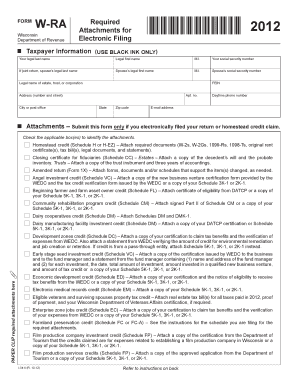

Form W Ra

What is the Form W Ra

The Form W Ra is an important document used primarily in the context of tax reporting and compliance in the United States. It serves as a request for a refund of overpaid taxes or as a means to report specific tax-related information to the Internal Revenue Service (IRS). Understanding the purpose and function of this form is crucial for individuals and businesses alike, as it helps ensure that tax obligations are met accurately and efficiently.

How to use the Form W Ra

Using the Form W Ra involves several steps to ensure that it is filled out correctly and submitted in a timely manner. First, gather all necessary information, including personal details and tax identification numbers. Next, complete the form by following the provided instructions carefully. It is essential to double-check all entries for accuracy before submission. Once completed, the form can be submitted electronically or via mail, depending on the specific requirements set forth by the IRS.

Steps to complete the Form W Ra

Completing the Form W Ra requires attention to detail. Here are the steps to follow:

- Begin by downloading the form from the IRS website or obtaining a physical copy.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Provide details regarding the tax year for which you are requesting a refund or reporting information.

- Carefully follow the instructions for each section of the form, ensuring that all required fields are completed.

- Review the form for any errors or omissions before submission.

Legal use of the Form W Ra

The legal use of the Form W Ra is governed by IRS regulations and guidelines. To be considered valid, the form must be filled out accurately and submitted within the designated time frames. Compliance with these legal requirements ensures that the information provided is recognized by the IRS, thereby protecting the taxpayer's rights and interests. Additionally, using a reliable electronic signature tool can enhance the legal standing of the submitted document.

Key elements of the Form W Ra

Several key elements are essential for the Form W Ra to be considered complete and valid:

- Taxpayer Information: Accurate personal and identification details are crucial.

- Tax Year: Clearly indicate the tax year related to the request.

- Reason for Submission: Specify whether the form is for a refund request or reporting purposes.

- Signature: A valid signature, whether electronic or handwritten, is necessary to authenticate the submission.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form W Ra. These guidelines outline the necessary documentation, deadlines, and acceptable submission methods. Familiarizing oneself with these guidelines helps ensure compliance and reduces the risk of errors that could delay processing. It is advisable to consult the IRS website or a tax professional for the most current and detailed information regarding the form.

Quick guide on how to complete form w ra

Effortlessly Prepare Form W Ra on Any Device

Managing documents online has gained signNow traction among businesses and individuals alike. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the correct format and securely save it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly and without delays. Manage Form W Ra on any gadget using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

Steps to Edit and Electronically Sign Form W Ra with Ease

- Find Form W Ra and select Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you'd like to send your form—via email, text (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and electronically sign Form W Ra to maintain excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form w ra

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Form W Ra?

A Form W Ra is a document used by the IRS to report certain types of income, and having a digital platform like airSlate SignNow simplifies the signing process. This form must be accurately completed to avoid tax issues, making the electronic signing feature essential for businesses. airSlate SignNow ensures that your Form W Ra is signed quickly and securely.

-

How does airSlate SignNow help with signing Form W Ra?

airSlate SignNow allows users to easily send and eSign Form W Ra within a secure environment. The platform provides a straightforward interface for both senders and signers, streamlining the entire process. With airSlate SignNow, you can complete your Form W Ra efficiently without the need for paper documents.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs, including a free trial for new users. The plans provide access to all features, so you can manage the signing of documents like Form W Ra without breaking the bank. Choosing the right plan will help optimize your workflow and save costs in the long run.

-

Can I integrate airSlate SignNow with other software for handling Form W Ra?

Yes, airSlate SignNow offers seamless integrations with popular software like Google Workspace, Salesforce, and more. This allows you to streamline the creation and signing process for Form W Ra along with your other business documents. Leveraging these integrations enhances productivity and ensures that all your documentation needs are met efficiently.

-

What features make airSlate SignNow the best choice for Form W Ra?

airSlate SignNow provides features such as reusable templates, customizable workflows, and a secure signing process that make it an ideal choice for managing Form W Ra. Its user-friendly interface also ensures that users can easily navigate through the signing process. Additionally, real-time tracking features help you stay updated on the status of your documents.

-

Is airSlate SignNow secure for signing Form W Ra?

Absolutely! airSlate SignNow employs top-notch security protocols, including SSL encryption, to protect your Form W Ra and other documents. The platform complies with industry standards and regulations to ensure the safety and confidentiality of your data. You can sign documents with peace of mind knowing that your information is secure.

-

What benefits does airSlate SignNow provide for small businesses dealing with Form W Ra?

For small businesses, airSlate SignNow offers an easy-to-use and cost-effective solution for managing Form W Ra and other documents. The platform reduces the time and hassle associated with traditional paper signing methods, allowing businesses to focus on growth. Furthermore, the ability to track document status enhances efficiency and accountability.

Get more for Form W Ra

- Sc contract form

- Protection trust create form

- Montana contract for sale and purchase of real estate with no broker for residential home sale agreement form

- Illinois widow form

- Supplemental needs trust form

- Or wills last form

- Kentucky mutual wills package with last wills and testaments for married couple with minor children form

- Indiana mutual wills package with last wills and testaments for married couple with adult children form

Find out other Form W Ra

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document