Calbpsfile Form

What is the Calbpsfile

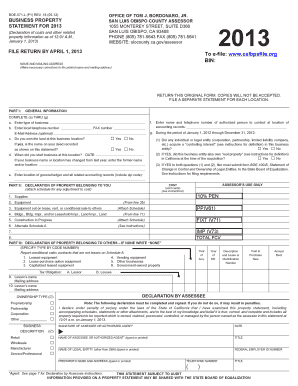

The Calbpsfile is a specific form used for various administrative and legal purposes within the United States. It serves as a crucial document for individuals and organizations needing to comply with certain regulations or requirements. The form is designed to streamline the process of submitting necessary information to relevant authorities, ensuring that all parties involved can easily access and review the details provided.

How to use the Calbpsfile

Using the Calbpsfile involves several straightforward steps. First, ensure you have the correct version of the form, which can typically be found on official government websites or through authorized providers. Next, gather all required information and documentation needed to complete the form accurately. Once you have everything prepared, fill out the form carefully, ensuring that all fields are completed as instructed. After completing the form, review it for accuracy before submission.

Steps to complete the Calbpsfile

Completing the Calbpsfile requires attention to detail. Follow these steps for a successful submission:

- Obtain the latest version of the Calbpsfile from a reliable source.

- Read the instructions carefully to understand the requirements.

- Gather all necessary information and supporting documents.

- Fill out the form, ensuring all sections are completed accurately.

- Review the form for any errors or missing information.

- Submit the form as per the guidelines, either online or through traditional mail.

Legal use of the Calbpsfile

The legal use of the Calbpsfile is governed by specific regulations that ensure its validity. To be considered legally binding, the form must be filled out correctly and submitted according to the applicable laws. Compliance with eSignature regulations, such as ESIGN and UETA, is essential when submitting the form electronically. Additionally, retaining a copy of the completed form is advisable for record-keeping and verification purposes.

Required Documents

To successfully complete the Calbpsfile, certain documents may be required. These could include identification documents, proof of residency, and any other relevant paperwork that supports the information provided on the form. It is essential to check the specific requirements associated with the Calbpsfile to ensure all necessary documents are included with your submission.

Form Submission Methods

The Calbpsfile can typically be submitted through various methods, depending on the requirements set forth by the issuing authority. Common submission methods include:

- Online submission via designated government portals.

- Mailing the completed form to the appropriate office.

- In-person submission at designated locations.

Choosing the right submission method can help ensure timely processing and compliance with all necessary regulations.

Quick guide on how to complete calbpsfile

Complete Calbpsfile seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents quickly and without delays. Manage Calbpsfile on any device using airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign Calbpsfile with ease

- Obtain Calbpsfile and click Get Form to commence.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign tool, which takes moments and carries the same legal significance as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method of sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Calbpsfile and ensure effective communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the calbpsfile

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is calbpsfile and how does it work with airSlate SignNow?

calbpsfile is a unique file format used within the airSlate SignNow platform to enhance document management capabilities. It allows users to easily send, receive, and sign documents electronically. By utilizing calbpsfile, businesses can streamline their signing processes and improve efficiency.

-

How much does using calbpsfile within airSlate SignNow cost?

The use of calbpsfile in airSlate SignNow is included in the competitive pricing plans offered. Depending on your business needs, you'll find various subscription options that provide full access to the calbpsfile feature along with other document management tools, ensuring a cost-effective solution.

-

What features does calbpsfile offer users?

calbpsfile enhances your usability with features such as customizable templates, bulk sending, and secure storage. These features allow for a more efficient workflow by enabling quick access to file management and electronic signatures, making document handling easier than ever.

-

How can calbpsfile benefit my business?

By implementing calbpsfile, your business can signNowly reduce the time and resources spent on document signing processes. The efficiency gained from using calbpsfile translates into faster deal closures and improved customer satisfaction, helping your business thrive.

-

Can I integrate calbpsfile with other applications?

Yes, calbpsfile can be seamlessly integrated with various third-party applications to enhance your document management workflow. airSlate SignNow supports integrations with popular tools, allowing users to sync their documents effortlessly and utilize the full potential of calbpsfile alongside other software.

-

Is it easy to learn how to use calbpsfile in airSlate SignNow?

Absolutely! The airSlate SignNow platform is designed for ease of use, so learning how to utilize calbpsfile requires minimal effort. With a user-friendly interface and helpful guides, you’ll be up and running with calbpsfile in no time, enabling you to manage documents effectively.

-

What security measures are in place for calbpsfile documents?

airSlate SignNow ensures that all calbpsfile documents are protected with advanced security protocols. These measures include encryption, secure access controls, and compliance with global regulations, keeping your sensitive information safe while using calbpsfile for your business transactions.

Get more for Calbpsfile

- Billboard attachment sublease agreement form

- Sample lease unsworth properties form

- Confidential letter agreement form

- Form of mortgage security agreement alabama

- 9 landlord and tenant california bureau of real estate form

- What is a consulting services agreement form

- Easement right of way use agreement burleson form

- Denver county correction deed formcoloradodeedscom

Find out other Calbpsfile

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document