California Net Tangible Benefit Disclosure Form

What is the California Net Tangible Benefit Disclosure

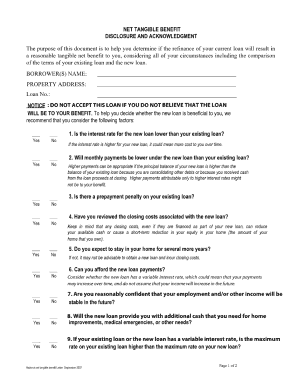

The California net tangible benefit disclosure is a legal document required in certain transactions, particularly in the context of real estate and loans. This form outlines the tangible benefits that a borrower will receive from a loan or financial agreement, ensuring transparency and protecting consumer rights. It is essential for lenders to provide this disclosure to borrowers, as it helps them understand the implications of their financial decisions.

Key elements of the California Net Tangible Benefit Disclosure

Several key elements must be included in the California net tangible benefit disclosure to ensure its effectiveness and compliance with state regulations. These elements typically include:

- A clear explanation of the financial benefits associated with the loan

- Details regarding the costs involved in obtaining the loan

- A summary of any risks associated with the financial agreement

- Information about the terms and conditions of the loan

Including these elements helps borrowers make informed decisions and understand the value they are receiving.

Steps to complete the California Net Tangible Benefit Disclosure

Completing the California net tangible benefit disclosure involves several steps to ensure accuracy and compliance. Here is a straightforward process to follow:

- Gather relevant financial information, including loan terms and costs.

- Identify the tangible benefits that the borrower will receive.

- Draft the disclosure, ensuring all required elements are included.

- Review the document for accuracy and clarity.

- Provide the completed disclosure to the borrower for their records.

Following these steps can help ensure that the disclosure is both comprehensive and compliant with legal requirements.

Legal use of the California Net Tangible Benefit Disclosure

The legal use of the California net tangible benefit disclosure is crucial for protecting both lenders and borrowers. This document must be provided in accordance with California law, which mandates that borrowers receive clear and concise information about the benefits and costs associated with their loans. Failure to provide this disclosure can lead to legal repercussions for lenders, including potential penalties and liability for damages.

How to obtain the California Net Tangible Benefit Disclosure

Obtaining the California net tangible benefit disclosure is straightforward. Lenders typically have templates available that comply with state regulations. Borrowers can request this form directly from their lender or financial institution. Additionally, many online resources provide access to standardized versions of the disclosure, ensuring that all necessary information is included.

Examples of using the California Net Tangible Benefit Disclosure

Examples of when the California net tangible benefit disclosure is used include:

- When a borrower refinances a mortgage to secure a lower interest rate.

- In transactions involving home equity lines of credit (HELOCs).

- For loans that involve significant fees or points that could impact the overall cost.

These examples illustrate how the disclosure helps borrowers understand the financial implications of their decisions.

Quick guide on how to complete california net tangible benefit disclosure

Easily Prepare California Net Tangible Benefit Disclosure on Any Device

Digital document management has become popular among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to easily locate the right form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Handle California Net Tangible Benefit Disclosure on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to Edit and eSign California Net Tangible Benefit Disclosure Effortlessly

- Locate California Net Tangible Benefit Disclosure and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information using tools provided by airSlate SignNow specifically for this purpose.

- Generate your eSignature with the Sign tool, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Choose how you'd like to share your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misfiled documents, cumbersome form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign California Net Tangible Benefit Disclosure and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the california net tangible benefit disclosure

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a net tangible benefit form?

The net tangible benefit form is a crucial document used to demonstrate financial savings and advantages during transactions. It helps businesses assess the tangible benefits of a financial decision, ensuring they make informed choices. Utilizing the net tangible benefit form streamlines processes and improves clarity for all parties involved.

-

How does airSlate SignNow simplify the net tangible benefit form process?

airSlate SignNow simplifies the net tangible benefit form process by providing an intuitive platform for creation and eSigning. Users can effortlessly fill out the form, ensuring all necessary information is captured accurately. This efficiency not only speeds up transactions but also minimizes the potential for errors.

-

Can I integrate the net tangible benefit form with other software using airSlate SignNow?

Yes, airSlate SignNow offers seamless integrations with various software solutions to enhance the functionality of the net tangible benefit form. You can connect it with CRM systems, payment processing tools, and more. These integrations help streamline workflows, making it easier to manage your documents.

-

Is there a cost associated with using the net tangible benefit form on airSlate SignNow?

airSlate SignNow offers competitive pricing plans that include the ability to utilize the net tangible benefit form. Pricing is based on the features and services you select, ensuring you only pay for what you need. You can choose from various tiers to find the best fit for your business.

-

What are the key benefits of using the net tangible benefit form?

The key benefits of using the net tangible benefit form include increased transparency and better decision-making for businesses. By providing clear insights into financial advantages, it helps in evaluating economic decisions more effectively. Additionally, electronic signatures expedite agreements, enhancing overall efficiency.

-

What features does airSlate SignNow offer for managing the net tangible benefit form?

AirSlate SignNow offers features such as customizable templates for the net tangible benefit form, automated workflows, and advanced security measures. Users can track the status of their documents in real time, and the platform is designed to be user-friendly. This ensures that your forms are handled seamlessly from start to finish.

-

How can I ensure my net tangible benefit form is legally binding?

To ensure your net tangible benefit form is legally binding, utilize airSlate SignNow's secure eSigning feature. Electronic signatures provided through the platform comply with the ESIGN Act and UETA, making them legally recognized. By using a trusted platform, you can guarantee the authenticity and integrity of your documents.

Get more for California Net Tangible Benefit Disclosure

- Selling your vehicle ctgov form

- About bills of sale new york dmv new york state form

- The condition of same or form

- Scope of work contractor shall notify builder of excessive defects in the form

- This trim construction contract contract effective as of the date of form

- Consideration every contract needs itnolo form

- This hvac contract contract effective as of the date of the last party to sign form

- Work site the project shall be constructed on the property of owner located at form

Find out other California Net Tangible Benefit Disclosure

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF