to compliance issues. Once the form is completed, it can be submitted either electronically or via mail, depending on the preferred method of submission. Utilizing digital tools can streamline this process and enhance accuracy.

Steps to complete the 82 052a Current Form

Completing the 82 052a current form requires careful attention to detail. Follow these steps for successful completion:

- Start by downloading the form from the Iowa Department of Revenue website or accessing it through a digital platform.

- Fill in your personal or business information, including name, address, and identification number.

- Document all fuel purchases, specifying the type of fuel, quantity, and total cost.

- Calculate the total fuel tax owed based on the reported usage.

- Review the form for accuracy, ensuring all information is correct and complete.

- Submit the form according to the chosen submission method, either electronically or by mail.

Legal use of the 82 052a Current Form

The legal use of the 82 052a current form is governed by state tax regulations. It is essential for individuals and businesses to ensure compliance with these regulations to avoid penalties. The form must be filled out accurately and submitted within the designated time frame to be considered valid. Electronic submissions are legally accepted, provided they adhere to the standards set forth by the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). This legal framework supports the use of digital signatures and electronic records in place of traditional paper forms.

Key elements of the 82 052a Current Form

Understanding the key elements of the 82 052a current form is vital for accurate completion. The form typically includes the following sections:

- Identification Information: This section requires the name and address of the filer, along with any relevant identification numbers.

- Fuel Purchase Details: Here, filers must list all fuel purchases, including the type of fuel, quantity, and purchase price.

- Tax Calculation: This section is where the total fuel tax owed is calculated based on reported usage.

- Signature Section: A signature, either digital or handwritten, is required to validate the form.

Form Submission Methods (Online / Mail / In-Person)

The 82 052a current form can be submitted through various methods, providing flexibility for filers. Options include:

- Online Submission: Many users prefer to submit the form electronically through the Iowa Department of Revenue's online portal, which offers a secure and efficient way to file.

- Mail Submission: Filers can print the completed form and mail it to the appropriate address provided by the Iowa Department of Revenue.

- In-Person Submission: Some individuals may choose to submit the form in person at designated offices, allowing for immediate confirmation of receipt.

Quick guide on how to complete 82 052a current form

Effortlessly Prepare 82 052a Current Form on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the right form and securely save it online. airSlate SignNow provides all the tools required to create, edit, and eSign your documents swiftly without delays. Manage 82 052a Current Form across any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Easiest Way to Edit and eSign 82 052a Current Form with Ease

- Search for 82 052a Current Form and click Get Form to begin.

- Use the tools available to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with the tools provided by airSlate SignNow designed explicitly for this task.

- Create your eSignature using the Sign feature, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method for sending your form, whether via email, text (SMS), invite link, or by downloading it to your computer.

Say goodbye to lost or misplaced documents, tedious searches for forms, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Edit and eSign 82 052a Current Form and guarantee seamless communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 82 052a current form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 82 052a ia form and how can I use it with airSlate SignNow?

The 82 052a ia form is a specific document that can be easily completed and signed using airSlate SignNow. This platform allows you to upload, fill out, and eSign the form seamlessly. By utilizing our secure electronic signatures, you can ensure compliance and efficiency in your document management.

-

Are there any costs associated with using the 82 052a ia form on airSlate SignNow?

airSlate SignNow offers a range of pricing plans that can accommodate your needs for using the 82 052a ia form. We provide flexible subscription options that ensure you get the best value for your eSigning needs. With our cost-effective solutions, you can manage your documents without breaking the bank.

-

What features does airSlate SignNow provide for the 82 052a ia form?

When using the 82 052a ia form on airSlate SignNow, you benefit from features like customizable templates, real-time tracking, and secure storage. Our platform also integrates advanced tools for collaboration, ensuring that multiple parties can easily engage with the document. This enhances efficiency and simplifies the signing process.

-

Can I integrate the 82 052a ia form with other applications?

Yes, airSlate SignNow offers seamless integrations with various applications to facilitate the use of the 82 052a ia form. From CRMs to cloud storage solutions, you can connect your favorite tools without hassle. This integration capability streamlines your workflow, making document management more efficient.

-

How does using airSlate SignNow improve the handling of the 82 052a ia form?

Using airSlate SignNow to handle the 82 052a ia form allows for rapid document processing and eliminates the delays associated with traditional signatures. Our platform ensures that your documents are signed quickly and securely, improving turnaround times. This not only boosts productivity but also enhances customer satisfaction.

-

Is the 82 052a ia form secure when signed with airSlate SignNow?

Absolutely! The 82 052a ia form is signed securely with airSlate SignNow, which employs industry-leading encryption methods. Your data privacy is our priority, and our electronic signatures meet regulatory compliance standards. You can trust that your documents are safe with us.

-

What benefits can I expect from using the 82 052a ia form on airSlate SignNow?

By utilizing the 82 052a ia form on airSlate SignNow, you can expect increased efficiency and reduced paper usage. The ease of electronic signatures accelerates your workflow, allowing for quicker decision-making. Additionally, this can lead to signNow cost savings for your business.

Get more for 82 052a Current Form

- As a result of this agreement the creditor may be able to take your property or wages if you do not pay the agreed form

- Local forms united states bankruptcy court for the western

- Mandatory creditor listmatrix middle district of pennsylvania form

- Judge pimentel crim transcript book 2justicecrime ampamp justice form

- Applies so long as a loan is owed by buyers to any person form

- Financing or guaranteeing our loan we are aware of and understand form

- Bill of sale form pennsylvanian last will and testament

- Names of individuals as type of form

Find out other 82 052a Current Form

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF

- Can I Sign Michigan Banking PDF

- Help Me With Sign Minnesota Banking Word

- How To Sign Missouri Banking Form

- Help Me With Sign New Jersey Banking PDF

- How Can I Sign New Jersey Banking Document

- Help Me With Sign New Mexico Banking Word

- Help Me With Sign New Mexico Banking Document

- How Do I Sign New Mexico Banking Form

- How To Sign New Mexico Banking Presentation

- How Do I Sign New York Banking PPT

- Help Me With Sign Ohio Banking Document

- How To Sign Oregon Banking PDF

- Help Me With Sign Oregon Banking Presentation

- Can I Sign Pennsylvania Banking Form

- How To Sign Arizona Business Operations PDF

- Help Me With Sign Nebraska Business Operations Presentation

- How To Sign Arizona Car Dealer Form