Form 857

What is the Form 857

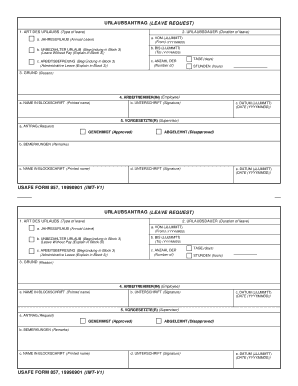

The Form 857, also known as the USAFE Form 857, is a document used primarily within the United States Air Forces in Europe (USAFE) for various administrative purposes. It is essential for ensuring compliance with specific military regulations and procedures. This form is often utilized in contexts such as personnel management, resource allocation, and operational planning.

How to use the Form 857

Using the Form 857 involves several key steps to ensure proper completion and submission. First, identify the specific purpose for which the form is required. Next, gather all necessary information and documentation that will support your application or request. After filling out the form accurately, review it for any errors or omissions before submitting it to the appropriate authority. This process helps maintain organizational efficiency and compliance with military standards.

Steps to complete the Form 857

Completing the Form 857 requires careful attention to detail. Follow these steps:

- Obtain the latest version of the form from an authorized source.

- Fill in your personal information, ensuring accuracy in all entries.

- Provide any required supporting documentation as specified on the form.

- Review the completed form for completeness and correctness.

- Submit the form as directed, either electronically or in hard copy.

Legal use of the Form 857

The legal use of the Form 857 is governed by military regulations and guidelines. It is crucial to ensure that all information provided is truthful and accurate, as any discrepancies could lead to disciplinary actions. The form serves as an official record and must be treated with the same level of scrutiny as other legal documents within the military framework.

Key elements of the Form 857

Key elements of the Form 857 include:

- Personal identification details of the individual completing the form.

- Specific purpose or request associated with the form.

- Supporting documentation requirements.

- Signature and date fields to validate the submission.

Form Submission Methods

The Form 857 can be submitted through various methods, depending on the specific requirements of the unit or organization. Common submission methods include:

- Online submission through designated military portals.

- Mailing the completed form to the appropriate office.

- In-person delivery to the relevant administrative office.

Quick guide on how to complete form 857

Prepare Form 857 effortlessly on any device

Virtual document management has become widespread among companies and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers, as you can acquire the needed form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage Form 857 on any device using airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign Form 857 with ease

- Locate Form 857 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign tool, which takes moments and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred method to deliver your form—via email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Modify and eSign Form 857 and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 857

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 857 and why is it important?

Form 857 is a critical document used in various business processes, ensuring that the information is collected and submitted accurately. Its importance lies in its role in compliance and record-keeping. By using airSlate SignNow, you can create and manage Form 857 seamlessly, enhancing your document workflow.

-

How can airSlate SignNow help with completing Form 857?

AirSlate SignNow provides intuitive tools for filling out Form 857, allowing you to complete it electronically and efficiently. The platform supports eSigning, ensuring that your completed Form 857 is both legally binding and secure. This simplifies and accelerates the process, making document management easier for your business.

-

Is there a cost associated with using airSlate SignNow for Form 857?

Yes, airSlate SignNow has various pricing plans tailored to different business needs. These plans are cost-effective and offer features that enhance the efficiency of handling documents like Form 857. You can choose a plan based on your usage and requirements, ensuring you have the right tools at your disposal.

-

What features does airSlate SignNow offer for managing Form 857?

AirSlate SignNow offers a suite of features that simplify the handling of Form 857, including customizable templates, real-time collaboration, and secure cloud storage. Additionally, the platform allows for automated workflows, minimizing human error and ensuring that your Form 857 is processed smoothly. These features enhance overall productivity and document accuracy.

-

Can I integrate airSlate SignNow with other applications for Form 857?

Absolutely! AirSlate SignNow seamlessly integrates with various third-party applications, enhancing your workflow when handling Form 857. Whether you use CRM systems, cloud storage, or other productivity tools, these integrations facilitate a smooth process, allowing you to access and manage Form 857 alongside your existing applications.

-

What are the benefits of using airSlate SignNow for eSigning Form 857?

Using airSlate SignNow for eSigning Form 857 offers numerous benefits, including enhanced security and compliance with legal standards. The platform ensures that your signatures are legally binding and stored securely. Additionally, eSigning accelerates the turnaround time for your documents, allowing for quicker approvals and processing.

-

How secure is airSlate SignNow when handling Form 857?

AirSlate SignNow prioritizes security, utilizing advanced encryption and secure cloud storage to protect your Form 857 and other documents. With features like user authentication and audit trails, you can ensure that your data remains confidential and secure throughout its lifecycle. Trust is fundamental, and airSlate SignNow is committed to safeguarding your information.

Get more for Form 857

- Bargain sale deed form 497296998

- Quitclaim deed trust to limited liability company arizona form

- Warranty deed from a trust to a trust arizona form

- Az trust form

- Grant bargain sale form

- Quitclaim deed grantee form

- Grant deed trust to an individual arizona form

- Quitclaim deed trust to two individuals arizona form

Find out other Form 857

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure