T2054 Fillable Form

What is the T2054 Fillable

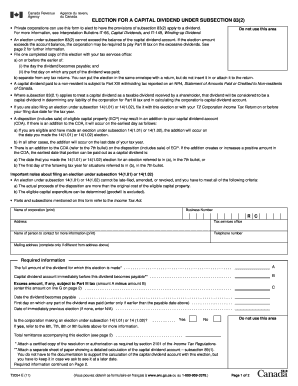

The T2054 fillable form is a document used for tax purposes in the United States, specifically designed for reporting certain types of income or deductions. This form is essential for individuals and businesses who need to provide detailed information regarding their financial activities. The fillable version of the T2054 allows users to complete the form electronically, facilitating easier data entry and submission.

How to use the T2054 Fillable

Using the T2054 fillable form is straightforward. Users can access the form online, fill in the required fields, and save their progress. The electronic format ensures that calculations are performed automatically, reducing the risk of errors. Once completed, the form can be printed for mailing or submitted electronically, depending on the filing requirements. It is important to review all entries for accuracy before submission.

Steps to complete the T2054 Fillable

Completing the T2054 fillable form involves several key steps:

- Access the T2054 fillable form online.

- Enter your personal information, including name, address, and taxpayer identification number.

- Provide details about your income and deductions as required by the form.

- Review the form for any errors or missing information.

- Save a copy of the completed form for your records.

- Submit the form either electronically or by mail, following the specific submission guidelines.

Legal use of the T2054 Fillable

The T2054 fillable form holds legal significance in the context of tax reporting. For the form to be considered valid, it must be completed accurately and submitted within the designated deadlines. Compliance with IRS regulations is crucial, as failure to adhere to these guidelines may result in penalties or legal consequences. Utilizing a reliable electronic signing solution can enhance the legal standing of the submitted form.

Filing Deadlines / Important Dates

Filing deadlines for the T2054 fillable form vary depending on the specific tax year and the taxpayer's situation. Generally, forms must be submitted by April 15 of the following year for individual taxpayers. Businesses may have different deadlines based on their fiscal year. It is essential to stay informed about these dates to avoid late filing penalties.

Required Documents

To complete the T2054 fillable form, certain documents may be required. These typically include:

- Previous year’s tax return for reference.

- Documentation of income sources, such as W-2s or 1099s.

- Receipts or records for deductions being claimed.

- Any relevant financial statements that support the information reported.

Form Submission Methods (Online / Mail / In-Person)

The T2054 fillable form can be submitted through various methods, providing flexibility for users. Options include:

- Online Submission: Many taxpayers prefer to file electronically, which can expedite processing times.

- Mail: Completed forms can be printed and sent to the appropriate IRS address.

- In-Person: Some individuals may choose to file in person at designated IRS offices, though this is less common.

Quick guide on how to complete t2054 fillable

Effortlessly Prepare T2054 Fillable on Any Device

Managing documents online has become increasingly popular among organizations and individuals. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents quickly and efficiently. Handle T2054 Fillable on any platform using the airSlate SignNow apps for Android or iOS and enhance your document-centric processes today.

The Simplest Method to Modify and eSign T2054 Fillable

- Find T2054 Fillable and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize crucial sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose how you want to share your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious document searches, and errors that require reprinting. airSlate SignNow satisfies your document management needs in just a few clicks from any device you prefer. Modify and eSign T2054 Fillable to ensure seamless communication at every stage of your form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the t2054 fillable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is t2054 in relation to airSlate SignNow?

The t2054 refers to a specific form or feature within the airSlate SignNow platform that facilitates document management. It is designed to streamline the eSignature process, making it simple and efficient for businesses to manage their paperwork digitally.

-

How does airSlate SignNow's t2054 enhance document security?

airSlate SignNow ensures that all documents signed using t2054 are protected with high-level encryption. This safeguards sensitive data and provides audit trails to track any changes or access to the documents, ensuring compliance with legal standards.

-

What pricing options are available for using the t2054 feature?

The pricing for airSlate SignNow's t2054 feature varies depending on the plan you choose. There are options for businesses of all sizes, from basic packages for startups to advanced solutions for larger enterprises, each offering different features and support.

-

Can t2054 be integrated with other software applications?

Yes, the t2054 feature of airSlate SignNow seamlessly integrates with various software applications, including CRM systems and cloud storage services. This flexibility allows businesses to incorporate eSignatures into their existing workflows without disruption.

-

What are the main benefits of using t2054 in airSlate SignNow?

Using t2054 in airSlate SignNow provides numerous benefits, such as faster turnaround times for document signatures and reduced operational costs. Additionally, it enhances organization and accessibility of documents, allowing teams to work more efficiently.

-

Is training required to use the t2054 feature effectively?

No extensive training is required to use the t2054 feature in airSlate SignNow. The platform is designed to be user-friendly, and we provide tutorials and customer support to help users get familiar with its functionality quickly.

-

What types of documents can be processed with t2054?

The t2054 feature allows you to process a wide range of documents, including contracts, agreements, and forms. Whether you are in real estate, legal, or any other field, airSlate SignNow can handle various document formats efficiently.

Get more for T2054 Fillable

- Contract completion form

- Louisiana statement claim form

- Lease movables form

- Quitclaim deed from individual to corporation louisiana form

- Warranty deed from individual to corporation louisiana form

- Movables form

- Notice of nonpayment seller of movables individual louisiana form

- Quitclaim deed from individual to llc louisiana form

Find out other T2054 Fillable

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself