Mra Tenth Schedule Regulation 22b Form

What is the Mra Tenth Schedule Regulation 22b

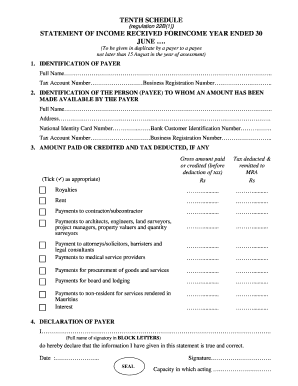

The Mra Tenth Schedule Regulation 22b is a regulatory framework that outlines specific guidelines for reporting income and financial activities. This regulation is particularly significant for individuals and businesses that need to provide detailed statements of income received during a given period. Understanding the nuances of this regulation is essential for compliance with tax laws and ensuring accurate reporting.

Steps to complete the Mra Tenth Schedule Regulation 22b

Completing the Mra Tenth Schedule Regulation 22b involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, receipts, and any relevant tax documents. Next, carefully fill out the form, ensuring that all income sources are accurately reported. It is crucial to double-check all entries for accuracy before submission. Finally, submit the completed form through the appropriate channels, whether online or via mail, to ensure it is received by the governing body.

Legal use of the Mra Tenth Schedule Regulation 22b

The legal use of the Mra Tenth Schedule Regulation 22b hinges on its adherence to established guidelines and regulations. This form must be completed accurately to ensure that the reported information is valid and can be used for legal and tax purposes. Compliance with this regulation not only protects individuals and businesses from potential penalties but also upholds the integrity of financial reporting.

Key elements of the Mra Tenth Schedule Regulation 22b

Several key elements define the Mra Tenth Schedule Regulation 22b. These include the requirement for detailed income reporting, specific deadlines for submission, and the necessity of supporting documentation. Additionally, the regulation may outline various exemptions or special considerations based on individual circumstances, making it vital for users to understand all components thoroughly.

How to obtain the Mra Tenth Schedule Regulation 22b

Obtaining the Mra Tenth Schedule Regulation 22b can be accomplished through various channels. Typically, the form is available on official government websites or through financial institutions that provide tax-related services. Users may also request the form directly from relevant regulatory bodies if it is not readily available online. Ensuring that you have the most current version of the form is essential for compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Mra Tenth Schedule Regulation 22b are critical for compliance. These deadlines can vary based on individual circumstances, such as the type of income reported or the specific regulations in place for the reporting year. It is important to stay informed about these dates to avoid penalties and ensure timely submission of the required documentation.

Quick guide on how to complete mra tenth schedule regulation 22b

Complete Mra Tenth Schedule Regulation 22b effortlessly on any device

Online document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily locate the necessary form and securely preserve it online. airSlate SignNow equips you with all the resources you need to create, edit, and electronically sign your documents quickly without delays. Handle Mra Tenth Schedule Regulation 22b on any device using airSlate SignNow apps for Android or iOS and simplify any document-related process today.

How to modify and electronically sign Mra Tenth Schedule Regulation 22b without hassle

- Find Mra Tenth Schedule Regulation 22b and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature with the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Mra Tenth Schedule Regulation 22b and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mra tenth schedule regulation 22b

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of the tenth schedule regulation 22b 1 in document signing?

The tenth schedule regulation 22b 1 is essential as it outlines specific requirements for electronic signatures within legal documents. By following these regulations, airSlate SignNow ensures that your eSignatures are compliant and enforceable, making it a reliable solution for businesses.

-

How does airSlate SignNow ensure compliance with the tenth schedule regulation 22b 1?

airSlate SignNow adheres to the tenth schedule regulation 22b 1 by implementing industry-standard encryption and authentication processes. This not only secures your documents but also confirms that your electronic signatures meet legal standards.

-

What features does airSlate SignNow offer that relate to the tenth schedule regulation 22b 1?

With airSlate SignNow, features like customizable templates and secure document storage align with the tenth schedule regulation 22b 1. These tools streamline the signing process while ensuring that all eSignatures meet necessary legal criteria.

-

Is there a trial period available for testing airSlate SignNow in relation to the tenth schedule regulation 22b 1?

Yes, airSlate SignNow offers a free trial that allows users to explore features while ensuring compliance with the tenth schedule regulation 22b 1. This trial lets prospective customers experience how our platform can meet their document signing needs effectively.

-

How does airSlate SignNow's pricing structure accommodate businesses needing compliance with the tenth schedule regulation 22b 1?

Our pricing structure is flexible and designed to cater to various business sizes, all while considering the need for compliance with the tenth schedule regulation 22b 1. With various plans, businesses can choose the right level of service that fits their budget without sacrificing compliance.

-

Can airSlate SignNow integrate with other tools while adhering to the tenth schedule regulation 22b 1?

Absolutely! airSlate SignNow seamlessly integrates with numerous platforms while ensuring adherence to the tenth schedule regulation 22b 1. This allows businesses to maintain compliance while leveraging their existing tools for enhanced productivity.

-

What are the benefits of using airSlate SignNow for processes involving the tenth schedule regulation 22b 1?

Using airSlate SignNow provides businesses with a secure and user-friendly way to handle eSignatures under the tenth schedule regulation 22b 1. This not only promotes efficient document processing but also enhances legal protection and reduces operational risks.

Get more for Mra Tenth Schedule Regulation 22b

- Georgia poa form

- Georgia purchase agreement form

- Hawaii release mortgage form

- Idaho residential landlord tenant rental lease forms and agreements package

- Legal name change in cook county form

- Indiana contractors forms package

- Kansas contract deed form

- Louisiana louisiana standby temporary guardian legal documents package form

Find out other Mra Tenth Schedule Regulation 22b

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast