D 1040nr Form

What is the D 1040NR Form

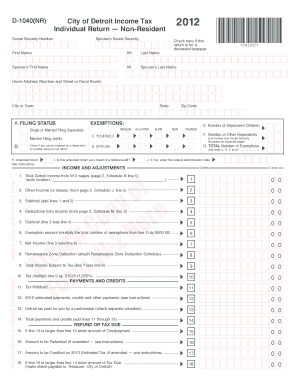

The D 1040NR Form is a tax document used by non-resident aliens in the United States to report their income and calculate their tax liability. This form is specifically designed for individuals who do not meet the criteria for resident alien status, which affects how they are taxed. Non-resident aliens typically include foreign students, scholars, and individuals who are in the U.S. on temporary visas. Understanding the D 1040NR Form is crucial for ensuring compliance with U.S. tax laws and accurately reporting income earned within the country.

How to use the D 1040NR Form

Using the D 1040NR Form involves several key steps to ensure accurate completion and submission. First, gather all necessary documentation, including income statements such as W-2s or 1099s, and any relevant deductions. Next, carefully fill out the form, reporting all income earned in the U.S. and any applicable deductions or credits. It is important to follow IRS guidelines when completing the form to avoid errors. Once completed, the form can be submitted electronically or via mail, depending on the taxpayer's preference and eligibility.

Steps to complete the D 1040NR Form

Completing the D 1040NR Form involves a systematic approach:

- Gather necessary documents, including income statements and tax identification numbers.

- Begin filling out the form by providing personal information, including your name, address, and status.

- Report all U.S. source income, including wages, interest, and dividends.

- Claim any eligible deductions and credits that apply to your situation.

- Review the completed form for accuracy and completeness.

- Submit the form electronically through approved software or mail it to the appropriate IRS address.

Legal use of the D 1040NR Form

The D 1040NR Form is legally binding when completed and submitted according to IRS regulations. To ensure its legal standing, it must be signed and dated by the taxpayer. Additionally, the form must be submitted by the appropriate deadline to avoid penalties. Compliance with U.S. tax laws is essential, as failure to file or inaccuracies can lead to legal repercussions. Utilizing digital tools for e-signatures enhances the security and integrity of the submission process.

Filing Deadlines / Important Dates

Filing deadlines for the D 1040NR Form are crucial for compliance. Typically, non-resident aliens must file their tax return by April fifteenth of the year following the tax year. However, if the taxpayer is outside the U.S. on that date, they may qualify for an automatic extension until June fifteenth. It is important to check for any specific changes or updates to deadlines each tax year, as these can vary based on individual circumstances and IRS announcements.

Required Documents

To successfully complete the D 1040NR Form, several documents are required:

- Income statements, such as W-2 forms from employers or 1099 forms for freelance work.

- Tax identification number (TIN) or Social Security number (SSN) if applicable.

- Records of any tax withheld from income, which may be reported on forms received from employers.

- Documentation for any deductions or credits claimed, including receipts and statements.

Quick guide on how to complete d 1040nr form

Effortlessly prepare D 1040nr Form on any device

Digital document management has gained popularity among companies and individuals. It serves as a perfect eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage D 1040nr Form on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign D 1040nr Form with ease

- Find D 1040nr Form and click Get Form to commence.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive details using the tools specifically offered by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Verify the information and click the Done button to save your modifications.

- Select your preferred method for submitting your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Put aside concerns about lost or misfiled documents, laborious form navigation, or mistakes that necessitate reprinting document copies. airSlate SignNow caters to your document management needs in just a few clicks from any desired device. Modify and eSign D 1040nr Form and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the d 1040nr form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the D 1040nr Form?

The D 1040nr Form is a tax form used by non-resident aliens to report their U.S. source income. This form helps the IRS identify your tax obligations and ensures compliance with U.S. tax laws. Understanding the D 1040nr Form is essential for any non-resident earning income in the United States.

-

How can airSlate SignNow assist with the D 1040nr Form?

airSlate SignNow provides an efficient platform to electronically sign and send your D 1040nr Form quickly and securely. With its user-friendly interface, you can manage your tax documents without hassle, saving you time and effort. Using airSlate SignNow allows you to focus on your tax matters rather than document logistics.

-

Is there a cost associated with using airSlate SignNow for the D 1040nr Form?

Yes, airSlate SignNow has various pricing plans to fit different budgets and needs. These plans include features specifically designed for document signing and management, making it a cost-effective solution for handling the D 1040nr Form. You can choose a plan that meets your needs while ensuring compliance with tax regulations.

-

What features does airSlate SignNow offer for managing the D 1040nr Form?

airSlate SignNow offers features such as customizable templates, automated reminders, and secure cloud storage for your D 1040nr Form. The platform's intuitive tools simplify the signing process, making it easier to gather signatures and manage documents. These features contribute to a streamlined experience for all users.

-

Can I integrate airSlate SignNow with other applications for my D 1040nr Form?

Yes, airSlate SignNow integrates seamlessly with numerous applications such as Google Drive, Salesforce, and Dropbox. This allows you to easily import, export, and manage your D 1040nr Form alongside other essential documents and tools. Integration enhances workflow efficiency and ensures your documents are readily accessible.

-

What benefits do I get by using airSlate SignNow for the D 1040nr Form?

Using airSlate SignNow for the D 1040nr Form provides numerous benefits, including saving time on document management and ensuring secure signatures. The platform’s ease of use and accessibility allows non-residents to handle their tax documentation efficiently. This convenience is crucial for meeting deadlines and maintaining compliance.

-

How secure is my information when using airSlate SignNow for the D 1040nr Form?

Security is a top priority for airSlate SignNow, which employs advanced encryption protocols to protect your information while processing the D 1040nr Form. Additionally, the platform complies with industry standards and regulations to ensure your data remains confidential. You can trust airSlate SignNow to keep your sensitive tax information safe.

Get more for D 1040nr Form

- Contract assignment agreementlegalmatch form

- Simple assignment of promissory note form

- Assignmentproperty in attached schedule form

- Notarized affidavit sample diwe mediade form

- Lease and license agreement lake view dev and form

- Customer follow up auto mechanic form

- Artist management agreement templatenet form

- Letter to tenant regarding moving out move out letter form

Find out other D 1040nr Form

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT