Editable Bir Form1700

What is the Editable Bir Form1700

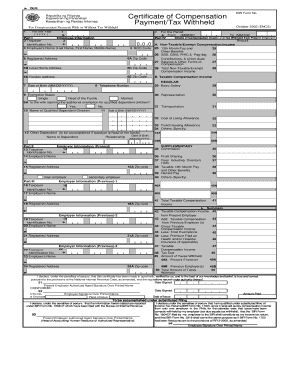

The Editable Bir Form1700 is a tax-related document used primarily in the United States. It serves as a declaration for various tax obligations and is essential for individuals and businesses to report their income accurately. This form is particularly relevant for taxpayers who need to provide detailed information regarding their earnings, deductions, and credits. Understanding the purpose and requirements of this form is crucial for compliance with tax regulations.

How to use the Editable Bir Form1700

Using the Editable Bir Form1700 involves several steps to ensure accurate completion. First, gather all necessary financial documents, such as income statements and previous tax returns. Next, access the editable version of the form, which allows you to fill in your information digitally. Carefully enter your details, ensuring that all fields are completed accurately. Once filled, review the information for any errors before finalizing the document. Finally, you can eSign the form using a secure digital signature solution, ensuring its legal validity.

Steps to complete the Editable Bir Form1700

Completing the Editable Bir Form1700 requires a systematic approach. Follow these steps:

- Gather required documents, including income sources and deductions.

- Access the editable form through a trusted digital platform.

- Fill in your personal and financial information accurately.

- Review the completed form for any discrepancies.

- Sign the document using an electronic signature for validation.

- Save a copy for your records and submit it as required.

Legal use of the Editable Bir Form1700

The Editable Bir Form1700 is legally binding when completed correctly and signed using a compliant electronic signature. To ensure its legality, it must meet specific requirements outlined by federal and state tax laws. This includes adherence to the ESIGN Act and UETA, which govern electronic signatures in the United States. Utilizing a secure platform that provides a digital certificate further enhances the form's legal standing, making it acceptable for submission to tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Editable Bir Form1700 are critical for compliance. Typically, the form must be submitted by the tax deadline, which is usually April 15 for individual taxpayers. However, specific deadlines may vary based on the taxpayer's situation, such as extensions or special circumstances. It is essential to stay informed about any changes to these dates to avoid penalties and ensure timely filing.

Required Documents

To complete the Editable Bir Form1700, several documents are typically required. These may include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Records of any additional income

- Receipts for deductible expenses

- Previous tax returns for reference

Having these documents ready will streamline the process and help ensure accuracy when filling out the form.

Quick guide on how to complete editable bir form1700

Complete Editable Bir Form1700 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to easily find the necessary form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Manage Editable Bir Form1700 on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered process today.

The easiest way to modify and eSign Editable Bir Form1700 with ease

- Find Editable Bir Form1700 and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or conceal sensitive information using tools specially designed by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and then click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced files, tiring form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Editable Bir Form1700 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the editable bir form1700

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Editable Bir Form1700?

The Editable Bir Form1700 is a crucial tax form used for income tax returns in the Philippines. With airSlate SignNow, you can effortlessly fill out and edit this form, ensuring that all your information is accurate and up-to-date. Our platform makes it simple to manage your tax documents securely and efficiently.

-

How do I fill out an Editable Bir Form1700 using airSlate SignNow?

Filling out an Editable Bir Form1700 with airSlate SignNow is intuitive. Simply upload the form, fill in the required fields, and make any necessary edits. You can also save your progress and retrieve your document anytime, streamlining the submission process.

-

Is there a cost associated with using airSlate SignNow for Editable Bir Form1700?

airSlate SignNow offers various pricing plans to suit different needs, including options for individual users and businesses. You can start with a free trial to explore the features for Editable Bir Form1700 and see if it meets your requirements. Our solution is designed to be cost-effective, ensuring value for every customer.

-

What features does airSlate SignNow offer for managing Editable Bir Form1700?

Our platform provides numerous features that enhance the management of Editable Bir Form1700, including e-signature capabilities, document tracking, and secure cloud storage. You can collaborate with team members in real-time, making the entire process efficient and transparent.

-

Can I integrate airSlate SignNow with other applications for Editable Bir Form1700?

Yes, airSlate SignNow offers seamless integrations with various applications such as Google Drive, Dropbox, and Microsoft Office. This allows you to pull documents into your Editable Bir Form1700 workflow easily or save completed forms directly to your preferred platform.

-

What are the benefits of using airSlate SignNow for Editable Bir Form1700?

Using airSlate SignNow for Editable Bir Form1700 simplifies the tax filing process. You benefit from enhanced accuracy, reduced paperwork, and faster processing times. Additionally, our secure platform ensures that your sensitive data is protected throughout the entire workflow.

-

How secure is my information when using airSlate SignNow for Editable Bir Form1700?

Security is a top priority at airSlate SignNow. We utilize advanced encryption protocols to protect your Editable Bir Form1700 and any other sensitive documents. Our platform complies with industry standards, ensuring that your information remains confidential and secure.

Get more for Editable Bir Form1700

- Petition for expungement pursuant to parcrimp 9122b form

- And the board of directors of a form

- Incorporators shareholders and the board of directors of a form

- Pennsylvania department of state bureau of form

- Names of individuals form

- For diversity cases only form

- Address window of your internet browser form

- Utah state bulletin administrative rules utahgov form

Find out other Editable Bir Form1700

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple