Icma Rollover Form

What is the Icma Rollover Form

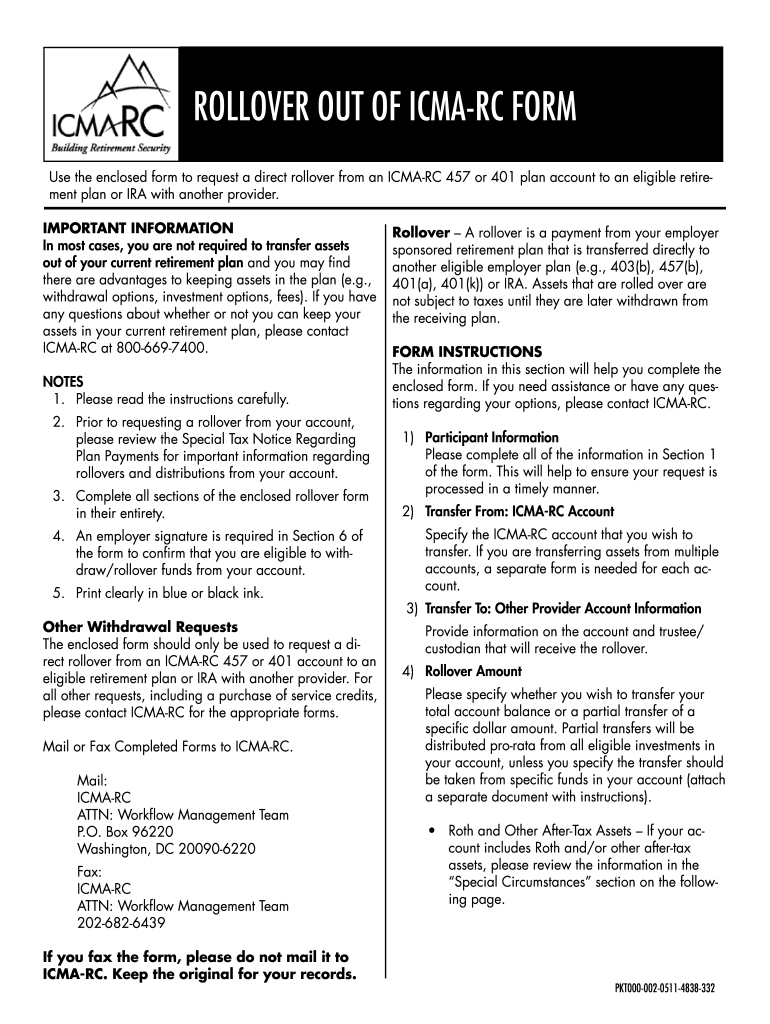

The Icma rollover form is a specific document used by individuals to transfer retirement savings from one account to another, typically from a qualified retirement plan to an individual retirement account (IRA). This form is essential for ensuring that the rollover process complies with IRS regulations, allowing individuals to maintain the tax-deferred status of their retirement funds. Understanding the purpose and requirements of the Icma rollover form is crucial for anyone looking to manage their retirement savings effectively.

Steps to complete the Icma Rollover Form

Completing the Icma rollover form involves several key steps to ensure accuracy and compliance. First, gather all necessary personal and account information, including your Social Security number and details of the accounts involved in the rollover. Next, fill out the form with precise information, ensuring that all fields are completed accurately. After completing the form, review it carefully for any errors before submission. Finally, submit the form according to the specified instructions, which may include sending it via mail or electronically, depending on the institution handling the rollover.

Key elements of the Icma Rollover Form

The Icma rollover form contains several critical elements that must be addressed to facilitate a successful rollover. These elements typically include the account holder's personal information, details about the existing retirement plan, and the new account information where the funds will be transferred. Additionally, the form may require the account holder's signature and date to validate the request. Understanding these key components is essential for ensuring that the rollover process proceeds smoothly and without delays.

Legal use of the Icma Rollover Form

The legal use of the Icma rollover form is governed by IRS regulations that dictate how retirement funds can be transferred between accounts. To ensure compliance, it is important to complete the form accurately and submit it within the required timeframes. Failure to adhere to these regulations may result in tax penalties or the loss of tax-deferred status for the funds. Utilizing a reliable electronic signature platform can further enhance the legal validity of the form, providing a secure and compliant method for completing and submitting the document.

How to obtain the Icma Rollover Form

The Icma rollover form can typically be obtained from the financial institution managing your retirement account or through the official website of the organization overseeing the Icma program. Many institutions offer downloadable versions of the form, allowing you to complete it at your convenience. If you have difficulty locating the form online, consider contacting customer service for assistance. Ensuring that you have the correct and most current version of the form is vital for a successful rollover process.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Icma rollover form can be done through various methods, depending on the requirements of the receiving institution. Common submission methods include online submission via secure portals, mailing the completed form to the designated address, or delivering it in person to the appropriate office. Each method has its own advantages, such as speed and convenience, so it is essential to choose the one that best fits your needs while ensuring compliance with submission guidelines.

Quick guide on how to complete icma rollover form

Effortlessly prepare Icma Rollover Form on any device

Digital document management has become increasingly favored by both companies and individuals. It offers a superb eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Manage Icma Rollover Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to modify and eSign Icma Rollover Form easily

- Obtain Icma Rollover Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or mask sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you would like to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow caters to your document management requirements in just a few clicks from a device of your choice. Edit and eSign Icma Rollover Form to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the icma rollover form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to rollover out of icma rc form?

To rollover out of icma rc form, you need to complete a few steps, including filling out the necessary documents and ensuring you meet the requirements for the rollover. Using airSlate SignNow, you can easily eSign and send your completed form securely, streamlining the entire process for you.

-

Are there any fees associated with rolling over out of icma rc form?

When rolling over out of icma rc form, there might be fees imposed by your current plan or financial service provider. However, using airSlate SignNow, you can manage the documentation easily without incurring high costs, as our solution is designed to be cost-effective for users.

-

What features does airSlate SignNow offer for managing the rollover out of icma rc form?

airSlate SignNow offers features such as document templates, eSigning, and real-time collaboration to help you efficiently manage the rollover out of icma rc form. These features are designed to simplify the documentation process and reduce the time spent on administrative tasks.

-

How can I ensure my rollover out of icma rc form is secure?

Security is paramount when submitting your rollover out of icma rc form. airSlate SignNow uses advanced encryption and secure cloud storage to ensure that your documents remain confidential and safe from unauthorized access during the rollover process.

-

Can I integrate airSlate SignNow with other platforms while rolling over out of icma rc form?

Yes, airSlate SignNow provides integration capabilities with various platforms, allowing you to seamlessly handle your rollover out of icma rc form. Whether you use CRM systems or cloud storage solutions, our tool can connect and enhance your workflow.

-

What benefits can I expect from using airSlate SignNow for my rollover out of icma rc form?

Using airSlate SignNow for your rollover out of icma rc form brings several benefits, including time savings, reduced paperwork, and enhanced efficiency. By digitizing your signing process, you can complete your rollover quickly and easily, focusing more on your financial goals.

-

Is airSlate SignNow user-friendly when rolling over out of icma rc form?

Absolutely! airSlate SignNow is designed for ease of use, making it simple for anyone to complete and submit a rollover out of icma rc form, regardless of their tech skills. The intuitive interface guides you through every step, ensuring a smooth experience.

Get more for Icma Rollover Form

- North carolina divorce 481377429 form

- Deed husband wife 481377430 form

- North carolina llc notices resolutions and other operations forms package

- North carolina cohabitation agreement form

- North dakota quitclaim deed from husband to himself and wife form

- Mineral deed form north dakota

- Nd deed 481377436 form

- Nd form

Find out other Icma Rollover Form

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later