Donation Receipt Template Canada Form

Key elements of the charitable donation receipts template

A charitable donation receipt serves as an official acknowledgment of a contribution made to a qualified organization. It is essential for both the donor and the organization for tax purposes. The key elements that should be included in a charitable donation receipt template are:

- Organization Name: The full legal name of the charitable organization.

- Organization Address: The complete mailing address of the organization.

- Tax Identification Number (TIN): The organization’s TIN or Employer Identification Number (EIN) for verification.

- Donor Information: The name and address of the donor making the contribution.

- Date of Donation: The specific date when the donation was made.

- Description of Donation: A detailed description of the items or cash donated, including their fair market value if applicable.

- Statement of No Goods or Services Provided: A statement confirming whether the donor received any goods or services in exchange for the donation.

- Signature: An authorized signature from the organization’s representative, which adds legitimacy to the receipt.

How to use the charitable donation receipts template

Utilizing a charitable donation receipts template is a straightforward process that can simplify the documentation of donations. Here’s how to effectively use the template:

- Download the Template: Obtain a reliable charitable donation receipts template from a trusted source.

- Fill in the Details: Enter all required information, including the organization’s details, donor information, and specifics about the donation.

- Review for Accuracy: Ensure that all information is accurate and complete to avoid issues during tax filing.

- Provide a Copy to the Donor: Once completed, provide a signed copy of the receipt to the donor for their records.

- Keep a Record: Maintain a copy of the receipt for the organization’s records, as it may be needed for future reference or audits.

Steps to complete the charitable donation receipts template

Completing a charitable donation receipts template requires careful attention to detail. Follow these steps to ensure accuracy:

- Gather Required Information: Collect all necessary information about the donor and the donation.

- Open the Template: Access the downloaded template using a compatible software program.

- Input Donor Information: Fill in the donor's name and address accurately.

- Enter Donation Details: Specify the date, amount, and description of the donation.

- Include TIN and Organization Details: Ensure the organization’s name, address, and TIN are correctly entered.

- Add Signature: Have an authorized representative sign the receipt to validate it.

- Save and Distribute: Save the completed receipt and distribute copies to the donor and the organization’s records.

IRS Guidelines

The Internal Revenue Service (IRS) has specific guidelines regarding charitable donations and the receipts required for tax deductions. Understanding these guidelines is essential for both donors and organizations:

- Qualified Organizations: Donations must be made to qualified charitable organizations to be tax-deductible.

- Receipt Requirements: Donors must obtain a receipt for any donation of $250 or more to claim a deduction.

- Non-Cash Donations: For non-cash contributions valued at over $500, additional documentation may be required.

- Record Keeping: Both donors and organizations should keep records of donations and receipts for at least three years after filing taxes.

Legal use of the charitable donation receipts template

Using a charitable donation receipts template legally requires adherence to specific regulations. Here are important legal considerations:

- Compliance with IRS Rules: Ensure the receipt meets IRS requirements for tax-deductible donations.

- Accurate Representation: The receipt must accurately reflect the donation details to avoid legal issues.

- Authorized Signatures: Only authorized individuals should sign the receipt to maintain its validity.

- Retention of Records: Organizations should retain copies of all receipts issued for compliance and audit purposes.

Examples of using the charitable donation receipts template

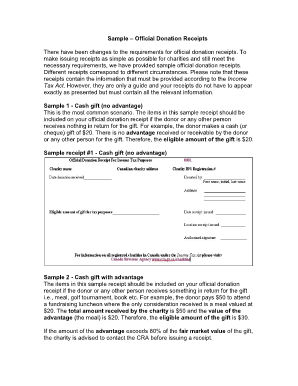

Examples can help clarify how to effectively use a charitable donation receipts template. Here are a few scenarios:

- Cash Donations: A donor gives $500 to a local food bank. The food bank issues a receipt detailing the donation amount and confirming no goods or services were provided.

- Non-Cash Donations: An individual donates furniture valued at $1,000 to a charity. The organization provides a receipt listing the items donated and their estimated value.

- Recurring Donations: For monthly donations, a charity can issue a cumulative receipt at the end of the year summarizing all contributions made.

Quick guide on how to complete donation receipt template canada

Finalize Donation Receipt Template Canada smoothly on any gadget

Managing documents online has gained immense popularity among businesses and individuals alike. It presents an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the right format and securely store it online. airSlate SignNow equips you with all the necessary tools to develop, modify, and electronically sign your documents promptly without any hold-ups. Handle Donation Receipt Template Canada on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Donation Receipt Template Canada with ease

- Obtain Donation Receipt Template Canada and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to preserve your modifications.

- Select your preferred method to send your document, via email, SMS, or invitation link, or download it to your computer.

Wave goodbye to lost or mislaid files, the hassle of searching through forms, or mistakes that require new document copies to be printed. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Modify and electronically sign Donation Receipt Template Canada and ensure exceptional communication at every stage of your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the donation receipt template canada

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a charitable donation receipts template and why do I need one?

A charitable donation receipts template is a pre-designed document that organizations use to acknowledge donations from individuals or businesses. It's essential for nonprofits to provide these receipts for tax deduction purposes, ensuring donors have the necessary documentation for their contributions.

-

How can airSlate SignNow help me create a charitable donation receipts template?

airSlate SignNow offers user-friendly tools to customize your charitable donation receipts template. With its drag-and-drop features, you can easily add your organization's branding, incorporate donor information, and ensure compliance with IRS standards for donation receipts.

-

Is there a cost associated with using the charitable donation receipts template on airSlate SignNow?

airSlate SignNow provides various pricing plans, including a free trial that allows you to explore the functionalities related to creating a charitable donation receipts template. Depending on your needs, there are affordable plans available, ensuring cost-effective solutions for all organizations.

-

What are the key features of the charitable donation receipts template offered by airSlate SignNow?

The charitable donation receipts template from airSlate SignNow includes features such as eSign capabilities, customizable branding options, automated sending, and secure storage. These features streamline the donation management process and enhance the donor experience.

-

Can I integrate the charitable donation receipts template with other tools?

Yes, airSlate SignNow allows integration with various third-party applications, enabling seamless workflow management. You can connect your charitable donation receipts template with platforms like CRM systems, payment processors, and accounting software to enhance efficiency.

-

How does a charitable donation receipts template benefit my organization?

A charitable donation receipts template simplifies the acknowledgment process and helps maintain accurate records of donations. By using this template, your organization can enhance donor relationships and ensure compliance with tax regulations, contributing to greater transparency.

-

Are there any customization options available for the charitable donation receipts template?

Absolutely! The charitable donation receipts template on airSlate SignNow can be fully customized. You can adjust the layout, add logos, and modify content to suit your organization's voice, making your receipts more personalized and professional.

Get more for Donation Receipt Template Canada

- Legal last will and testament form for widow or widower with minor children hawaii

- Legal last will form for a widow or widower with no children hawaii

- Legal last will and testament form for a widow or widower with adult and minor children hawaii

- Legal last will and testament form for divorced and remarried person with mine yours and ours children hawaii

- Legal last will and testament form with all property to trust called a pour over will hawaii

- Written revocation of will hawaii form

- Hawaii persons 497304771 form

- Notice to beneficiaries of being named in will hawaii form

Find out other Donation Receipt Template Canada

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple