Form 1120 Schedule G Instructions

What is the Form 1120 Schedule G Instructions

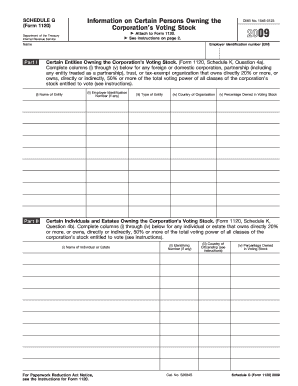

The Form 1120 Schedule G instructions provide guidance for corporations filing their federal income tax returns. This form is specifically used to report information regarding the corporation's activities and the details of its shareholders. Understanding these instructions is crucial for ensuring compliance with the Internal Revenue Service (IRS) requirements. The Schedule G is typically filed alongside Form 1120, which is the U.S. Corporation Income Tax Return.

Steps to complete the Form 1120 Schedule G Instructions

Completing the Form 1120 Schedule G involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including financial statements and details about shareholders. Next, follow these steps:

- Provide the corporation's name, address, and Employer Identification Number (EIN).

- Report the total number of shareholders and their respective ownership percentages.

- Detail any changes in ownership throughout the tax year.

- Complete any additional sections as required based on the corporation's specific activities.

After filling out the form, review it for accuracy before submission.

Legal use of the Form 1120 Schedule G Instructions

The legal use of the Form 1120 Schedule G instructions is essential for corporations to fulfill their tax obligations. This form must be completed accurately to avoid potential penalties or audits by the IRS. The instructions outline the legal requirements for reporting shareholder information and corporate activities, ensuring that the corporation complies with federal tax laws.

Filing Deadlines / Important Dates

Corporations must adhere to specific filing deadlines for the Form 1120 Schedule G. Typically, the form is due on the fifteenth day of the fourth month following the end of the corporation's tax year. For calendar year filers, this means the deadline is April 15. It is important to stay informed about any changes to these dates, as extensions may be available under certain circumstances.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Form 1120 Schedule G can be done through various methods. Corporations have the option to file electronically through the IRS e-file system, which is often faster and more efficient. Alternatively, the form can be mailed to the appropriate IRS address based on the corporation's location. In-person submissions are generally not available for tax forms, making electronic and mail submissions the primary methods.

Key elements of the Form 1120 Schedule G Instructions

The key elements of the Form 1120 Schedule G instructions include detailed guidance on how to report shareholder information, the required disclosures, and any specific calculations needed. Understanding these elements is vital for ensuring that all necessary information is accurately reported. The instructions also highlight the importance of keeping thorough records to support the information provided on the form.

Quick guide on how to complete form 1120 schedule g instructions

Complete Form 1120 Schedule G Instructions effortlessly on any device

Digital document management has gained traction among companies and individuals. It serves as a perfect environmentally friendly alternative to traditional printed and signed papers, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents promptly without wait. Manage Form 1120 Schedule G Instructions on any device with airSlate SignNow Android or iOS applications and enhance any document-related task today.

The easiest way to adjust and eSign Form 1120 Schedule G Instructions seamlessly

- Find Form 1120 Schedule G Instructions and click Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you prefer to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require printing new copies of documents. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign Form 1120 Schedule G Instructions and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1120 schedule g instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the 1120 schedule g instructions?

The 1120 schedule g instructions guide taxpayers on how to report certain income and expense items on their corporate tax returns. These instructions detail the necessary steps for accurate reporting and compliance. Understanding these instructions is crucial for businesses to avoid penalties and ensure their filings are correct.

-

How does airSlate SignNow simplify the process of filling out 1120 schedule g?

airSlate SignNow streamlines the process of completing the 1120 schedule g by providing an intuitive platform for document management and eSigning. With our software, users can fill out necessary forms with ease, ensuring that all required fields are addressed accurately. This efficiency directly supports timely and correct tax submissions.

-

Are there any costs associated with using airSlate SignNow for 1120 schedule g instructions?

Yes, while airSlate SignNow offers a cost-effective solution for managing documents, there are subscription plans available. These plans provide varying features based on your business needs, ensuring that you receive the best value while adhering to the 1120 schedule g instructions. We recommend reviewing our pricing options to choose the best fit for your needs.

-

What features does airSlate SignNow offer for businesses preparing 1120 schedule g?

airSlate SignNow offers features such as reusable templates, document tracking, and robust eSignature capabilities to assist in preparing the 1120 schedule g. These features enhance efficiency and accuracy by allowing users to manage multiple tax documents seamlessly. Additionally, our user-friendly interface simplifies the entire process.

-

Can airSlate SignNow integrate with other platforms for managing 1120 schedule g instructions?

Absolutely! airSlate SignNow integrates with various platforms and accounting software, making it easier to manage your 1120 schedule g instructions alongside other business tasks. These integrations allow for seamless data flow and can improve overall productivity when handling tax documents and reports.

-

What benefits can businesses expect from using airSlate SignNow for tax forms like the 1120 schedule g?

By using airSlate SignNow for tax forms like the 1120 schedule g, businesses can expect enhanced efficiency, reduced errors, and improved compliance. The platform's easy-to-use features streamline the documentation process, allowing teams to focus on their core activities. Ultimately, this leads to more accurate tax submissions and peace of mind.

-

Is there customer support available for questions regarding 1120 schedule g instructions?

Yes, airSlate SignNow provides comprehensive customer support to help users with their inquiries regarding 1120 schedule g instructions. Our support team is well-equipped to assist with any questions users may have about navigating the platform or interpreting the tax instructions. You can signNow out via chat, email, or phone for timely assistance.

Get more for Form 1120 Schedule G Instructions

- Fiduciary deed for use by executors trustees trustors administrators and other fiduciaries massachusetts form

- Massachusetts deed 497309996 form

- Warranty deed from limited partnership or llc is the grantor or grantee massachusetts form

- Ma deed form

- Ma quitclaim 497309999 form

- Massachusetts quitclaim deed 497310000 form

- Legal last will and testament form for single person with no children massachusetts

- Legal last will and testament form for a single person with minor children massachusetts

Find out other Form 1120 Schedule G Instructions

- Can I Electronic signature New York Residential lease agreement form

- eSignature Pennsylvania Letter Bankruptcy Inquiry Computer

- Electronic signature Virginia Residential lease form Free

- eSignature North Dakota Guarantee Agreement Easy

- Can I Electronic signature Indiana Simple confidentiality agreement

- Can I eSignature Iowa Standstill Agreement

- How To Electronic signature Tennessee Standard residential lease agreement

- How To Electronic signature Alabama Tenant lease agreement

- Electronic signature Maine Contract for work Secure

- Electronic signature Utah Contract Myself

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy