Property Tax Form 6

What is the Property Tax Form 6

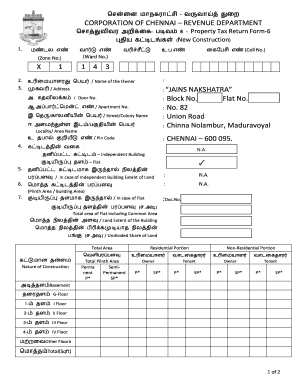

The Property Tax Form 6 is a crucial document used by property owners in the United States to report property values for tax assessment purposes. This form is typically required by local tax authorities to determine the amount of property tax owed. It includes information about the property, such as its location, size, and assessed value. Completing this form accurately is essential to ensure that property taxes are assessed fairly and in accordance with local regulations.

Steps to Complete the Property Tax Form 6

Completing the Property Tax Form 6 involves several key steps to ensure accuracy and compliance. First, gather all necessary information regarding the property, including ownership details, property type, and any improvements made. Next, accurately fill out each section of the form, providing clear and concise information. It is important to double-check all entries for accuracy before submission. Finally, ensure that you sign and date the form, as this is required for it to be considered valid.

How to Obtain the Property Tax Form 6

The Property Tax Form 6 can typically be obtained from your local tax assessor's office or its official website. Many jurisdictions also offer the form in a downloadable PDF format, allowing for easy access and completion. If you prefer a physical copy, you can visit the tax office directly to request one. It is advisable to check for any specific instructions or additional documentation that may be required when obtaining the form.

Legal Use of the Property Tax Form 6

The legal use of the Property Tax Form 6 is governed by state and local laws. When completed and submitted correctly, this form serves as a legally binding document that outlines the property owner's claim regarding the property's value. It is essential to adhere to all legal requirements when filling out the form, as inaccuracies or omissions can lead to penalties or disputes with tax authorities. Understanding local regulations will help ensure that the form is used appropriately.

Required Documents

When completing the Property Tax Form 6, several supporting documents may be required to substantiate the information provided. Commonly required documents include proof of ownership, recent property appraisals, and any documentation related to property improvements or changes. It is advisable to check with your local tax authority for a specific list of required documents to ensure a smooth filing process.

Form Submission Methods

The Property Tax Form 6 can typically be submitted through various methods, including online, by mail, or in person. Many jurisdictions now offer online submission options, which can streamline the process and reduce processing times. If submitting by mail, ensure that you send the form to the correct address and keep a copy for your records. In-person submissions may require an appointment, so it is wise to check in advance.

Filing Deadlines / Important Dates

Filing deadlines for the Property Tax Form 6 can vary by state and locality. It is crucial to be aware of these deadlines to avoid penalties or late fees. Most jurisdictions have specific dates by which the form must be submitted, often aligning with the annual tax assessment cycle. Checking with your local tax authority will provide the most accurate and relevant information regarding important dates.

Quick guide on how to complete property tax form 6

Effortlessly Complete Property Tax Form 6 on Any Device

Digital document management has become increasingly favored by both businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents rapidly without delays. Manage Property Tax Form 6 on any device using airSlate SignNow's Android or iOS applications and simplify any document-centric task today.

How to Edit and Electronically Sign Property Tax Form 6 with Ease

- Locate Property Tax Form 6 and click Get Form to begin.

- Utilize the tools we provide to finish your document.

- Select important sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Property Tax Form 6 and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the property tax form 6

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 'form 6 property tax chennai' and how can airSlate SignNow assist with it?

The 'form 6 property tax chennai' is a crucial document for filing property tax in Chennai. With airSlate SignNow, you can easily prepare, send, and eSign this form digitally, streamlining the process and ensuring compliance with local regulations. Our platform makes it convenient to manage all your property tax documents in one place.

-

What features does airSlate SignNow offer for processing 'form 6 property tax chennai'?

airSlate SignNow includes features like customizable templates, automated workflows, and secure eSignature capabilities to facilitate the completion of 'form 6 property tax chennai'. These tools help reduce errors and streamline submission, making your tax filing effortless and efficient.

-

How does using airSlate SignNow for 'form 6 property tax chennai' save money?

Using airSlate SignNow for 'form 6 property tax chennai' eliminates the need for physical paperwork and reduces printing costs. Our cost-effective solution also minimizes the time spent on tax preparation, allowing you to allocate resources more efficiently and saving you both time and money in the long run.

-

Are there any integrations available for managing 'form 6 property tax chennai' with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various software solutions, making it easy to link your project management and accounting tools for managing 'form 6 property tax chennai'. This ensures smooth data flow and keeps all your related documents organized and accessible.

-

Can I track the status of 'form 6 property tax chennai' sent for eSigning?

Absolutely! With airSlate SignNow, you can track the real-time status of your 'form 6 property tax chennai' documents sent for eSigning. You'll receive notifications on when your document is viewed and signed, providing transparency and peace of mind throughout the process.

-

Is airSlate SignNow user-friendly for submitting 'form 6 property tax chennai'?

Yes, airSlate SignNow is designed to be user-friendly, even for those who may not be tech-savvy. The intuitive interface simplifies the process of filling out and submitting 'form 6 property tax chennai', ensuring that anyone can navigate and complete their property tax documents confidently.

-

What security measures are in place for 'form 6 property tax chennai' on airSlate SignNow?

AirSlate SignNow prioritizes your security with industry-standard encryption and secure cloud storage for your 'form 6 property tax chennai' documents. We also ensure compliance with data protection regulations, giving you peace of mind that your sensitive information is safe.

Get more for Property Tax Form 6

- Declaration of defendant form

- I understand and acknowledge that the settlement of my workers compensation case by the compromise and form

- Hco enrollment form

- Petition for pre application discovery order wcab 30 form

- Free iampampampa guide 11 information findformscom

- Having been received and form

- Justia petition for order allowing pre application form

- Fillable online dir ca dir ca fax email print pdffiller form

Find out other Property Tax Form 6

- Sign New Hampshire Terms of Use Agreement Easy

- Sign Wisconsin Terms of Use Agreement Secure

- Sign Alabama Affidavit of Identity Myself

- Sign Colorado Trademark Assignment Agreement Online

- Can I Sign Connecticut Affidavit of Identity

- Can I Sign Delaware Trademark Assignment Agreement

- How To Sign Missouri Affidavit of Identity

- Can I Sign Nebraska Affidavit of Identity

- Sign New York Affidavit of Identity Now

- How Can I Sign North Dakota Affidavit of Identity

- Sign Oklahoma Affidavit of Identity Myself

- Sign Texas Affidavit of Identity Online

- Sign Colorado Affidavit of Service Secure

- Sign Connecticut Affidavit of Service Free

- Sign Michigan Affidavit of Service Online

- How To Sign New Hampshire Affidavit of Service

- How Can I Sign Wyoming Affidavit of Service

- Help Me With Sign Colorado Affidavit of Title

- How Do I Sign Massachusetts Affidavit of Title

- How Do I Sign Oklahoma Affidavit of Title