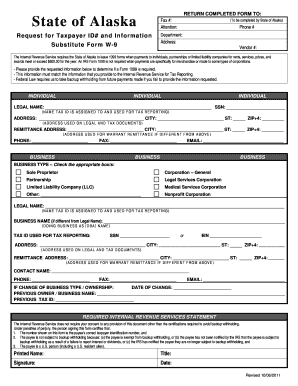

W9 Form Alaska

What is the W-9 Form for Business?

The W-9 form is a tax document used in the United States by businesses to request the taxpayer identification number (TIN) of a contractor or vendor. It is primarily used for reporting income paid to non-employees, such as freelancers or independent contractors, to the Internal Revenue Service (IRS). The form helps businesses ensure they have the correct information for tax reporting purposes, as it collects essential details including the name, business name (if applicable), address, and TIN of the payee.

How to Use the W-9 Form for Business

To utilize the W-9 form, a business should provide it to any contractor or vendor before making payments. Upon receiving the form, the contractor fills it out with their personal or business information and returns it to the requesting business. This process ensures that the business has the necessary information to accurately report payments made to the contractor on their tax returns. It is important to keep these forms on file for record-keeping and compliance with IRS regulations.

Steps to Complete the W-9 Form for Business

Completing the W-9 form involves several straightforward steps:

- Download the W-9 form from the IRS website or request it from the business.

- Fill in your name and business name, if applicable.

- Provide your address and the type of entity you are (individual, corporation, partnership, etc.).

- Enter your taxpayer identification number (TIN), which can be your Social Security number (SSN) or Employer Identification Number (EIN).

- Sign and date the form to certify that the information provided is accurate.

Legal Use of the W-9 Form for Business

The W-9 form is legally binding, meaning that the information provided must be accurate and truthful. Misrepresentation or failure to provide the correct TIN can result in penalties from the IRS. Businesses should ensure that they only request W-9 forms from legitimate contractors and maintain these records to support their tax filings. Compliance with IRS guidelines regarding the use of the W-9 form is crucial to avoid potential legal issues.

Key Elements of the W-9 Form for Business

The W-9 form contains several key elements that are essential for both the business and the contractor:

- Name: The legal name of the individual or business entity.

- Business Name: The name under which the business operates, if different from the legal name.

- Address: The complete mailing address of the contractor.

- Taxpayer Identification Number: The SSN or EIN used for tax reporting.

- Certification: The signature of the contractor certifying the accuracy of the information.

IRS Guidelines for the W-9 Form

The IRS provides specific guidelines for the use and submission of the W-9 form. It is important for businesses to understand these guidelines to ensure compliance. The form should be requested prior to making any payments to contractors, and it should be kept on file for at least four years. Additionally, businesses must use the information from the W-9 to accurately report payments on Form 1099-MISC or 1099-NEC, depending on the type of payment made.

Quick guide on how to complete w9 form alaska

Complete W9 Form Alaska effortlessly on any device

Online document management has become increasingly favored by businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow equips you with all the tools you need to create, alter, and electronically sign your documents swiftly without delays. Manage W9 Form Alaska across any platform using airSlate SignNow’s Android or iOS applications and streamline any document-related tasks today.

The easiest way to modify and electronically sign W9 Form Alaska smoothly

- Find W9 Form Alaska and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or conceal sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Verify all the details and then click on the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and electronically sign W9 Form Alaska and ensure excellent communication at every phase of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the w9 form alaska

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a W9 for business and why do I need it?

A W9 for business is a form used by businesses to request the taxpayer identification number of a vendor, contractor, or freelancer. This form is essential for reporting taxable income to the IRS. Understanding what a W9 for business is will help ensure compliance with tax regulations and avoid potential penalties.

-

How can airSlate SignNow help with W9 forms?

airSlate SignNow provides an easy and efficient solution to send, receive, and eSign W9 forms. With our platform, you can streamline the process of collecting W9s from vendors, making compliance smoother. Using airSlate SignNow ensures that your W9 for business is securely gathered and stored.

-

Is there a cost associated with using airSlate SignNow for W9 forms?

AirSlate SignNow offers a cost-effective solution for handling W9 forms for business transactions. Our pricing is designed to scale with your business needs, making it accessible for companies of all sizes. You can explore flexible pricing plans that cater specifically to managing your document needs effectively.

-

Can I integrate airSlate SignNow with my existing accounting software?

Yes, airSlate SignNow can seamlessly integrate with various accounting software systems, which helps simplify the management of W9 forms. This integration allows for automatic data syncing and enhances workflow efficiency. Understanding what a W9 for business is becomes easier when you can manage everything in one platform.

-

What are the benefits of using airSlate SignNow for W9 forms?

Using airSlate SignNow for W9 forms automates the document signing process, saving time and reducing errors. It enhances the security of your business information while keeping your workflows compliant with tax regulations. This digital transformation makes understanding what a W9 for business entails simple and efficient.

-

How secure is airSlate SignNow when handling W9 forms?

AirSlate SignNow takes security seriously, employing encryption and authentication measures to protect your W9 forms for business. Your data is stored securely, ensuring compliance with industry standards. This peace of mind allows you to confidently manage sensitive tax information with our platform.

-

Can I track the status of my W9 forms sent through airSlate SignNow?

Absolutely! AirSlate SignNow provides tracking features that allow you to monitor the status of your sent W9 forms for business. You can see when your documents have been viewed, signed, and completed, helping you manage your workflows more effectively.

Get more for W9 Form Alaska

- Assignment of mortgage package idaho form

- Assignment of lease package idaho form

- Lease purchase agreements package idaho form

- Satisfaction cancellation or release of mortgage package idaho form

- Premarital agreements package idaho form

- Painting contractor package idaho form

- Framing contractor package idaho form

- Foundation contractor package idaho form

Find out other W9 Form Alaska

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free