Penny Post Loans Form

What is the Penny Post Loans

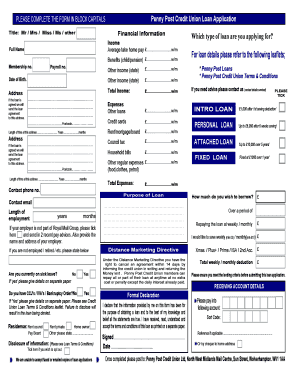

Penny post loans are a type of financial product offered by credit unions, designed to provide individuals with quick access to funds. These loans typically feature lower interest rates compared to traditional bank loans, making them an attractive option for borrowers. The penny post credit union loan application form is the official document required to initiate the borrowing process. This form collects essential information about the applicant, including personal details, financial status, and the amount requested. Understanding the specifics of penny post loans can help potential borrowers make informed decisions about their financing needs.

How to obtain the Penny Post Loans

To obtain a penny post loan, individuals must first complete the penny post online loan application. This process generally involves the following steps:

- Gather necessary documentation, including proof of income and identification.

- Access the penny post credit union loan application form online.

- Fill out the form accurately, ensuring all required fields are completed.

- Submit the application electronically through a secure platform.

Once submitted, the credit union will review the application and assess the borrower's eligibility based on their financial profile.

Steps to complete the Penny Post Loans

Completing the penny post loan application form involves several important steps to ensure accuracy and compliance:

- Read the instructions carefully to understand the information required.

- Provide accurate personal details, including your name, address, and Social Security number.

- Detail your financial situation, including income, expenses, and any existing debts.

- Specify the loan amount you wish to request and the purpose of the loan.

- Review the completed form for any errors before submission.

Following these steps can help streamline the application process and improve the chances of approval.

Legal use of the Penny Post Loans

The legal use of penny post loans is governed by various regulations that ensure borrower protection and compliance. To be considered legally binding, the penny post credit union loan form must meet specific criteria:

- Both parties must agree to the terms outlined in the loan agreement.

- The borrower must provide a valid signature, which can be done electronically.

- The loan must comply with federal and state lending laws.

Understanding these legal aspects can help borrowers navigate their responsibilities and rights when taking out a loan.

Eligibility Criteria

To qualify for a penny post loan, applicants must meet certain eligibility criteria set by the credit union. Common requirements include:

- Being a member of the credit union offering the loan.

- Demonstrating a stable source of income.

- Having a satisfactory credit history, although some credit unions may offer loans to those with less-than-perfect credit.

Meeting these criteria is essential for a successful application and can influence the terms of the loan offered.

Application Process & Approval Time

The application process for penny post loans is designed to be efficient and user-friendly. After submitting the penny post loan application form, borrowers can typically expect the following timeline:

- Initial review of the application, which may take one to three business days.

- Approval notification, which can be communicated via email or phone.

- Disbursement of funds, usually occurring within a few days after approval.

Being aware of this timeline can help borrowers plan accordingly for their financial needs.

Quick guide on how to complete penny post loan form

Complete penny post loan form seamlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, as you can easily find the necessary form and securely save it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents quickly without interruptions. Manage penny post loans on any device with airSlate SignNow Android or iOS applications and ease any document-related task today.

How to alter and eSign penny post credit union loan application form effortlessly

- Find penny post credit union loan form and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method of sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious searches for forms, or mistakes that necessitate printing new copies of documents. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign penny post loan application form while ensuring clear communication at every step of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to penny post credit union loan application form

Create this form in 5 minutes!

How to create an eSignature for the penny post credit union loan form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask penny post loan form

-

What are penny post loans?

Penny post loans refer to a type of financial product designed to provide microloans at low-interest rates. They are ideal for individuals or businesses needing quick cash for small expenses without high fees. Understanding penny post loans can help you make informed financial decisions.

-

How do penny post loans work?

Penny post loans typically involve applying through a lender, who evaluates your financial situation. Once approved, funds are deposited directly into your account, allowing you to cover unexpected costs. This streamlined process makes penny post loans a convenient option for urgent financial needs.

-

What are the benefits of using penny post loans?

Using penny post loans can provide quick access to funds without the traditional barriers of larger loans. They often have minimal paperwork and fast approval times, offering a lifeline for those in urgent situations. Additionally, the low-interest rates can help borrowers save on costs compared to other financing options.

-

Are there any fees associated with penny post loans?

While penny post loans typically feature lower interest rates, there can still be fees depending on the lender. It is essential to read the terms and conditions carefully to fully understand any associated costs. This due diligence ensures you are aware of the total expense when using penny post loans.

-

Can I apply for penny post loans online?

Yes, many lenders offer the convenience of applying for penny post loans online. This digital approach allows you to complete the application process from your home without unnecessary hassles. Make sure to choose a reputable lender with a secure and easy-to-navigate online application system.

-

How quickly can I receive funds from penny post loans?

The speed of fund disbursement for penny post loans can vary by lender, but many offer same-day or next-day access to funds. After approval, money is typically transferred electronically to your account swiftly. This quick access can help alleviate urgent financial situations effectively.

-

What integration options are available for managing penny post loans?

Several financial management platforms can integrate with penny post loans, allowing you to track your expenses easily. These integrations may include budgeting apps or accounting software that sync with your loan details. Utilizing these tools enhances your financial oversight and planning.

Get more for penny post online loan application

- Washington application form

- Quitclaim deed limited liability company to individual washington form

- Wa bargain form

- Discovery interrogatories from plaintiff to defendant with production requests washington form

- Certification of mailing washington form

- Discovery interrogatories from defendant to plaintiff with production requests washington form

- Discovery interrogatories for divorce proceeding for either plaintiff or defendant washington form

- Washington warranty deed form

Find out other asa lending application form

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship