Wellsfargo401k Form

What is the Wells Fargo 401k?

The Wells Fargo 401k is a retirement savings plan offered by Wells Fargo that allows employees to save a portion of their paycheck before taxes are taken out. This type of plan is designed to help individuals accumulate savings for retirement while benefiting from tax advantages. Contributions to the Wells Fargo 401k can be made through payroll deductions, and employers may also offer matching contributions to encourage employee participation.

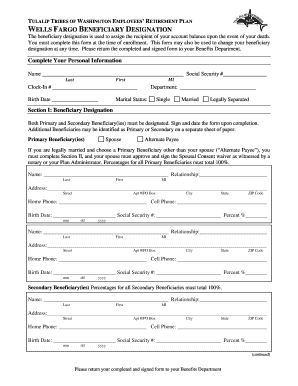

Steps to complete the Wells Fargo 401k change of beneficiary form

Completing the Wells Fargo 401k change of beneficiary form involves several important steps to ensure that your designation is accurately recorded. Follow these steps:

- Obtain the form: Access the Wells Fargo 401k change of beneficiary form from the Wells Fargo website or your account portal.

- Fill in your information: Provide your personal details, including your name, account number, and contact information.

- Designate beneficiaries: Clearly specify the individuals or entities you wish to name as beneficiaries. Include their full names, relationships to you, and percentage of benefits each should receive.

- Sign and date the form: Ensure that you sign and date the form to validate your request.

- Submit the form: Send the completed form to Wells Fargo through the specified submission method, whether online, by mail, or in person.

Legal use of the Wells Fargo 401k

The Wells Fargo 401k change of beneficiary form is a legally binding document that outlines your wishes regarding the distribution of your retirement savings upon your passing. To ensure its legal validity, it must be completed accurately and submitted according to Wells Fargo's guidelines. Additionally, the form should comply with relevant laws and regulations governing retirement plans in the United States.

Required Documents

When completing the Wells Fargo 401k change of beneficiary form, you may need to provide certain documents to verify your identity and the identities of your beneficiaries. These documents may include:

- Government-issued identification, such as a driver's license or passport.

- Proof of relationship to beneficiaries, if applicable.

- Any previous beneficiary designation forms, if changes are being made.

Form Submission Methods

The Wells Fargo 401k change of beneficiary form can be submitted through various methods, ensuring convenience for users. The available submission methods include:

- Online submission via the Wells Fargo retirement account portal.

- Mailing the completed form to the designated address provided by Wells Fargo.

- In-person submission at a local Wells Fargo branch for immediate processing.

Eligibility Criteria

To utilize the Wells Fargo 401k change of beneficiary form, you must meet certain eligibility criteria. Generally, you need to be a participant in the Wells Fargo 401k plan and have the authority to make changes to your beneficiary designations. It is also important to ensure that you are of legal age to make such designations and that you understand the implications of your choices.

Quick guide on how to complete wellsfargo401k

Complete Wellsfargo401k effortlessly on any device

Web-based document management has become widespread among organizations and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documentation, allowing you to access the right form and securely save it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents promptly without delays. Manage Wellsfargo401k on any device with airSlate SignNow Android or iOS applications and enhance your document-driven processes today.

The easiest way to modify and eSign Wellsfargo401k without difficulty

- Locate Wellsfargo401k and click Get Form to initiate.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent parts of the documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred delivery method for your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Alter and eSign Wellsfargo401k and ensure outstanding communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wellsfargo401k

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Wells Fargo 401k change of beneficiary form?

The Wells Fargo 401k change of beneficiary form is a document that allows you to update the designated beneficiaries for your retirement account. This form is essential for ensuring that your assets are distributed according to your wishes after your passing. Using airSlate SignNow makes it easy to fill out and eSign this form securely.

-

How does airSlate SignNow simplify the signing of the Wells Fargo 401k change of beneficiary form?

airSlate SignNow streamlines the process of signing the Wells Fargo 401k change of beneficiary form by providing an intuitive platform. You can easily upload, sign, and share documents online, reducing the need for physical paperwork. This digital solution ensures that your changes are processed promptly.

-

Are there any fees associated with using the Wells Fargo 401k change of beneficiary form through airSlate SignNow?

Using airSlate SignNow to manage the Wells Fargo 401k change of beneficiary form is budget-friendly. While there may be nominal fees for premium features, the basic functionality allows you to eSign documents efficiently at no extra cost. This cost-effective solution caters to individuals and businesses alike.

-

Can I store my completed Wells Fargo 401k change of beneficiary form on airSlate SignNow?

Absolutely! airSlate SignNow allows you to store your completed Wells Fargo 401k change of beneficiary form securely in the cloud. This feature ensures that you can access and retrieve your documents at any time, providing peace of mind when managing your retirement plan.

-

What are the benefits of using airSlate SignNow for my Wells Fargo 401k change of beneficiary form?

Using airSlate SignNow for your Wells Fargo 401k change of beneficiary form provides several benefits, including ease of use, security, and efficient processing. You can complete and eSign the form from anywhere, reducing delays and ensuring your beneficiary information is updated quickly. This digital approach is both sustainable and user-friendly.

-

Is it possible to integrate airSlate SignNow with other applications for the Wells Fargo 401k change of beneficiary form?

Yes, airSlate SignNow offers integration capabilities with various applications to enhance your experience with the Wells Fargo 401k change of beneficiary form. You can integrate with tools like Google Drive and Salesforce, allowing for seamless document management and collaboration. This flexibility supports a more efficient workflow.

-

How long does it take to process the Wells Fargo 401k change of beneficiary form once signed?

The processing time for the Wells Fargo 401k change of beneficiary form can vary, but using airSlate SignNow accelerates this process signNowly. Once signed, the form is submitted electronically, which typically allows for quicker confirmation and updates compared to traditional paper methods. Always check with your Wells Fargo representative for specific processing times.

Get more for Wellsfargo401k

- Comes now the plaintiff and would show as follows to wit form

- Superior court of the state of delaware leonard form

- Comes now the plaintiff by and through its attorney of record 490235213 form

- I an adult resident of county form

- I an adult resident citizen of form

- Name chief form

- Dear principal name form

- Name human resources director form

Find out other Wellsfargo401k

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online

- Sign Oklahoma Insurance Limited Power Of Attorney Now

- Sign Idaho Legal Separation Agreement Online

- Sign Illinois Legal IOU Later

- Sign Illinois Legal Cease And Desist Letter Fast

- Sign Indiana Legal Cease And Desist Letter Easy

- Can I Sign Kansas Legal LLC Operating Agreement

- Sign Kansas Legal Cease And Desist Letter Now