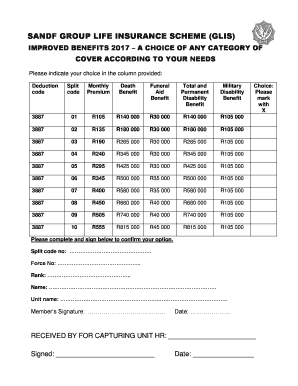

Sandf Group Life Insurance Scheme Form

What is the Sandf Group Life Insurance Scheme

The Sandf Group Life Insurance Scheme is a program designed to provide financial protection to the families of members of the South African National Defence Force (SANDF) in the event of the member's death. This scheme offers a range of benefits, including death benefits that help ease the financial burden on beneficiaries during difficult times. The coverage typically includes a lump sum payout to the designated beneficiaries, ensuring that they receive necessary financial support. Understanding the specifics of this scheme is crucial for members and their families to ensure they are adequately protected.

How to use the Sandf Group Life Insurance Scheme

Utilizing the Sandf Group Life Insurance Scheme involves a few straightforward steps. First, members must ensure they are enrolled in the scheme, which usually occurs automatically upon joining the SANDF. Once enrolled, members should regularly review their policy details, including beneficiary designations, to ensure that their loved ones are correctly listed. In the event of a claim, beneficiaries need to contact the relevant administrative office to initiate the claims process, providing necessary documentation such as the death certificate and proof of relationship.

Steps to complete the Sandf Group Life Insurance Scheme

Completing the necessary paperwork for the Sandf Group Life Insurance Scheme involves several key steps:

- Confirm your eligibility by reviewing your enrollment status in the scheme.

- Gather required documents, including personal identification and beneficiary information.

- Fill out the necessary forms accurately, ensuring all information is current and correct.

- Submit the completed forms to the designated administrative office, either online or via mail.

- Keep a copy of all submitted documents for your records.

Legal use of the Sandf Group Life Insurance Scheme

The legal validity of the Sandf Group Life Insurance Scheme is governed by various regulations that ensure the scheme operates within the framework of the law. For an eDocument related to the scheme to be considered legally binding, it must comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). This compliance guarantees that electronic signatures and documents are recognized as valid, provided that certain conditions are met, such as proper authentication and consent from all parties involved.

Eligibility Criteria

Eligibility for the Sandf Group Life Insurance Scheme generally includes active members of the SANDF. Specific criteria may vary based on the member's rank, length of service, and adherence to the regulations set forth by the scheme. It is important for members to verify their eligibility status and understand any requirements that may affect their coverage. This ensures that they and their beneficiaries can fully benefit from the protections offered by the scheme.

Required Documents

When engaging with the Sandf Group Life Insurance Scheme, certain documents are essential for both enrollment and claims processing. Members typically need to provide:

- A valid identification document, such as a national ID or passport.

- Proof of relationship for beneficiaries, which may include marriage certificates or birth certificates.

- Completed application or claims forms, as required by the scheme.

- Any additional documentation specified by the administrative office.

Who Issues the Form

The forms related to the Sandf Group Life Insurance Scheme are typically issued by the administrative body responsible for managing the scheme within the SANDF. This body ensures that all necessary documentation is available to members and their beneficiaries. Members can contact the designated office for assistance in obtaining the correct forms and guidance on how to complete them accurately.

Quick guide on how to complete sandf group life insurance scheme

Effortlessly prepare Sandf Group Life Insurance Scheme on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and electronically sign your documents promptly without interruptions. Manage Sandf Group Life Insurance Scheme on any device using airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to edit and eSign Sandf Group Life Insurance Scheme with ease

- Find Sandf Group Life Insurance Scheme and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information carefully and then click the Done button to save your adjustments.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Sandf Group Life Insurance Scheme while ensuring excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sandf group life insurance scheme

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the sandf group life insurance scheme?

The sandf group life insurance scheme is a comprehensive insurance product designed to provide financial protection to members' beneficiaries in the event of untimely death. It ensures that families of employees can receive monetary support during difficult times, making it an essential consideration for employers looking to enhance employee welfare.

-

What are the key benefits of the sandf group life insurance scheme?

The sandf group life insurance scheme offers several key benefits, including financial security for beneficiaries, peace of mind for employees, and a low-cost way to provide life insurance coverage. Additionally, it can help attract and retain talent by demonstrating that a company values the well-being of its employees.

-

How is the pricing structured for the sandf group life insurance scheme?

Pricing for the sandf group life insurance scheme typically depends on factors such as the number of insured members, their average age, and the total insurance coverage amount desired. Generally, group policies offer lower rates compared to individual plans due to the shared risk among a larger population.

-

Can the sandf group life insurance scheme be customized?

Yes, the sandf group life insurance scheme can often be customized to fit the specific needs of an organization. Employers can choose different coverage levels, add optional riders, and determine the benefit amounts to better align with their employees' requirements and preferences.

-

How does the sandf group life insurance scheme benefit employers?

Employers benefit from the sandf group life insurance scheme by enhancing their employee benefits package, leading to improved employee satisfaction and loyalty. Additionally, providing life insurance can reduce turnover rates and foster a positive organizational culture, making it an attractive aspect of recruitment.

-

What integrations are available with the sandf group life insurance scheme?

The sandf group life insurance scheme can integrate with various HR and payroll systems, making it easy to manage employee enrollments and make premium payments. These integrations streamline administrative tasks and ensure that the insurance coverage is always up to date and accurately recorded.

-

How do employees enroll in the sandf group life insurance scheme?

Employees can typically enroll in the sandf group life insurance scheme during open enrollment periods or when they first join the company. The enrollment process often involves completing simple forms and providing necessary documentation, allowing for a straightforward and quick setup.

Get more for Sandf Group Life Insurance Scheme

- Outstanding in accordance to the appropriate laws of the state of south carolina form

- Compensation paid form

- Report of earnings of injured employee based on four completed quarters form

- Your workers compensation policy guide south carolina form

- Individuals amp partnerships sign here form

- This lease agreement may be renewed or extended only upon form

- Cobb county state court george louis bailey marvin form

- Liability insurance effective on the date of the occurrence and if so state the name of each such form

Find out other Sandf Group Life Insurance Scheme

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF